[ad_1]

ipopba

The news that Microsoft (MSFT) is spending $10 billion to acquire a 49% position of ChatGPT is seen as a big negative for Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL). The Internet search giant isn’t as threatened by the AI chatbot service as perceived by most. My investment thesis remains ultra Bullish on the stock trading near $90 on concerns an AI chatbot is going to hit their main business.

Big Microsoft Investment

The software giant is working on investing up to $10 billion in OpenAI in order to acquire the promising AI chatbot technology. The deal is interesting in that Microsoft appears willing to pay a $29 billion valuation to only control 49% of the business, though the tech giant will collect 75% of the profits up until repaying the investment.

The deal is odd in that Microsoft won’t actually control the business, but the company will maintain the AI technology on their cloud services. While a lot of prognosis claim Google search is at prime risk, a lot of technology leaders continue to make such tweets as below highlighting the huge restrictions of the AI chat services.

Google search doesn’t appear at risk at all when ChatGPT can’t even correctly provide the current leader of Twitter and the timing of the CEO change. Other queries suggest the AI chatbot can’t report the World Cup winner due to the chatbot being trained based on older data.

The service can’t crawl the web for answers, making ChatGPT very limited in the current form. Google has their own AI voice services that can be incorporated into Google search, though OpenAI would need to provide a search function that can search the internet for answers in order to replace what the search giant does now.

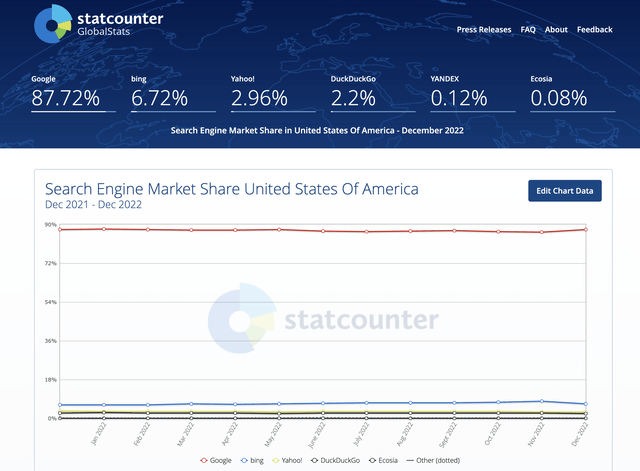

By most statistical measures, Google controls near 90% of the U.S search engine market share. Bing only controls a small portion of the market estimated at below 7% by Statcounter.

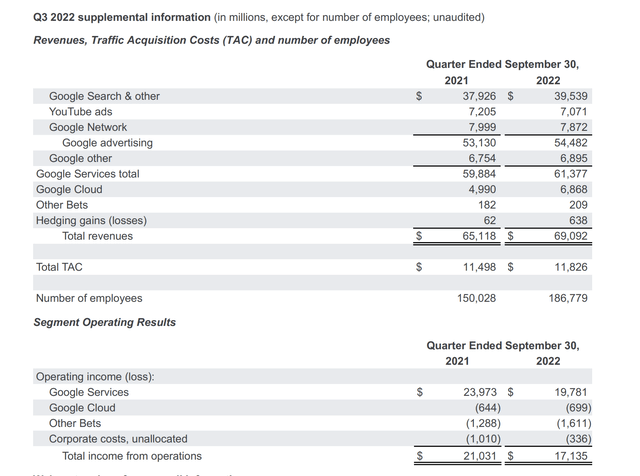

Alphabet uses this dominant market share position to produce a search business with nearly $40 billion in quarterly revenues. The Google Network ads add another $8 billion in quarterly revenues and along with YouTube ads leads to a business generating huge operating margins of 40% back in Q3’21.

Source: Alphabet Q3’22 earnings release

The margins dipped last quarter due to the mismatched spending heading into a weak economy. Also, the Google Search business likely has far higher margins than the other business units, like YouTube ads, included in the Google Services numbers.

Microsoft naturally wants a much larger portion of this high margin business and ChatGPT is seen as a path to garner more business. So much so that Google has had internal code read meetings regarding the issue to ensure ChatGPT doesn’t steal the golden goose of the search market.

While some see the AI chatbot service as a threat to Google search, even the founding CEO of OpenAI doesn’t see the service as ready for real work. Sam Altman freely admitted ChatGPT creates a misleading impression of greatness.

Due to the initial signs that the AI chatbot is good at writing and fixing code, the service might have a big future working with developers rather than replacing Google search. The Information reported that Microsoft wants to implement a version of the Bing search engine with the AI behind ChatGPT by the end of March. The timeline appears incredibly aggressive considering the service can’t correctly answer a question on the CEO of Twitter and Sam Altman suggests the AI delivers output with questionable truthiness.

CNet highlights a list of other AI chatbots and even search engines already using similar GPT-3 technology. Not to mention, Google already has their own language model called LaMDA with the potential to incorporate this technology into Google search. The original messaging from Google is that this natural language model wasn’t ready for prime time similar to the ChatGPT released, but not fully trained.

Big Rebound In The Cards

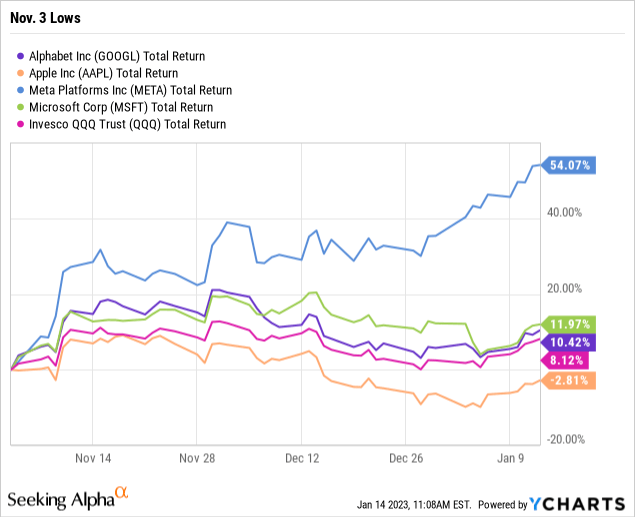

Among the tech giants, Apple (AAPL) and Microsoft exited the early November lows with the highest forward PE multiples. These stocks have naturally struggled to gain much momentum this year. Alphabet is far more similar to Meta Platforms (META), yet the social media stock has already rallied over 54% off the lows. Alphabet has barely rallied 10% in the market rebound with the Invesco QQQ ETF (QQQ) up a similar 8%.

The point here is that the fears of ChatGPT have held Alphabet back from rallying similar to Meta. Based on our estimates, the search giant has the potential to produce up to $10 in EPS after improving efficiency with the 15% layoff at Verily the latest sign CEO Sundar Pichai is serious about his high level target of 20% efficiency improvements.

The biggest risk to a large rebound in the stock is that Google is forced to launch a competing AI chatbot incorporated into search. OpenAI might be taking a $10 billion investment from Microsoft due to the high costs and any aggressive competition on this front could squeeze margins just as the market wants Google to become 20% more efficient as promised by the CEO.

Takeaway

The key investor takeaway is that Google remains too cheap with the large EPS potential on the profit boost from efficiency gains. The ChatGPT threat remains vastly overstated so far.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.