[ad_1]

Jian Fan/iStock via Getty Images

Investment Thesis

Harmonic (NASDAQ:HLIT) reported very strong Q2 results that saw its top line jump 39% y/y. Clearly, this is welcome news for shareholders of a stock that has been highly volatile throughout 2022.

That being said, as we look beyond the surface headline, I question whether the growth in its Cable Access business is likely to lead the stock’s multiple to rerate higher?

Presently, investors are paying 18x next year’s adjusted EPS figures. I believe that this is already a fair multiple for this stock.

Revenue Growth Rates Remain Strong

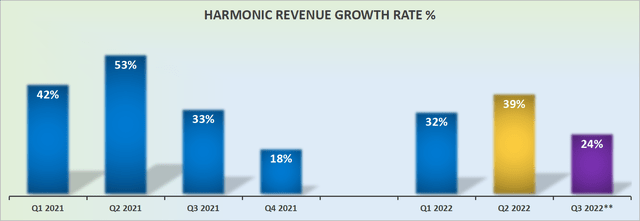

Harmonic’s revenues increased 39% y/y. This allowed the company to report record revenues in the quarter. Clearly, a great result, particularly when we consider that Q2 of last year was so notably strong.

Typically, this would mean that for the remainder of 2022, Harmonic would have very easy comparables, right? However, this doesn’t appear to be the case.

In fact, Harmonic’s Q3 guidance points to 24% y/y of revenue growth rates. This is a substantial deceleration from what investors have become accustomed to in 2022.

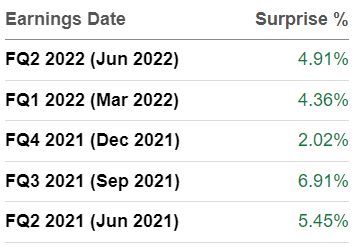

And I know that from a bulls’ perspective, they would proclaim that management is lowballing estimates to allow for an easy beat later on.

HLIT analysts’ revenue estimates

However, as you can see above, the revenue beats by Harmonic have typically been around mid-single digits. Even if revenues ended up coming 6% above the high end of its guidance, at 30% y/y revenue growth rates, this would still be a deceleration into what is supposedly an easier comparable quarter.

Next, we’ll dig further into its business model.

Harmonic’s Near-Term Prospects

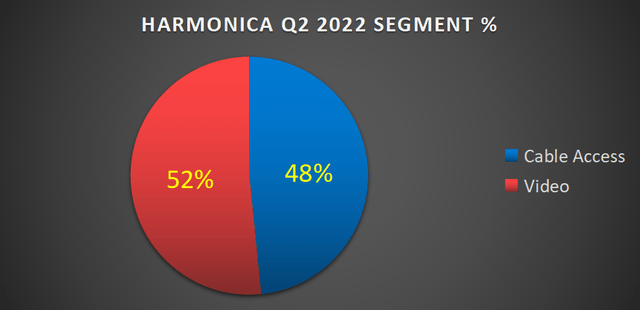

Harmonic delivers virtualized cable access and video delivery solutions.

As you can see above, its business is roughly split between Cable Access and Video. The Cable Access segment is growing significantly faster, as it was up 62% y/y, compared with up 20% y/y for the Video segment.

This implies that by the end of 2022, Cable Access will probably approximate 56% to 58% of the overall business.

That being said, Cable Access’ gross margins were 43% in the quarter, down 400 basis points from the same point a year ago, at 47%.

So, what’s likely to happen over time, is that the business will be reporting strong growth rates, but its profit margins will be less impressive. And this will impact the multiple that future investors will be willing to pay for the stock. Something I’ll soon address.

Profitability Profile, Looking Ahead

For Q3 2022 Harmonic sees non-GAAP operating margins of 10.2% at the high end, which is a 90 basis points improvement from 9.3% of non-GAAP operating margins in the same period a year ago.

Similarly, at the midpoint, Harmonic is guiding for $0.10 of EPS, which would be 11% up from $0.09 reported in the same period a year ago.

Consequently, it could be argued, that despite its alluring revenue growth rates, its excess revenues don’t fully seem to be percolating through its income statement.

Also, keep in mind that Harmonic’s business model is slightly leveraged, with net debt of $28 million. This is not a deal breaker, by any stretch, but nevertheless something to keep in mind, as debt holders will get paid out before equity holders.

On the other side of the equation, keep in mind that Q2 2022 was particularly strong in terms of cash flow, with $22 million reported, up from $17 million in the same period a year ago.

By my rough estimates, I suspect that Harmonic’s capex in 2022 will reach $10 to $15 million, thus implying that in 2022, Harmonic’s free cash flow will probably be less than $20 million.

HLIT Stock Valuation — Priced at 18x next year’s EPS

Harmonic isn’t growing fast enough in a sustainable basis to justify sticking a p/sales multiple on this stock.

Hence, I believe that in Harmonic’s case pricing its stock off its bottom line would be best suited for investors.

After taking into consideration its Q3 guidance adjusted EPS of $0.11 at the midpoint, together with $0.24 reported so far in H1 2022, plus around $0.15 for Q4 (using analysts’ estimate), that means that for 2022 as a whole, its adjusted EPS will probably reach $0.50.

If one were to generously assume that in 2023, Harmonic’s newly found momentum carries its EPS line higher by 25%, this would put Harmonic’s EPS next year at $0.63.

This would leave the stock trading at 18x next year’s EPS. I don’t believe this leaves me with a margin of safety.

The Bottom Line

Harmonic reported a very strong set of results. There’s no question that this quarter Harmonic was able to report results that shows that the business picked up considerable momentum of late.

And I have perhaps been snooty with its valuations of 18x next year’s EPS because I can see around me that there are countless companies that are down more than 60% from their highs, and in this context, I am not as exuberant as I would have been this time last year.

And that’s the problem with investing. Stocks don’t trade in a vacuum. What made sense in one environment, with a certain macro backdrop, doesn’t necessarily apply to the next environment. I rate the stock a hold.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.