[ad_1]

Ladanifer

Investment strategy matters as much as the asset class itself. For example, high quality assets such as medical office buildings come at a premium and with fierce competition for deals, thereby reducing cap rates and any chance of a competitive advantage. That’s why a better strategy may be to focus on under-the-radar sectors that have far less or even no institutional competition.

This brings me to Getty Realty Corp (NYSE:GTY), which trades at a high dividend yield with a solid strategy in place. I highlight why GTY remains a bargain buy for those seeking growing income, so let’s get started.

Why GTY?

Getty Realty is an internally-managed REIT with a $1.9 billion enterprise value, making it the largest REIT to specialize in the acquisition and development of convenience, automotive, and other single-tenant properties. At present, it holds a large portfolio of 1,024 freestanding properties that are spread across 38 U.S. states plus Washington D.C.

What sets GTY apart from many other net lease REITs is its pure-play focus primarily on automotive-related assets, many of which come with a convenience store component. This enables management to hone in on its core competency with fewer distractions. Furthermore, 71% of GTY’s properties are corner locations that garner the most traffic, and 65% of its properties are in the Top 50 MSAs in the U.S.

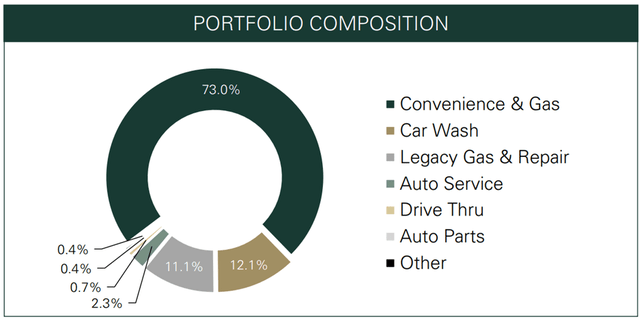

At present, 73% of its rents come from properties with both a convenience component and gas, and another 12% comes from car washes. Management is working to whittle down its exposure to legacy gas and repair, with this segment representing just 11% of portfolio ABR, as shown below.

GTY Property Mix (Investor Presentation)

Moreover, GTY benefits from low competition from private equity and other institutional buyers in this property class, as most holders are comprised of mom & pop type owners. This results in more attractive cap rates compared to other asset classes, such as tier 1 industrial properties, in which competition is intense.

Meanwhile, GTY’s property base is seeing strong fundamentals with a 99.4% occupancy rate, and full rent collection. Its tenants provide an essential service that customers need in both good times and bad, and this is reflected by strong tenant rent coverage of 2.7x. GTY has healthy industry fundamentals, with base rental income growing by a respectable 8.1% YoY in the second quarter, and 8.4% in the first half of the year.

GTY has also been acquisitive in its fragmented industry, adding 17 properties during the second quarter, including 11 car wash properties in Austin, Texas, and one convenience store in New York City. Looking forward, GTY is well positioned to continue its growth trajectory, as its supported by a strong BBB- rated balance sheet, with a low net debt to EBITDA ratio of 4.9x. Debt to total asset value sits at just 36%, and GTY maintains a strong fixed charge coverage ratio of 3.9x.

Risks to GTY’s business model comes from the trend of vehicle electrification. However, I believe EV adoption will be slower than many expect. New technology adoption is almost never on a linear trajectory that early adopters suggest. Moreover, much higher EV adoption would require an overhaul of the electrical grid and the raw material shortage for developing batteries have resulted in a cost crunch.

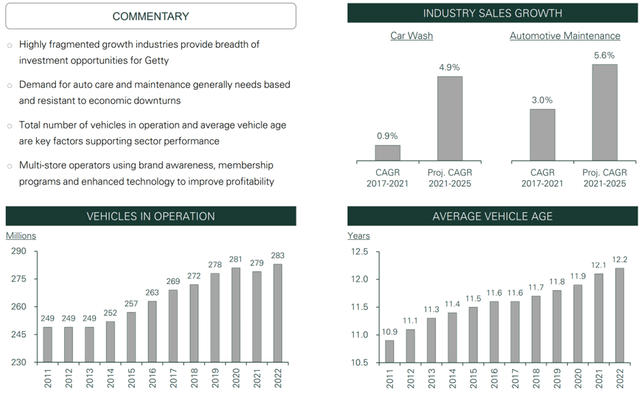

As shown below, vehicles in operation and average vehicle age have increased over the past decade, and car washes and automotive maintenance are expected to see mid-single-digit CAGR through 2025. Plus, even EVs can’t evade maintenance forever, as they also need tire changes and maintenance just like ICE vehicles.

Automotive Industry Stats (Investor Presentation)

Lastly, I see value in GTY at the current price of $29.90 with a forward P/FFO of 13.6, sitting below the net lease average of 15 to 20x. At this price, GTY yields an attractive 5.5%. The dividend is well-protected by a 77% payout ratio and comes with a 5-year CAGR of 8.3% and 8 years of consecutive growth. Sell side analysts have a consensus Buy rating with an average price target of $33.21, equating to a potential one-year 17% total return including dividends.

Investor Takeaway

GTY’s focus on the automotive sector provides it with a competitive advantage in an industry that is ripe for consolidation. The company has strong fundamentals, including near full occupancy and high base rental growth. GTY is also well-positioned to continue its growth trajectory, supported by a strong balance sheet. At present shares trade at a reasonable forward P/FFO, and offers an attractive yield. For these reasons, I believe GTY presents a great opportunity for dividend growth investors who seek a meaningful starting yield.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.