[ad_1]

Traders widely use the Fibonacci retracement as a technical analysis tool to determine price support and resistance levels, and also to determine the continuation or rejection of a trend. Traders focus on the price reacting at these levels to enter or exit a trade. By applying them on multiple timeframes, you get common price levels that act as key areas of interest.

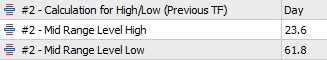

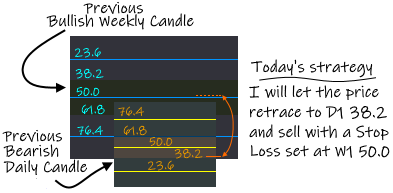

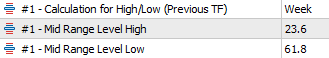

We calculate the retracement levels based on the Fibonacci sequence of numbers, whose ratios provide levels where prices retrace, before the trend continues in the original direction. The most used ratio levels are 23.6, 38.2, 50.0, 61.8 and 76.4.

‘Fibonacci Dimension’ indicator automatically takes the previous high and low for two user-defined timeframes and calculates their Fibonacci retracement levels. The visual dimension for the multiple timeframes allows deriving profitable strategies for execution.

|

The functionality included in ‘Fibonacci Dimension’ indicator are:

|

This document details the functionalities and is also a guide on how to configure the indicator.

| |

: | You can temporarily disable the indicator rather than deleting it. |

| Configure the Timeframes & Mid range levels |

You can select the timeframes used for outer (#1) and inner (#2) zones. The indicator also considers the mid range levels while displaying the retracement zones.

| |

: | You may decide to hide display of the inner (#2) zone. If false, the indicator ignores the values entered for #2. |

|

: | The indicator adds ‘Year’ to the timeframes in MetaTrader. MT5 has additional timeframes than MT4 and accordingly displays them in the list as per the version of the indicator. Please note that the selected timeframe should be higher than the current period in the chart. For e.g., you cannot have a ‘M30’ timeframe displayed if the current period on chart is ‘H1’.

The indicator uses the #1 timeframe to draw the outer zone, while inner zone has the #2 timeframe. #1 timeframe should be higher than #2 timeframe. You can select mid range levels to be shown as a different color for the outer and inner zone. My mid range display is usually 23.6 to 50.0, as I have noticed these levels have firm support and resistance. Please note that though the input properties display “Mid Range Level High” and “Mid Range Level Low”, the indicator supports both the bullish and bearish candle retracement levels as it automatically sorts them for display. |

| Displaying the Outer and Inner Zones |

The indicator allows you to configure the display of the outer and inner zone. In case over one set of multiple timeframes is required (multiple instances of the indicator), this section explains on how it can be done.

Below explains on how you can configure the displayed line, text and colors used by the indicator.

| |

: | You can configure the contents of the text label shown with the retracement levels. The following are the options: 1. Only Level Text 2. Timeframe with Level 3. Level with Price 4. Level with Timeframe and Price 5. No text |

| |

: | Following are the styles for the line displayed for the levels: 1. Solid 2. Dash 3. Dot 4. Dashdot 5. Dashdotdot Only the ‘Solid’ line can have the thickness greater than 1. |

|

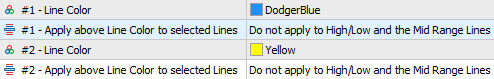

: | You can customise the color for the line displayed for retracement levels for outer (#1) and inner (#2) timeframes. It can apply the line color for: 1. Also apply to High/Low and Mid Range Lines 2. Apply only to High/Low but not the Mid Range Lines 3. Apply only to Mid Range Lines but not to High/Low Lines 4. Do not apply to High/Low and the Mid Range Lines The indicator displays the default color of the outer fill or mid range, if you want the line color not to apply for any level. |

|

: | You can customise the Font, its size and color displayed as text by the indicator. |

|

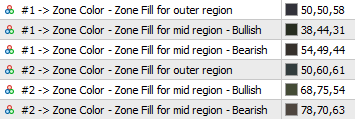

: | The indicator allows the selection of color to be filled by the outer (#1) and inner (#2) zones. Depending on the trend of the previous Timeframe (bullish or bearish) candle, the mid range color will change. |

- You can use the indicator on any chart (Forex, Indices, Stocks, Commodities, Cryptos).

- The indicator will show errors in “Journal” and “Experts” tabs of the terminal/toolbox (Ctrl+T) window.

Disclaimer: Past performance may not show future results. You cannot hold me responsible for use of the indicator or for any information provided in this document.

[ad_2]

Image and article originally from www.mql5.com. Read the original article here.