[ad_1]

Here’s a look at the smart-money movement I’ve been seeing lately, and what I’m looking to do about it in my trading in the week ahead.

This week, I’ll be covering:

- SNAP – From 0.13 To 0.40!

- TGT – From 0.42 To 1.53!

- AAPL – A Key Gauge Near CRITICAL support

The Fed and ECB are Gearing Up for Their Next Rate Moves

On September 21st, the Fed will be announcing its next move on interest rates. What usually happens before that is that Jay Ca-Pow (that’s my nickname for Jerome Powell) and his fellow economic string pullers (i.e. the rest of the Federal Reserve Governors) will give speeches leading up to that decision. The speeches often contain clues as to how these puppet masters will vote on the 21st, so the market will be listening very closely this week.

You might recall that Powell made waves during his speech at the Jackson Hole Symposium recently when he said reducing inflation is likely to require a sustained period of below-trend growth but failure to restore price stability would mean far greater pain.

Here’s the latest look at where the Fed currently has rates set.

If that’s not enough, the European Central Bank (ECB) will also be giving their latest decision on interest rates this week.

All I have to say is that Jay Ca-Pow and his henchmen had better not spook the market this week, because the 10-Yr yield is about to test a major level as SPY is sitting near critical support.

My friends, the relationship between stocks and bond yields is THE relationship I’ll be watching this week as I also focus on what is one of the most widely followed stocks on Wall Street for future guidance. But you’ve got to keep reading to find out more…

One thing’s for sure, I am comforted to know that I have my Smart Money tools to guide me through whatever the market decides to unleash this week!

Now, while enrollment to my Terminator Trades service is closed currently, readers still have an opportunity to get access to my favorite idea generation tools that I use every day to track smart money moves in the market.

Back on 9/02/22 Ethan and I alerted my LottoX Members to:

TGT Long

09 Sep 22 Contract: $165 Calls

Ethan is seeing great call volume on these weekly options, and thinks this name could rip higher. These are trading around $0.42.

And sure enough, the contract saw explosive price movement, with the contract jumping as much as +200% in 3.5 hours!

Next there was…

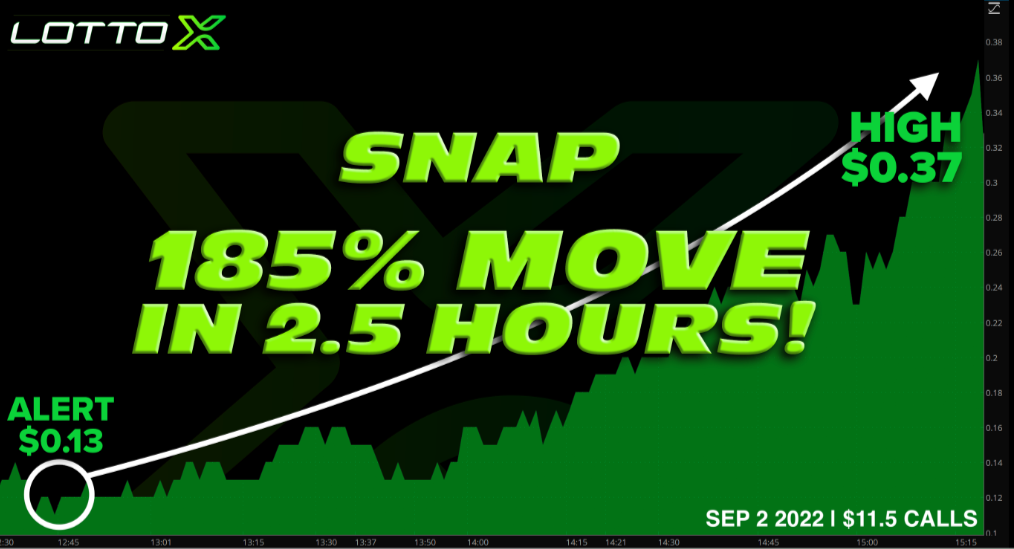

SNAP Long

09 Sep 22 Contract: $11.50 Calls

Ethan likes SNAP to the upside into tomorrow. These are trading around $0.13.

BOOM! The contract exploded as much as 185% in JUST 2.5 HOURS!

Now, BOTH of these throwbacks came from Thursday’s LottoX Live session. If you aren’t a member yet, consider saving on a year of access today. CLICK HERE TO JOIN LottoX.

Okay, that’s enough looking back… Because as much as I hope these helped you find some winning trade ideas, I want to talk about what’s cooking now in the Fat Cat Kitchen…

AAPL

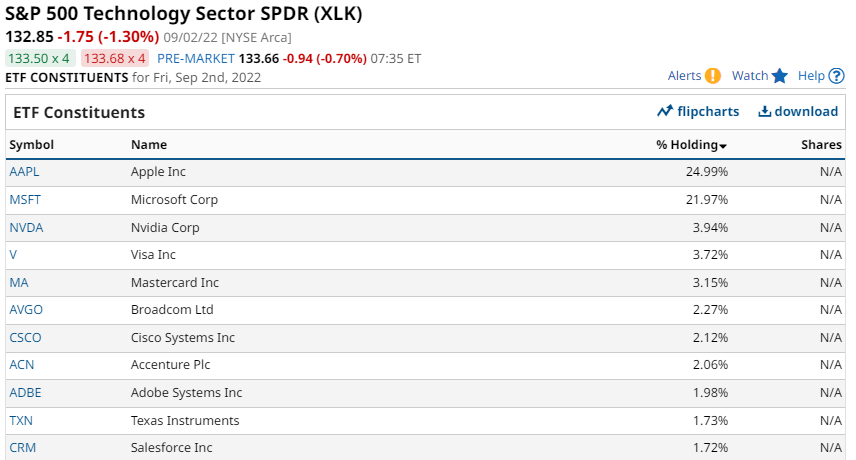

What I am seeing in AAPL is representative of what’s going on across the largecap growth space.

I mean, after all, it is the largest holding in the widely followed S&P 500 Technology Sector ETF (XLK).

Recently, AAPL has been an INCREDIBLY active name on both my Unusual Options Activity and Dark Pool Scanners.

I just want to remind you that, while open enrollment for my Terminator Trades Service ended last week, we expect to reopen (WITH VERY LIMITED SEATS) again at the end of September.

Now, WITHOUT A DOUBT, these are the best tools for identifying where Wall Street’s largest players are trying to hide their trades.

This is all happening as traders are battling for position near CRITICAL support, not just for AAPL, but, as I revealed with SPY earlier, the broader market.

REMEMBER, the reason Jay Ca-Pow’s next move on interest rates is so important is because big, popular, growth stocks like AAPL are HUGELY affected by interest rates.

Why is that, you ask?

Because, when interest rates are rising that can really eat into the future discounted cash flows of these companies. As a result, they can start to underperform again.

You can see how rising interest rates affect the performance of the S&P 500 Technology Sector ETF (XLK), of which, as a reminder, AAPL is the largest member, on this next chart.

NOTE: This week, I am playing this idea with a particular strategy that will help me capitalize on the upcoming earnings momentum.

This intelligence on AAPL is the kind of actionable information that my members are IMMEDIATELY alerted to every trading, along with NON-STOP streaming of SECRETIVE “Smart Money” movement.

That means you don’t have to wait for next week’s “Hustle” to get these ideas delivered to you.

Let’s have a great rest of the week and until next time!

[ad_2]

Image and article originally from ragingbull.com. Read the original article here.