[ad_1]

Onfokus

Intro

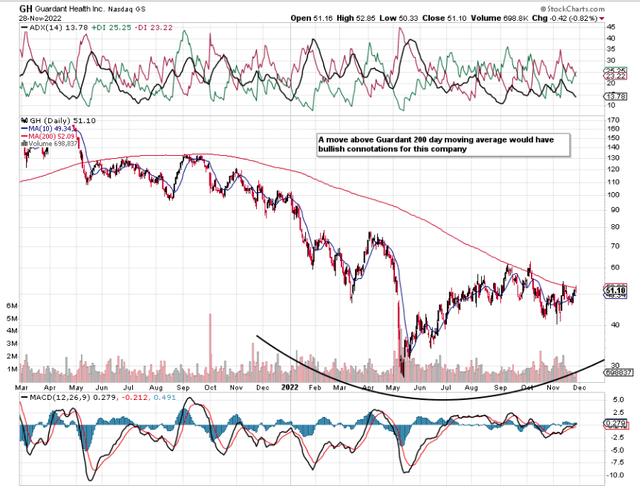

If we look at a chart of Guardant Health, Inc. (NASDAQ:GH), we see that shares have had a pretty strong November despite the company missing its earnings and sales estimates in its fiscal third quarter. Management announced its third-quarter numbers on the third of this month where -$1.18 in earnings per share was reported on sales of $117.4 million. Profitability is expected to improve fractionally in the fourth quarter due to almost a 14% expected increase in top-line sales compared to the fourth quarter of 12 months prior.

GH Technical Chart (Stockcharts.com)

Implied Volatility

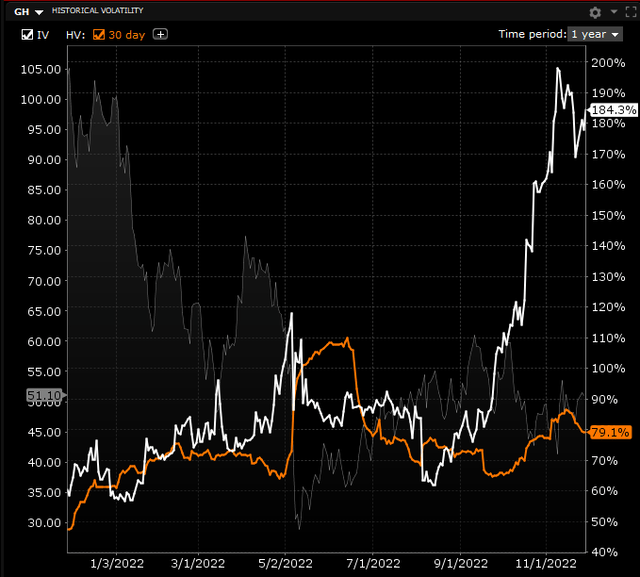

Although long-term investors will be attracted to this play by the company’s relentless pursuit of cancer patients living longer lives, the opportunity for us comes by way of taking advantage of Guardant’s sky-high implied volatility in the upcoming December cycle. Furthermore, we see below that implied volatility is well north of Guardant’s historical volatility. This is attractive for option sellers due to the inflated premium being currently offered in the company’s options.

Guardant Health Implied Volatility V Historic (Stockcharts.com)

So considering that the majority of fear evident in Guardant at present is on the downside (Put Skew), we want to devise an option strategy that takes advantage of this. Before we get into strategy, however, let’s go through a template that options trades can replicate when putting their hard-earned capital to work in the markets.

One way to definitely find success in the financial markets from an options standpoint is to seek out setups that have limited risk, significant reward potential, and a high probability of success. Essentially, if the trader can continuously put himself in scenarios where he has a limited downside or business risk but yet strong upside potential, then the odds are stacked in favor of achieving long-term success.

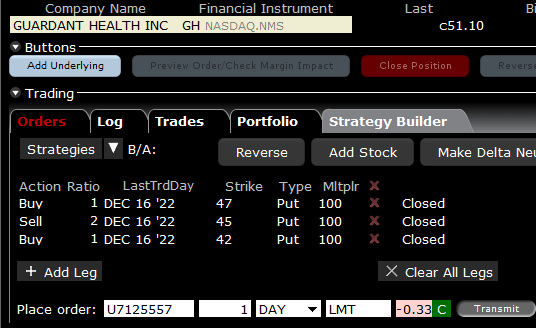

Broken Wing Butterfly

In Guardant Health at present, we are eyeing up a broken-wing butterfly in the December cycle which satisfies the three conditions outlined above. With shares of Guardant currently trading around the $51 handle, the purchase of the $47 regular December put option, the sale of two $45 put options, and then the purchase of one corresponding $42 put option results in the trader receiving $0.33 per butterfly sold. Let’s go through the three points discussed above to demonstrate the attractiveness of this setup.

| Maximum Profit | $233 Per Butterfly |

| Maximum Risk | $67 per butterfly |

| Probability Of Success | 80%+ |

GH – Broken Wing Butterfly Setup (Interactive Brokers)

Profit Potential

Firstly to the max profit potential. Although the possibility of attaining max profit is small, if indeed shares of Guardant were to finish at our short strikes of $45 per share at expiration, max profit would be realized. This would be so because the embedded long put spread would be at max profit ($200) plus the trader would also keep the initial credit received. Instead of thinking of the max profit, if we look at the position’s profit zone, we see why this is an excellent setup with a very high probability of success.

The reason being is due to the “no risk” element of the setup to the upside. Suffice it to say, if shares were to rally aggressively from their current price, the trader would keep the initial credit received per butterfly ($0.33) as all options would expire worthless. On the downside, the breakeven comes in at $42.67 per share. We calculate this by subtracting $233 or ($200 from the embedded long put spread plus the initial credit of $33) from our short trike of $45. Suffice it to say, shares would have to drop over 16% over the next 17 days to lose on this position. Not a bad deal at all.

There are more advantages to this setup which are the following. Because we are buying that $42 put strike (which essentially converts a put ratio spread into a broken wing butterfly), our risk is defined as seen above in the table ($67 per butterfly). However, a max loss need never happen for the following reason. If shares for example were to tank aggressively in forthcoming sessions below our break-even point, the extrinsic value (time value) in the options should mean that an unrealized max loss will not be reflected immediately. In these situations, we usually exit the position especially if we see no sign of a return to profitability over the near term.

Conclusion

Therefore to sum up, given the stretched levels of implied volatility in Guardant Health at present, the market is expecting a significant move. We intend to take advantage of this phenomenon by selling a put broken wing butterfly in the December cycle (where vol is at its highest). By controlling the number of contracts as well as being a defined risk setup, our risk is limited here which is key. We intend to put this on shortly and add it to our portfolio. We look forward to continued coverage.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.