[ad_1]

tbralnina/iStock via Getty Images

In a surprise move, Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) CEO Sundar Pichai hinted at the tech giant needing to make large-scale productivity improvements. The internet search leader has long been criticized for investing heavily in the future with what always appears limited constraints on spending. My investment thesis remains ultra-Bullish on the stock with any large boost to productivity a major positive for shareholders.

20% Productivity Boost

Speaking at Code Conference, Mr. Pichai spoke of Alphabet needing to become 20% more productive. He appeared to hint at potential job cuts to remove layers of management that have built up into a bureaucracy over the years:

Sometimes there are areas to make progress [where] you have three people making decisions; understanding that and bringing it down to two or one improves efficiency by 20%.

Following this news, Google reportedly told senior managers to restrict travel to “business critical” trips. Most big corporations haven’t fully moved back to business travel with restrictions due to covid-19 in place. American Airlines (AAL) suggested large corporations have only returned business travel to 75% of 2019 levels.

Either way, the news from Alphabet doesn’t really detail a specific financial goal. The company being 20% more productive could mean a lot, but typically, this would be a goal of boosting profits by 20%.

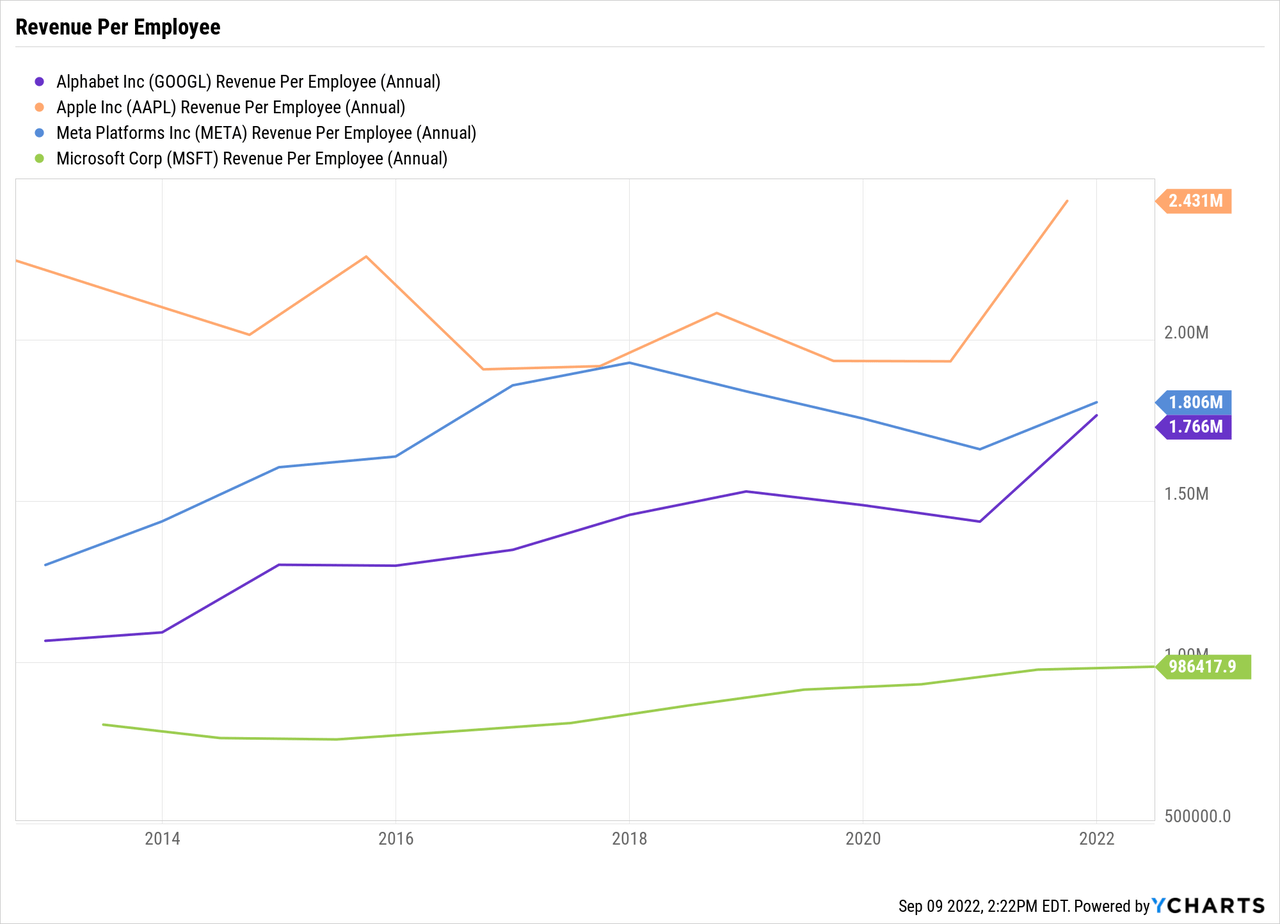

A couple of ways exist to measure productivity. Right now, Alphabet generates nearly $1.8 million in sales per employee. The figure jumped in 2021, but the growth was limited in prior years. Alphabet trails Apple (AAPL) by a large margin in sales per employee while Meta Platforms (META) is slightly above with Microsoft (MSFT) much lower below $1 million.

Since Alphabet appears very productive on the revenue side, the other way to improve productivity is to reduce costs while maintaining or growing current revenue levels. Both of the new snippets from Alphabet would suggest the company is looking to constrain costs by removing unnecessary expenses.

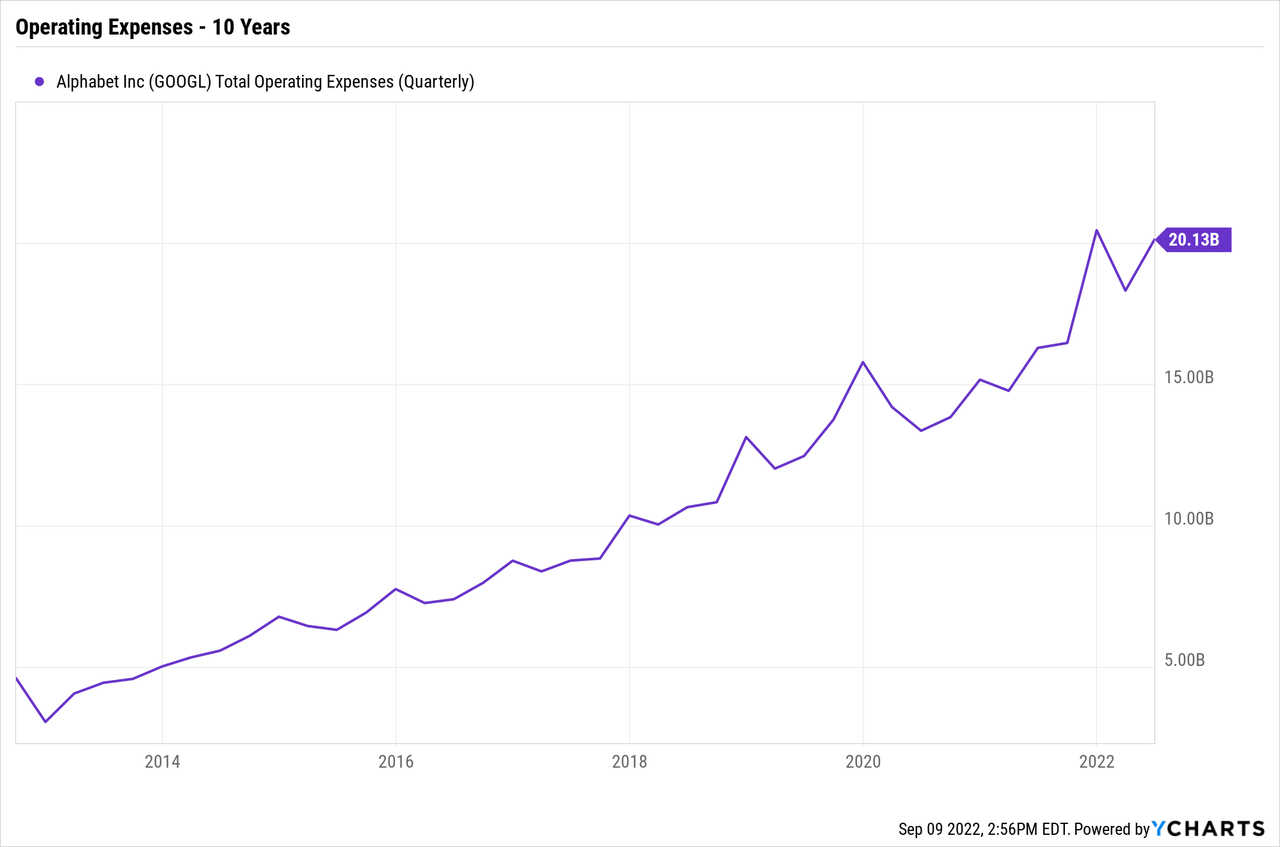

Using GAAP numbers, SG&A expenses have soared over the last decade. Alphabet was only spending around $5 billion per quarter on employee expenses back in 2014 and now the costs are above $20 billion.

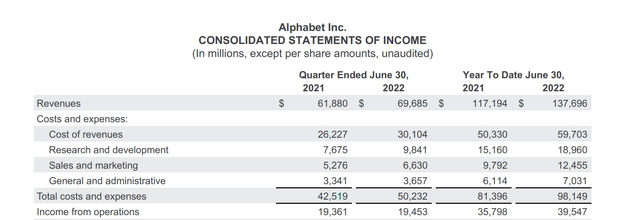

In Q2, Alphabet failed to generate a larger profit despite revenues surging 13% to reach $69.7 billion. The tech giant added $7.8 billion in revenues YoY, yet the operating income was actually down slightly due to much higher expenses.

Source: Alphabet Q2’22 earnings release

One can definitely see how Alphabet needs to work on productivity improvements in the business. Just to maintain Q2’21 operating margins of 31%, the company needed to produce $2.4 billion in additional income in one quarter alone.

By just maintaining margins, Alphabet could generate $10 billion in annual profits. The company ended the last quarter with 174,000 employees after growing the employee base from 144,000 in the prior Q2. Alphabet could easily just continue the prior pause on hiring after growing the employee base by 30K over the last year for 21% growth.

The tech giant is at the size where 15% annual revenue growth is a very strong year. The company isn’t a startup any longer where spending growth should exceed revenue growth. Alphabet should see substantial leverage in the system from limited additional spending to add additional advertising or cloud revenues.

EPS Surge

If the CEO can execute on a plan to be 20% more efficient, Alphabet could reduce costs by up to $40 billion annually now with quarterly costs topping $50 billion. Of course, the company could achieve productivity gains via a combination of revenue growth and cost cuts.

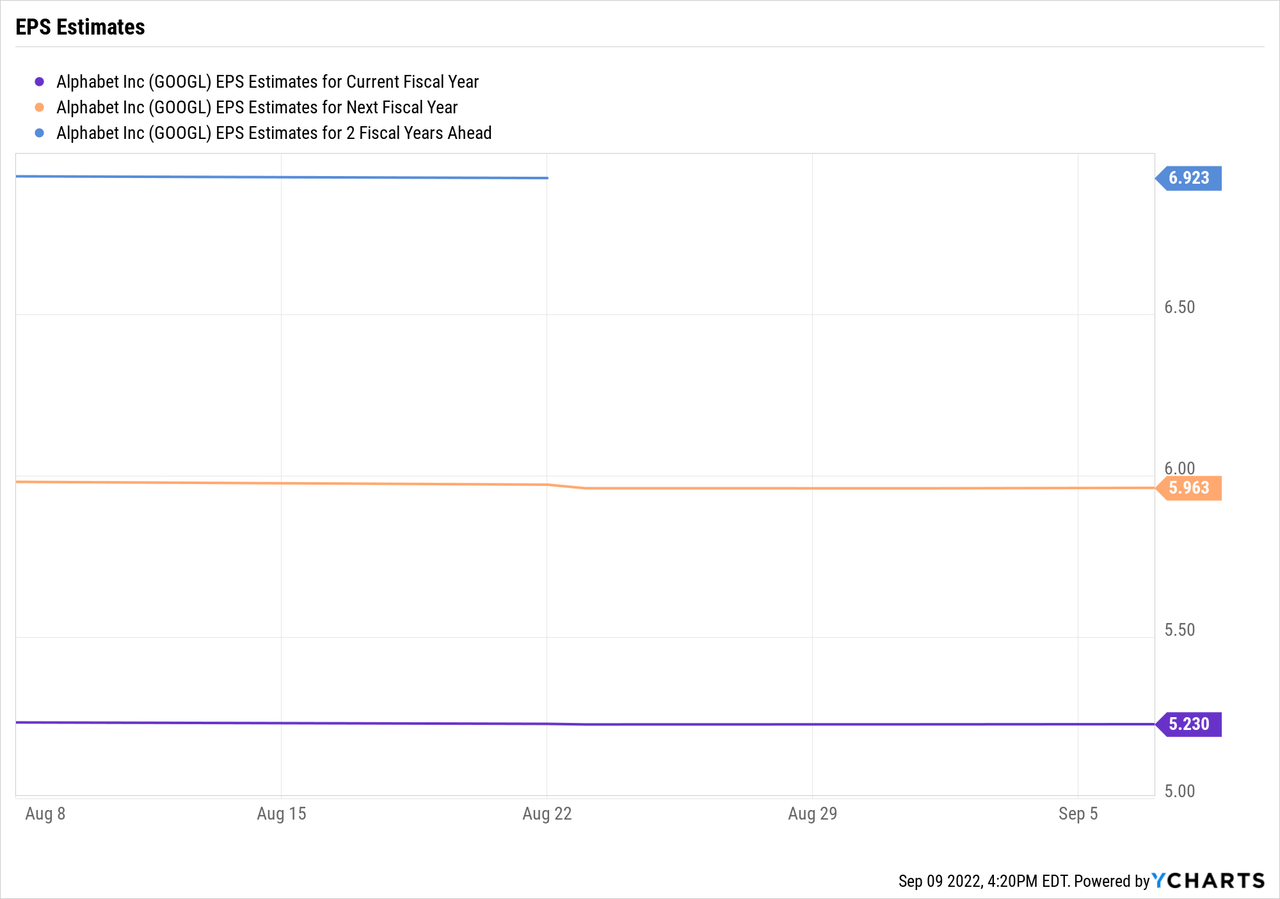

Analysts have Alphabet earning $5+ this year followed by nearly $6 in 2023. These GAAP numbers always include a ton of extra charges including stock-based compensation that’ll see a reduction from limited hiring of new engineers and possibly cutting a layer of management.

With 13.2 billion diluted shares, the $79 billion net income figure for 2023 quickly becomes a much larger number than simply multiplied by 20%. Based on 2023 revenue estimates of $326 billion, Alphabet has an expense structure of ~$230 billion for a cost efficiency improvement of $46 billion.

One can quickly see how a 20% productivity boost has a major outsized impact on profits. Based on a 15% effective tax rate, profits would jump nearly $37 billion, providing a nearly 50% boost to EPS with a gain of $2.80 per share to $8.76.

The stock only trades at 13x this EPS target. When stripping out SBC and factoring in the Q2’22 net cash balance of $110 billion, Alphabet is a far cheaper stock.

Our analysis already had the tech giant earning ~$1.25 per share more when stripping out SBC. Alphabet would already $7+ per share in 2023 before accounting for any productivity gains.

The company promoted the concept of curtailing excessive costs all the way back to when Ruth Porat was hired as CFO in 2015. Investors should invest accordingly knowing a large productivity boost isn’t likely for a company long built on aggressive spending. Though, if CEO Sundar Pichai actually achieved a 20% productivity boost, Alphabet would be looking at a non-GAAP EPS hitting $10.

Takeaway

The key investor takeaway is that Alphabet is exceptionally cheap without any productivity improvements or looking at non-GAAP numbers. If CEO Sundar Pichai can achieve 20% productivity improvements, the stock is in the bargain bin at just 11x earnings.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.