[ad_1]

spooh

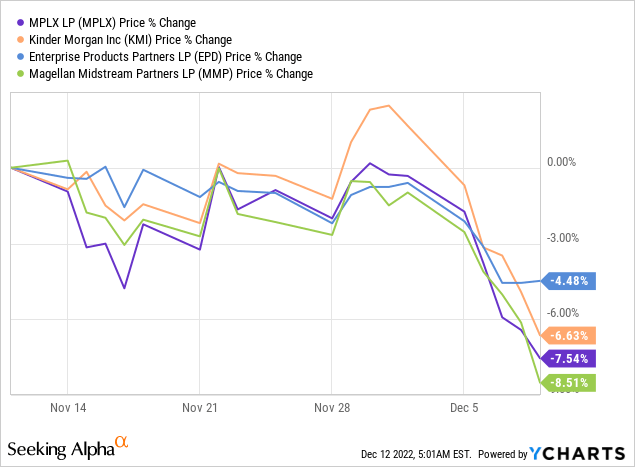

Midstream companies like MPLX LP (NYSE:MPLX) have seen their unit prices decline in recent days due to a consolidating market and growing recession fears. The dip, however, constitutes a buying opportunity for well-run midstream companies that operate critical transportation infrastructure and have strong balance sheets. MPLX has a distribution that is supported by distributable cash flow and the midstream firm just recently raised its distribution by 10%. MPLX’s units are trading at an attractive valuation based off of distributable cash flow and EBITDA, and the distribution can be expected to continue to grow going forward!

Dip provides engagement opportunity

Valuations in both the upstream and midstream segments have declined lately over concerns that energy prices will continue to drop and that a recession might impact demand for energy products like petroleum and natural gas in 2023. Units of MPLX skidded about 8% in the last month, which I believe creates an engagement opportunity for dividend investors that want to take advantage of the undeserved drop in pricing.

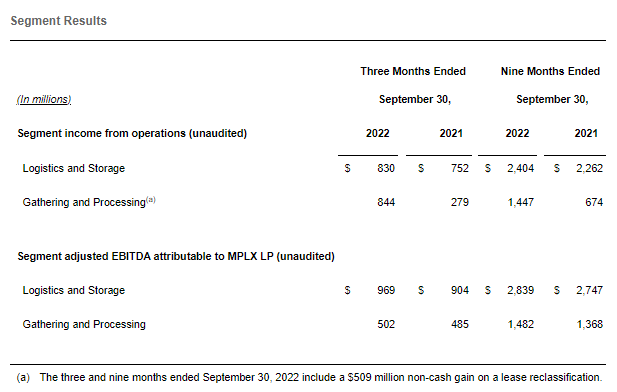

MPLX is a master limited partnership with large investments in crude oil and refined product pipelines, storage facilities, terminals, crude oil and natural gas gathering systems as well as natural gas/natural gas liquids processing and fractionation facilities. The company’s PP&E assets were valued at $18.9B at the end of the September-quarter which didn’t include an additional $4.1B in other midstream investments that are accounted for through the equity method. MPLX has a market cap of $31.9B and organizes its business into two main segments: (1) Logistics and Storage, which affects its crude oil and refined products business, and (2) Gathering and Processing, which deals with natural gas and NGLs. The Logistics and Storage segment is the largest segment for MPLX and accounted for 66% of the firm’s adjusted EBITDA ($969M) in Q3’22.

Source: MPLX

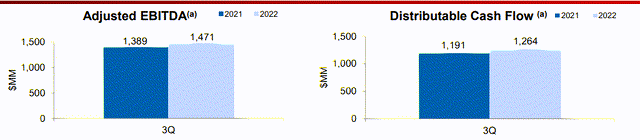

Midstream firms generate the majority of their adjusted EBITDA from fee arrangements with their customers meaning their earnings prospects don’t depend as much on the broader market than those of upstream firms. The predictable nature of MPLX’s fee streams, therefore, results in very low volatility in the firm’s distributable cash flow (as well as adjusted EBITDA). MPLX generated $1.47B in adjusted EBITDA in its two businesses in Q3’22, showing a 6% year over year growth rate. The firm’s distributable cash flow was $1.26B, up also 6% year over year.

Distribution coverage, recent distribution raise and unit yield

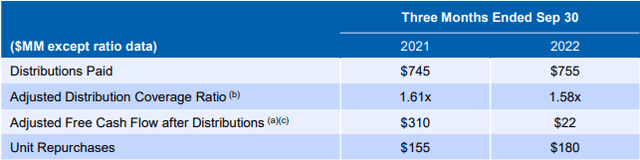

MPLX’s distribution is well-supported by the firm’s distributable cash flow. The company paid $755M in distributions to its partners in Q3’22 and the distribution coverage ratio calculated to 1.58 X. The distribution coverage ratio in the first nine months of FY 2022 was 1.64 X so MPLX really does offer a well-protected distribution to its limited partners.

Due to strong results and resilient cash flow in the third-quarter, MPLX raised its distribution 10% to $0.7750 per-unit, showing a $0.07 per-unit increase over the distribution paid in Q3’21. Based off of the new distribution rate and considering the 8% drop in the firm’s unit price in December, MPLX’s units currently yield 9.9%.

Balance sheet supportive of growth

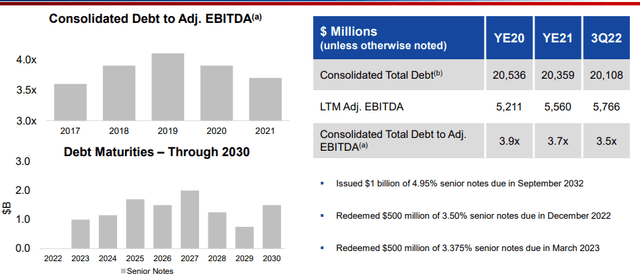

MPLX has a strong balance sheet with a declining debt trend. The firm’s leverage peaked in FY 2019 and the company has made strides in lowering its leverage during the pandemic. MPLX’s outstanding debt at quarter-end (Q3’22) was $20.1B and the leverage ratio declined from 3.9 X EBITDA in FY 2020 to just 3.5 X EBITDA in Q3’22. Declining leverage frees up cash for MPLX to either invest in new projects and grow unitholders’ distributions.

Attractive DCF and EBITDA-based valuation

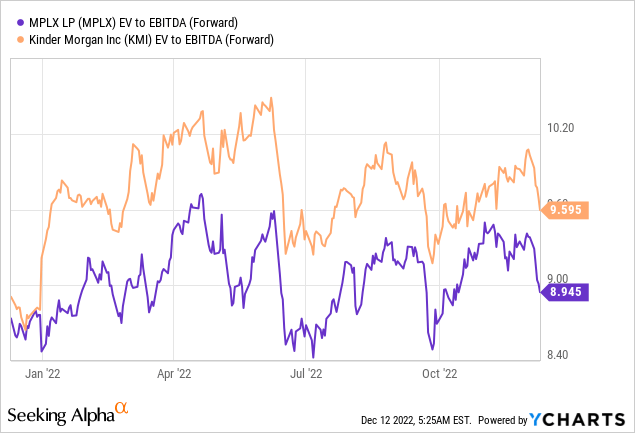

MPLX is attractively valued based off of distributable cash flow (“DCF”). The firm’s distributable cash flow attributable to GP and LP unitholders is about ~$1.2B quarterly, or ~$4.8B annually which gives MPLX a P/DCF ratio of 6.6 X. Kinder Morgan (KMI), another large-cap midstream firm with a similar level of distributable cash flow (~$4.7B expected for FY 2022), has a P/DCF ratio of 8.5 X. MPLX is also looking slightly better in an EBITDA comparison with Kinder Morgan, as its EV/EBITDA ratio is slightly lower.

Risks with MPLX

Midstream companies own and operate critical infrastructure that producers rely on to bring their energy products to storage facilities, terminals and export markets. MPLX, therefore, faces stable, long term demand prospects for its transportation and storage assets. However, the investment climate in the fossil fuel industry is currently not a supportive one. Curtailed investment activity in the midstream sector could limit MPLX’s future DCF and distribution growth.

Final thoughts

I have sold all my stocks of upstream companies lately and now own only midstream companies as I believe they have potential to out-perform the energy sector during a period of lower energy prices. Midstream companies largely rely on transportation and storage fees for their cash flows which means they are not subjected to the unpredictability and risk of volatile petroleum and natural gas market prices. Considering that MPLX LP’s distribution is solidly supported by distributable cash flow, the distribution was just recently increased by 10%, and the units are cheap based off of DCF, I believe dividend investors want to take advantage of the dip!

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.