[ad_1]

Rex_Wholster/iStock via Getty Images

Green Thumb Industries Inc. (OTCQX:GTBIF) went public in Canada in 2018 through a reverse-merger, and it trades a bit higher today than it did then. In 2022, it dropped 61.0%. As bad as that was, it was better than the New Cannabis Ventures Global Cannabis Stock Index, which fell 70.4%, and it also beat the New Cannabis Ventures American Cannabis Operator Index, which declined 65.8%. It is the largest holding at 25.1% of AdvisorShares Pure US Cannabis ETF (MSOS), which dropped 72.7% during the year.

While I like Green Thumb Industries, I don’t include it in my core cannabis model portfolio at this time. It is a 5.2% position in my Beat the American Cannabis Operator Index model portfolio, a slight discount to its 6.25% weighting in that index. I own 10 names in this virtual portfolio, all MSOs (multi-state operators). That portfolio, which has 0.1% cash, currently is 30% in Tier 1 names (neutral), 25.5% in Tier 2 names, 24.5% (very overweight) in Tier 3 and Tier 4 names (underweight) and no CBD companies (very underweight).

In this piece, I discuss the chart and the valuation, both of which suggest to me that the stock should rally. I also address management issues.

The Chart

GTI has put in a potential double-bottom:

The stock is still well above the early 2020 low, while some of its peers have made new lows. It is down 77.6% since its peak on 2/10/22 at $38.50.

The Valuation

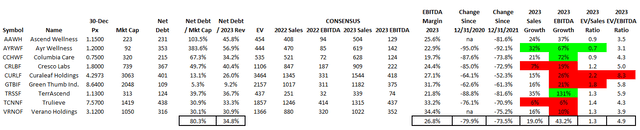

With the big decline in price but only a modest decline in its projected growth, the valuation looks very attractive. Looking at 2023 analyst estimates and comparing the enterprise value of $2.157 billion, which includes net debt of $109 million, the stock at $8.64 trades at just 1.8X projected revenue and just 5.8X projected adjusted EBITDA. Revenue is expected to increase in 2023 by 16%, with adjusted EBITDA growing 21%.

My target for 2023 year-end is $16.71. This is based on achieving a one-year forward EV/EBITDA ratio of 10X. Analysts are projecting 2024 revenue to reach $1.35 billion with adjusted EBITDA of $422 million (a ratio of 31.3%). This target would generate a return of 93%.

As much as GTI seems cheap, it doesn’t really stand out relative to its peers. This table includes the 5 Tier 1 names and the 4 Tier 2 names, which have an average multiple of 1.3X EV/Sales and 4.9X EV/EBITDA for their 2023 projections. GTI trades at a premium and is exceeded only by Curaleaf Holdings, Inc. (OTCPK:CURLF). The projected growth is below average for both revenue and adjusted EBITDA.

Alan Brochstein using Sentieo data

Management Issues

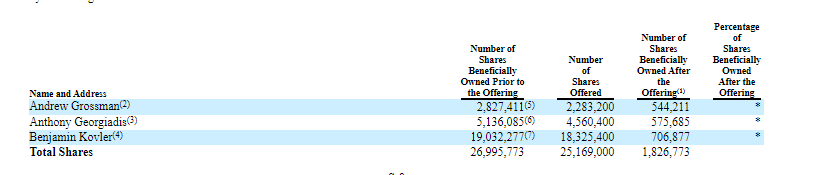

I have always been a fan of the CEO, Ben Kovler, whose family was tied to Jim Beam. He and other insiders have control of the company through the holding of the Super Voting Shares.

Former CFO, Anthony Georgiadis, who is now serving as President, is a great person in my view, but I didn’t think he was qualified to remain as the CFO for as long as he did. Peers have been upgrading this position and finding people with public company experience. The new CFO, Matt Faulkner, was previously Chief Accounting Officer since 2020 after joining the company in 2018 following almost two decades of work at Walgreens in accounting. I am not really in a position to judge the promotion yet.

Last week, the company filed a prospectus for the potential sale of securities by three insiders, primarily Kovler. I don’t expect any sales.

SEC

Conclusion

Green Thumb Industries Inc. is a solid cannabis operator and appears to be cheap. Among the MSOs, it has relatively low net debt and relatively high cash flow. The projected margins are a bit high relative to peers. I don’t see the stock as being one of the best performers among cannabis stocks or even the narrower universe of MSOs.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.