[ad_1]

Fusion Micro Finance IPO Review: Fusion Micro Finance Limited is coming up with its Initial Public Offering. The IPO will open for subscription on November 2nd, 2022, and close on November 4th, 2022. It is looking to raise Rs 1,103.99 Crores out of which Rs 600 Crores will be a fresh issue and the rest Rs 503.99 crores will be an offer for sale.

In this article, we will look at the Fusion Micro Finance IPO Review 2022 and analyze its strengths and weaknesses. Keep reading to find out!

Fusion Micro Finance IPO Review – About The Company

Fusion Micro Finance is a microfinance company providing financial services to underserved women across India in order to facilitate their access to greater financial opportunities. In fact, 92.26% of the company’s total Asset Under Management (AUM) falls under Rural areas.

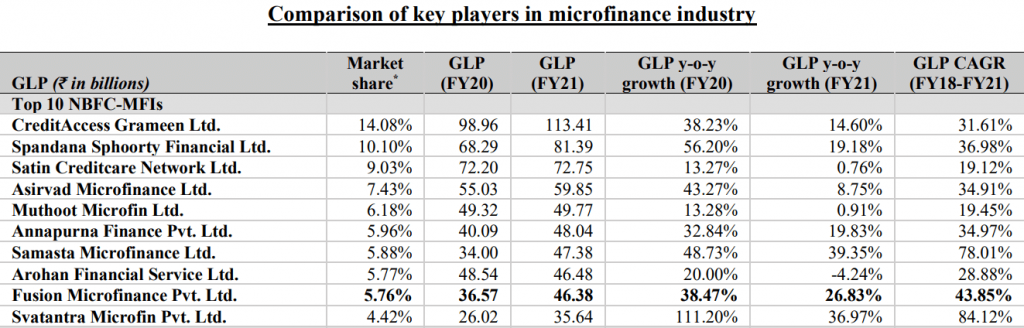

The company stands as one of the youngest companies among the top 10 NBFC-MFIs in India in terms of AUM as of March 31, 2021, according to CRISIL. In addition to that, the company had the third fastest gross loan portfolio growth of 44% among the top NBFC-MFIs in India between the financial years 2018 and 2021.

The company has a strong reach with 2.12 million active borrowers who are served through a network of 725 branches spread across 326 districts and 18 states and union territories in India, as of March 31, 2021.

The competitors of the company

(Source: DRHP of the company)

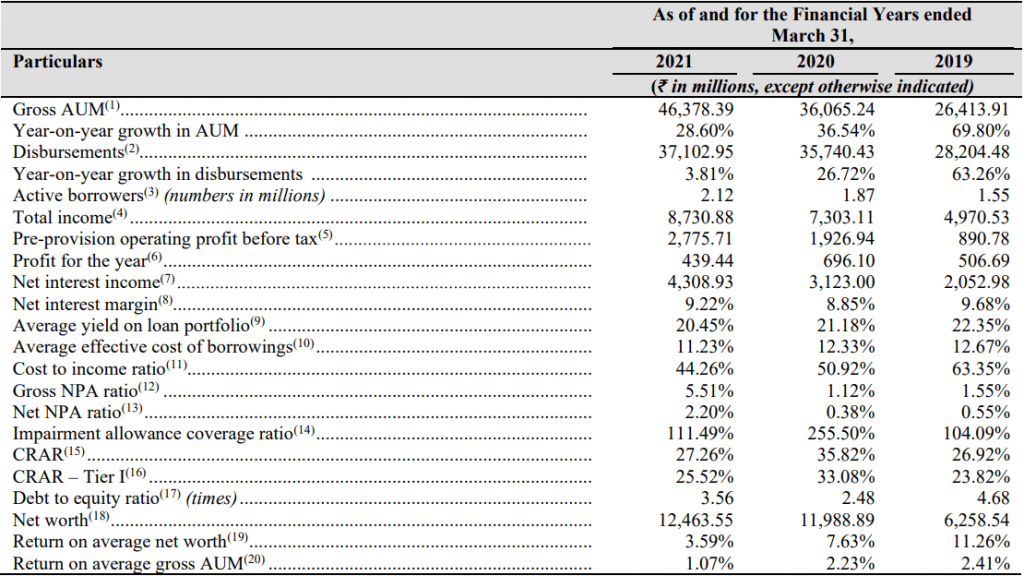

Fusion Micro Finance IPO Review – Financial Highlights

(Source: DRHP of the company)

Fusion Micro Finance IPO Review – Industry Overview

The microfinance industry has recorded healthy growth in the past few years. The industry’s gross loan portfolio increased at a CAGR of 28% since the financial year 2017 to reach approximately ₹2.7 trillion in the financial year 2021.

The NBFC-MFIs are expected to grow at a faster pace than the industry at a CAGR of 18-20% between the financial years 2021 and 2024. The share of NBFC-MFIs share is expected to increase to 34% by the financial year 2024.

CRISIL Research expects the share of the rural segment in MFIs’ business to remain higher, with increasing demand expected from this segment. Going forward as well, for MFIs, rural clientele is expected to remain high in the range of 55-60% compared to urban clientele.

Strengths of the Company

- The company has a well-diversified and extensive Pan-India presence.

- The company had the second-highest growth in the number of customers among the top ten NBFC-MFIs in India in the financial year 2021.

- The company has a diversified and cost-effective source of procuring capital.

- The company has an advanced operating model as they leveraged technologies such as artificial intelligence and machine learning for their digital platform- Shakti

- The company has a stable and experienced management team supported by Marquee Investors.

Weaknesses of the Company

- The company serves customers in Rural area with limited sources of income and thus lack any credit history. This raises the risk of defaults for the company.

- The company has certain inherent risks such as interest rate risks and technological risks.

- The company operates in a highly regulated sector. Any changes by the Central bank (RBI) in the policies can adversely affect their business.

- The company is subject to maintaining a certain portion of its funds as provisions that it must maintain at all times. This can reduce their capital in hand which might affect their business.

- The company has certain pending legal proceedings in connection with unauthorized transactions, fraud, or misappropriation by its employees and other proceedings against the directors of the company.

Fusion Micro Finance IPO Review- Grey Market Information

The shares of Fusion Micro Finance traded at a premium of 10% in the grey market on October 31st, 2022. The shares tarded at Rs 405. This gives it a premium of Rs 37 per share over the cap price of Rs 368.

Fusion Micro Finance IPO Review- Key IPO Information

| Particulars | Details |

|---|---|

| IPO Size | ₹ 1,103.99 Crore |

| Fresh Issue | ₹ 600.00 Crore |

| Offer for Sale (OFS) | ₹ 503.99 Crore |

| Opening date | November 2, 2022 |

| Closing date | November 4, 2022 |

| Face Value | ₹10 per share |

| Price Band | ₹350 to ₹368 per share |

| Lot Size | 40 |

| Minimum Lot Size | 1 (40 Shares) |

| Maximum Lot Size | 13 (520 Shares) |

| Listing Date | November 15, 2022 |

Promoters: Devesh Sachdev, Creation Investments Fusion, Llc, Creation Investments Fusion Ii, Llc, and Honey Rose Investment Ltd.

Book Running Lead Managers: ICICI Securities Limited, CLSA India Private Limited, IIFL Securities Limited, and JM Financial Limited.

Registrar To The Offer: Link Intime India Private Limited

The objective of the Issue

The Net Proceeds from the Fresh Issue are proposed to be utilized for the Augmentation of the capital base of the Company.

In Closing

In this article, we looked at the details of Fusion Micro Finance IPO Review 2022. Analysts remain divided on the IPO and its potential gains. This is a good opportunity for investors to look into the company and analyze its strengths and weaknesses. That’s it for this post.

Are you applying for the IPO? Let us know in the comments below.

You can now get the latest updates in the stock market on Trade Brains News and you can even use our Trade Brains Portal for fundamental analysis of your favourite stocks

Start Your Financial Learning Journey

Want to learn Stock Market and other Financial Products? Make sure to check out, FinGrad, the learning initiative by Trade Brains. Click here to Register today to Start your 3-Day FREE Trail. And do not miss out on the Introductory Offer!!

[ad_2]

Image and article originally from tradebrains.in. Read the original article here.