[ad_1]

RapidEye/E+ via Getty Images

The Copper Investment Thesis

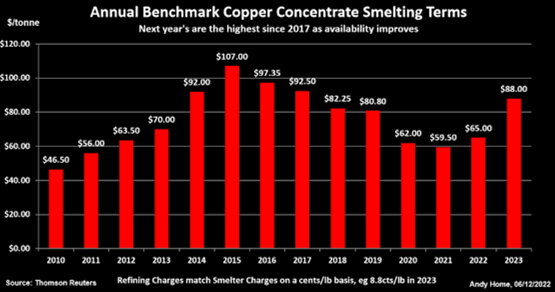

Annual Benchmark of Copper Concentrate Smelting Charges

Reuters

There is a wave of new copper mine supply entering the market, which is leading to higher treatment and refining charges [TCRCs] for smelters. The TCRCs for 2023, negotiated between the US producer Freeport-McMoRan (NYSE:FCX) and Chinese smelters, will be at $88 per tonne, indicating a massive 35% increase from 2022 levels. Notably, it will also be the highest annual charge since 2017.

This increase is likely attributed to the combination of increased demand for copper and higher energy costs for the smelters. It is also driven by the arrival of four major supply additions, comprising the Kamoa Kakula mine in the Congo, the Quellaveco mine in Peru, the expansion of the Quebrada Blanca II, and the Spence-SGO mines in Chile. The situation is further exacerbated by a series of smelter shutdowns in South America and Europe thus far, reducing the availability of options in the markets.

In addition, many smelter operators are already warning that copper treatment charges may have to stay elevated for longer, in order to accommodate increased processing capacity and costs. This is due to the insatiable demand for copper from the renewable energy and EV markets over the next few years, since wind and solar energy generation requires up to six times more copper per installed MW, while EVs require 2.5 times as much copper than conventional ICE vehicles. However, things do not look promising in the long term indeed, since market analysts project that there may be a 50M tonne supply shortfall by 2030, due to a lack of new copper mine development.

There have been minimal corporate investments in expanding copper production over the next few years, due to the immense cost, which is further exacerbated by the fact that new mining processes may take up to twelve years to become operational. The declining ore grades in remote developing economies have reduced production output while adding to the elevated costs as well, significantly worsened by the rising inflation of labor and energy costs.

For instance, the Kamoa Kakula mine has boasted a relatively low capital expenditure of $6.5K per tonne produced, based on the $1.3B of investment for 200K tonnes of annual production in its first phase in 2021. However, we must also highlight that this is a remarkably rare case, since most projects usually report an average Capex of $12K per tonne produced. It is understandable that corporations are not incentivized to invest, due to the lower copper spot prices of $8.45K per tonne at the time of writing. Naturally, these numbers are insufficient to cover the immense production costs.

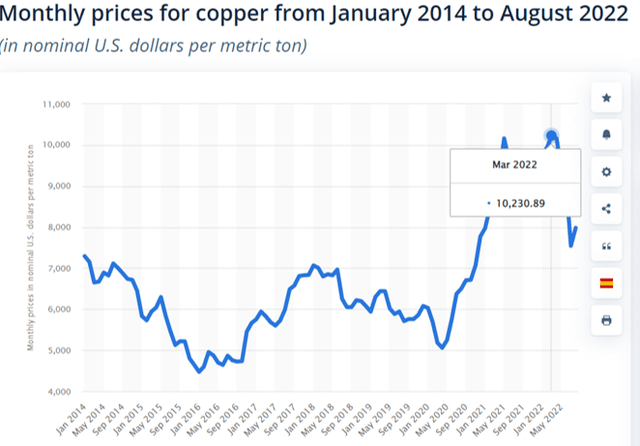

Copper Spot Prices

Furthermore, the copper spot prices are not showing signs of recovery after declining tremendously from their highs of $10.23K per tonne in March 2022, due to rising inflationary pressure, a worsening geopolitical situation involving oil/gas prices from Russia, and a Chips trade war between the US and China. The Feds are also poised to keep raising until a terminal rate of 5.1% through 2023, suggesting prolonged elevated interest pain ahead.

As a result, the global commodity prices may remain volatile since consumer discretionary spending may be tightened during this uncertain macroeconomic outlook, temporarily impacting the sales for EVs. While the demand for renewable energy products is growing in the US and China, production remains largely gated by global supply chains and plant outputs. Most solar companies are reporting elongated backlogs over the next few years, suggesting that demand continues to outstrip limited supply.

Combined with market analysts projecting a 70% chance of recession or a 65% chance of stagflation in 2023, we reckon that copper prices may remain compressed for a little longer. These would also naturally impact FCX’s financial performance and stock valuations in the short term, since copper comprised 80% of its revenues in 2021 and 81% over the last nine months in 2022.

So, Is FCX Stock A Buy, Sell, or Hold?

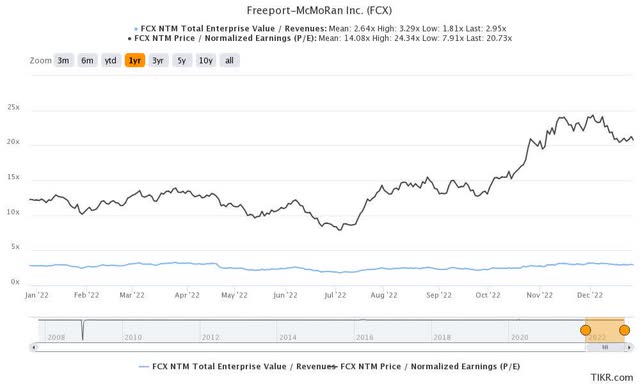

FCX 1Y EV/Revenue and P/E Valuations

FCX is currently trading at an EV/NTM Revenue of 2.95x and NTM P/E of 20.73x, higher than its 3Y pre-pandemic mean of 2.03x and 15.58x, respectively. The baked-in premium is also apparent against its 1Y mean of 2.64x and 14.08x, respectively. Based on its projected FY2024 EPS of $2.89 and current P/E valuations, we are looking at an aggressive price target of $59.90.

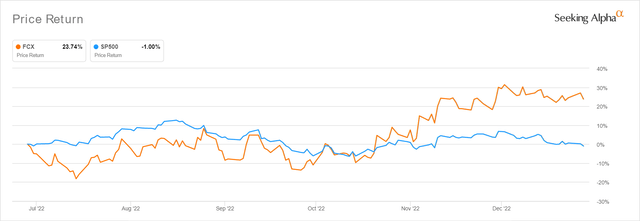

FCX 6M Stock Price

However, it is apparent that market analysts are less bullish on FCX than expected, due to their much lower price target of $36.00, suggesting minimal upside potential from here. The pessimism is probably due to the impressive 30.44% rally since July 2022, which points to its massive baked-in premium. Furthermore, the company’s forward execution through FY2025 has been notably upgraded, with a revenue CAGR of 1.9% and EPS CAGR of 4.8%, despite FY2021’s inflated numbers. Market analysts are also projecting FY2025 EPS of $3.77, suggesting an excellent upgrade of 50.4% since our first article in September 2022.

Depending on individual investors’ risk tolerance and investing trajectory, we reckon that FCX may remain a speculative play in the short-term, despite the 58.1% upside potential to our aggressive price target. It remains to be seen when copper prices may rally again, due to the volatile macroeconomic environment. Even with the Fed’s 50 basis points rate hike in November, the S&P still trades sideways at -21.1% YTD, suggesting Mr. Market’s pessimism ahead.

Despite copper’s long-term prospects, we prefer to rate the FCX stock as a Hold for now. Do not chase this rally due to the minimal margin of safety, especially since copper is highly cyclical in nature.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.