[ad_1]

Mario Tama

Intro

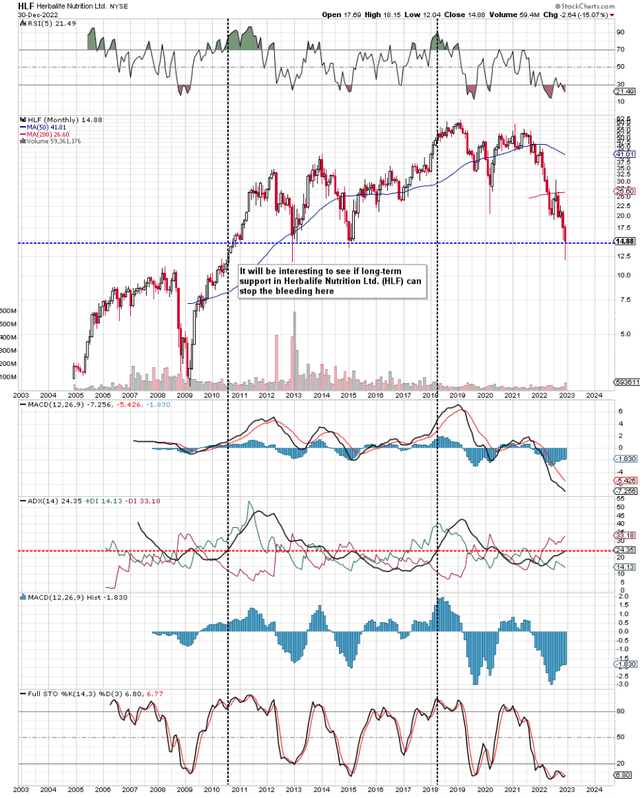

If we pull up a long-term chart of Herbalife Nutrition Ltd. (NYSE:HLF), we see that shares have come right back down to test long-term support. It is crucial support holds here as the next level of support is down at the $10 level. Furthermore, the long-term ADX trend following indicator has been rising, which looks ominous in itself. This is noteworthy because it means the trend in place (bearish) continues to gain traction.

To confirm this, all one has to do is look at past periods when we had a rising ADX indicator and how the share price responded accordingly. As we see below, (These times to the upside), shares of Herbalife Nutrition continued to gain traction when the long-term ADX indicator rose above the 25 level for example. This once more comes back to the premise that major trending moves many times take place from either market highs or market lows. Therefore, it is crucial Herbalife’s lows hold here to stop this aggressive selling we have been seeing in earnest.

Herbalife Long-Term Chart (Stockcharts.com)

After going through the company’s recent earnings report as well as its financials, Herbalife has some serious issues on its hands which the market is obviously fully aware of.

Q3 Earnings

Sales of $1.295 billion were down sequentially and also down by 9.5% compared to the same period 12 months prior. We witnessed the same pattern in net earnings with a Q3 net profit of $82.2 million down by over $35 million compared to the third quarter last year. Apart from the rough comparables, however, it was the pulling of fiscal 2022 guidance that literally set once more the bearish trend in motion. Since the announcement of the report approximately two months now, shares have lost close to 30% of their value.

Despite the negative growth trends, for example, the crux of the matter if the following. Herbalife has accumulated a lot of debt; some $2.725 billion at the end of the company’s most recent third quarter. Therefore, to try and plow through this debt load, management has prioritized debt payments with another $50 million going toward this line item in the third quarter alone this year. Suffice it to say, for the company to keep on paying down that debt load, it needs to protect the bottom line at all costs so cash can be produced in order to keep bringing down that leverage.

This is where things get sticky from a growth standpoint. Management is still spending close to $40 million per quarter in capital expenditure. The business essentially needs this to have any chance of sustained growth. Furthermore, you have the Herbalife One platform initiative which will need funding for some time to come to reach its full potential. Therefore, in order to protect the business (Which is essentially Herbalife’s profits), more money will have to be continually put into the company in order to balance the books. Unfortunately, from a shareholder’s standpoint, this is what has already started.

We state this because earlier this month, the company announced a $250 million note offering which equates to over 17% of Herbalife’s present market cap. Notes are expected to mature in 2028. Capital raises are never good for existing shareholders as these notes (investments) will inevitably result in less of a stake for existing shareholders.

EPS Revisions

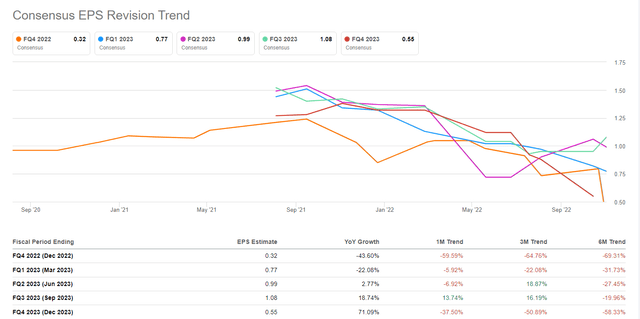

Suffice it to say, many things need to go the company´s way in order to dig itself out of the hole it has made. For one, the recent weakening of the US dollar is a help but we must see quarterly earnings revisions stabilize somewhat rather quickly. As we see below, the upcoming fourth-quarter bottom-line number has been dialed down by almost 60% over the past 30 days alone. Worrying, to say the least.

Herbalife Earnings Revisions (Seeking Alpha)

The problem with the above trend is Herbalife’s lack of equity on its balance sheet (Negative Net-Worth). What we mean by this is that when a company is working on a sound financial footing, growth rates do not have to be the sole focus as the market just wants to see a line of sight to when this growth will eventually happen. However, when a company is having to resort to external funding to keep investment elevated and to pay down debt, this cycle then can become a vicious downward spiral unless growth can be resurrected.

Conclusion

Therefore, to sum up, the technicals discussed above are definitely in alignment with Herbalife’s negative growth trends and worrying debt load. If ever growth was needed in the company, it is needed now. We look forward to continued coverage.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.