[ad_1]

What’s happenin’ everybody?

The odds that it’s coming are pretty darn good…

and that’s why I’ve been spending a little extra time showing members how to prepare, so they can be ready!

No, I’m not talking about Labor Day weekend.

I’m talking about a recession.

Friends, I am comforted by the fact that I’ve told you, time and time again, about how the Fed ALWAYS misses on the timing of their monetary actions surrounding their own economic forecasts.

Their “transitory” inflation stance from last year is a perfect example of that.

Now, as they lob historically large interest rate hikes at the market in an attempt to destroy the bubble they single-handedly created, they are dismissing the growing odds that they are driving the U.S. closer to recession.

Heck, there are even several experts who claim we are already there!

As a trader, I am not waiting around to see how this plays out.

Instead, I am doing what I always do, which is to educate my members on how to read what the market is telling us because, well…

THE MARKET NEVER LIES.

I’ve tried to explain to you that the market is a snapshot of the collective knowledge of millions of investors around the world.

And that combination of retail and institutional knowledge is translated into patterns of major indices like the S&P 500 for ALL traders to read.

At the same time, though, there are very large and, oftentimes, very crooked institutional traders that don’t want you to see where they are placing their bets ahead of the market’s next big move.

But I can see them.

And you know who else can see them?

Members of my “smart money” trading services!

Friends, did you know that there are 3 types of economic indicators?

They are:

- Leading Indicators

- Lagging Indicators

- Coincident Indicators

As their names suggest…

- Leading indicators provide clues about the future.

- Lagging indicators help to confirm economic patterns that are already happening.

- Coincident indicators help to clarify what is currently happening.

Now, next week’s trading is going to be dominated by 2 very important leading economic indicators: ISM Manufacturing (also known as PMI) and the Jobs (also known as the unemployment rate).

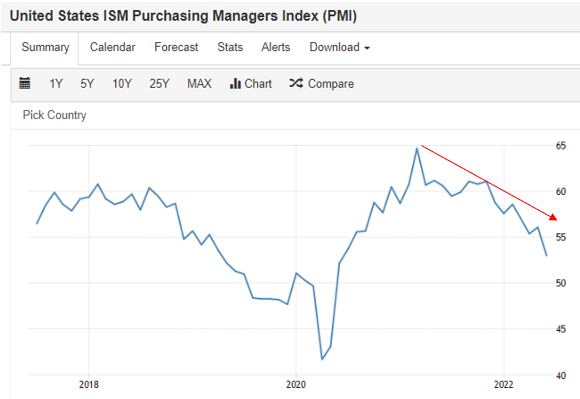

You can see from this chart that the ISM Index, which measures economic health through supplier deliveries, imports, exports, production, inventories, new orders, order backlogs, prices, and employment, has continued to fall in recent months, with no signs of stopping.

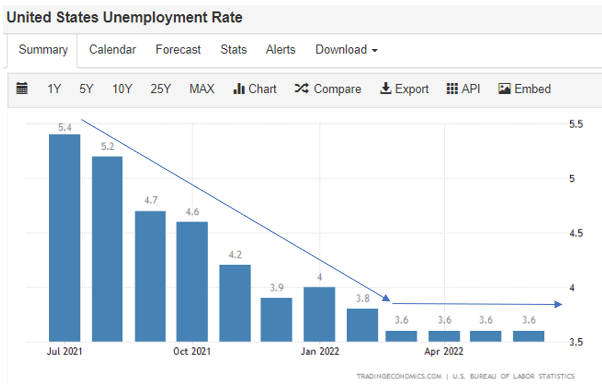

In addition, this next chart shows that, after a long trend of declining unemployment numbers in the U.S., unemployment is no longer declining.

Look, these two items are just a small part of the puzzle that lead economists to determine if the U.S. economy is in a recession or not.

This puzzle is complex, and it takes years of practice to learn how to navigate it.

I’ve been trading these numbers and educating folks how to do the same FOR YEARS, and I can tell you this: you are NOT going to find the answers using RSI and VWAP.

No.

As a trader, you need to be able to gauge the flow of money between certain sectors.

Sorry to say, that means you’ll need special tools that most retail traders either don’t know about or are not willing to invest in.

Unfortunately, I’ve seen it over and over again, these are the traders that are left saying “why didn’t I see that move coming?”

Friends, I spend my days looking for these flows and interpreting how they fit with other actionable market signals, and it’s my Smart Money Suite of premium, custom tools that help me do it.

Look, we’re all grownups here.

If you want to keep learning about the big trades after the fact, be my guest.

But I will tell you this: NEXT WEEK’S DATA could help determine if the U.S. has entered a recession again.

Trust me when I tell you that BIG Wall Street institutions have teams of people working to position ahead of these economic reports, and my Smart Money Suite is what you need to follow their moves ahead of the next BIG market move.

Let’s all have a great weekend and until next time…

[ad_2]

Image and article originally from ragingbull.com. Read the original article here.