[ad_1]

sankai

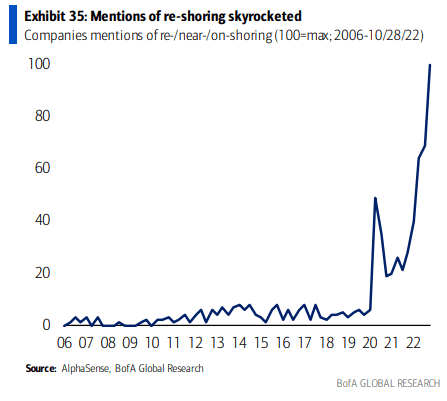

Mentions of “re-shoring” have been skyrocketing on earnings conference calls over the last year-plus. The notion of relegating supply chain and sourcing activities to volatile and politically unstable nations is quite out of vogue. Firms that are able to take advantage of this trend in deglobalization stand to benefit.

One semiconductor firm features robust growth and a decent valuation. Let’s outline where GlobalFoundries (NASDAQ:GFS) stands from an investment point of view.

Re-Shoring Renaissance

BofA Global Research

According to Bank of America Global Research, GlobalFoundries is the fourth largest outsourced semiconductor manufacturer (aka foundry) and is the last remaining US-based pure-play foundry. GlobalFoundries manufactures complex, feature-rich integrated circuits addressing mission-critical applications in smart mobile devices, personal computing, communication infrastructure and data center, home and industrial Internet of Things (IoT), and automotive markets.

The $32.2 billion market cap Semiconductors and Semiconductor Equipment industry company within the Information Technology sector trades at a high of 39.5 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

Ahead of earnings next month, the stock has a high 20.2% short interest, according to Seeking Alpha. With a rebound in chip stocks to kick off 2023, Citi had previously announced a bullish opinion on GlobalFoundries as well as BofA’s optimistic take due to the company’s strong domestic operations, to stick to the re-shoring theme. This comes after GFS beat on both earnings and revenue back in early November.

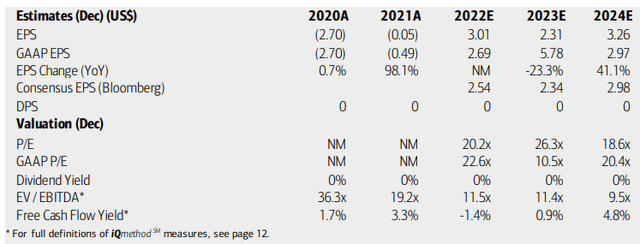

On valuation, analysts at BofA see earnings having climbed sharply out of the red in 2022. While operating profits are seen as contracting this year (while GAAP earnings jump), normalized earnings should be strong looking ahead to 2024. The Bloomberg consensus forecast suggests a mild downturn in 2023 before an EPS jump next year, too.

Assuming a $3 normal EPS figure, the stock trades around 20 times profits, which is not bad considering where GFS is positioned in a high-growth industry. Moreover, the firm’s EV/EBITDA ratio is slightly below that of the broad market. Free cash flow, though, is near the flat line. Overall, I think the valuation is ok, but not expensive like many long-duration semi names.

GlobalFoundries: Earnings, Valuation, Free Cash Flow Forecasts

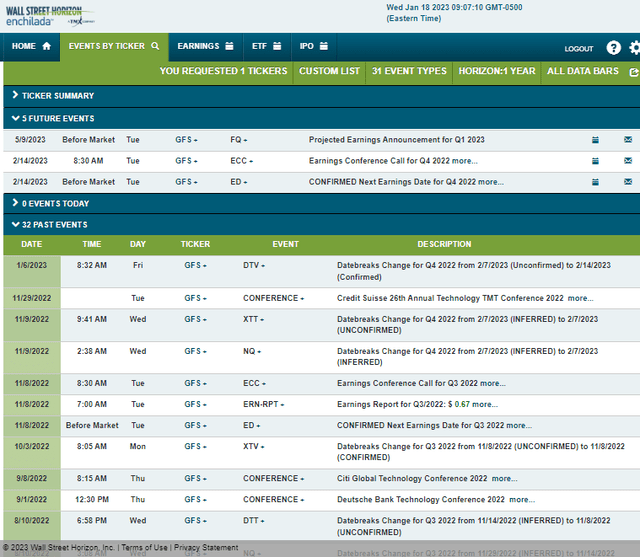

Looking ahead, corporate event data from Wall Street Horizon show a confirmed Q4 2022 earnings date of Tuesday, February 14 BMO with a conference call immediately after the numbers hit the tape. You can listen live here. The calendar is light on volatility catalysts aside from the Valentine’s Day report.

Corporate Event Calendar

The Technical Take

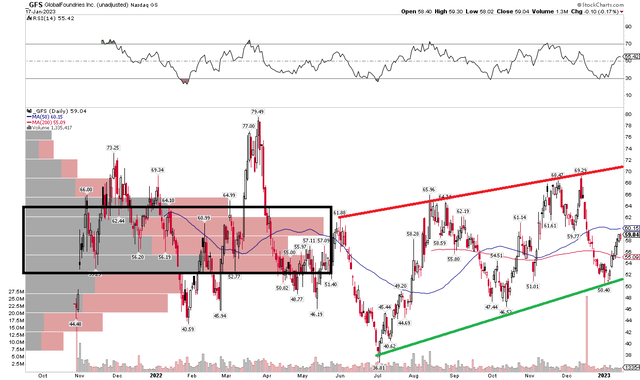

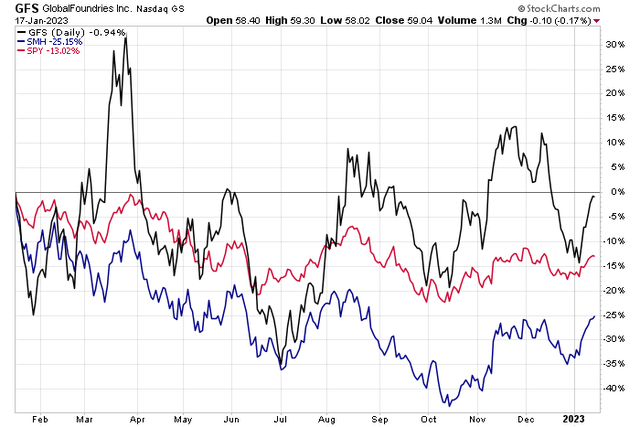

While semiconductor stocks are down about 25% from a year ago, and as the broad market is off by 13% YoY when including dividends, GFS is about flat. That’s an impressive relative strength. Notice in the chart below that shares are actually trending higher after notching a low more than six months ago.

Technically, shares could revisit the upper end of this channel, which would be in the low $70s, or about 20% more near-term upside. Support is seen at the lower range bound in the low $50s. While shares are in a bit of a congestion zone, as measured by the volume-by-price indicator on the left, I see momentum with the bulls right now.

GFS: Trending Higher Last 6 Months

GFS: Beating Its Industry & The Market

The Bottom Line

With relative strength in the last year and as shares bounce off support, GFS looks attractive here. Meanwhile, the valuation when considering GlobalFoundries’ advantageous re-shoring position makes for a compelling domestic equity theme in a high-growth industry.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.