[ad_1]

JHVEPhoto

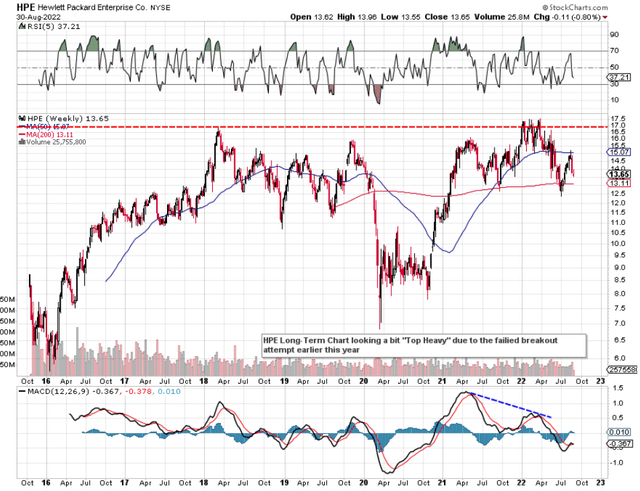

We wrote about Hewlett Packard Enterprise Company (NYSE:HPE) back in December of last year, when we were of the opinion that a bullish breakout was on the cards. Although shares rallied close to 20% soon (Where the rally lasted until March 2022) after our piece up to almost $18 a share, a sustained breakout above the stock’s 2018 highs could not be completed.

HPE Technical Chart (Stockcharts.com)

Hewlett Packard Q3 FY22 Earnings

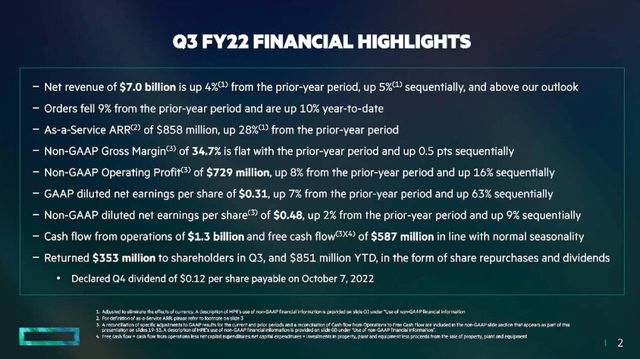

The March to July period this year witnessed an ugly decline in the HPE share price, so it will be interesting to see if the company´s recently reported third-quarter earnings can put a stop to the latest decline. Although Q3 results were in line with expectations and there were some very encouraging trends concerning profitability as we see below (Sequential Non-GAAP gross margin improvement as well as a rolling Non-GAAP operating profit increase), bottom-line guidance for fiscal 2022 was revised down due to ongoing supply chain headwinds and further recent strengthening in the U.S. dollar. Furthermore, free cash flow was also revised down, which means profitability is expected to be lower both from a cash and non-cash basis this year.

HPE Fiscal 2022 (Q3) Financial Highlights (Seeking Alpha)

Earnings growth (which obviously incorporates forward-looking expectations) is the main driver of stock prices on Wall Street. Therefore, we might see more volatility in the stock before we finally register a firm bottom here in HPE. In fact, given current market conditions and the heavy resistance above the prevailing share price (limited near-term upside), we see HPE as more of an income play (Dividends & Covered calls) at present. This means the evaluation of downside risk is key. A good way to decipher HPE’s downside risk is to research the trends which make up its dividend and the stock’s total return potential. We will start off with the payout ratio.

HPE Pay-Out Ratio

Based on HPE’s reported net profit of $3.7 billion over the past four quarters and $625 million of dividend payments, the company’s payout ratio comes in at approximately 17%. This means HPE’s 3.5% dividend yield could be in fact substantially higher, but management has decided to keep earnings in-house in recent times. Suffice it to say, there is not a problem with affordability, but is the company keeping a lot of its powder dry unnecessarily?

Hewlett Packard Enterprise Profitability

Although trailing 12-month profitability metrics look very impressive in HPE, investors should be aware of the $2.6+ billion non-recurring gain which boosted net profit in the first quarter of this year. For example, HPE´s reported return on equity presently comes in at almost 20%, but if we were to adjust this figure by subtracting that one-off Q1 addition from the 12-month trailing profit total, we would get an adjusted ROE of close to 5%. This is slightly below the company’s historic ROE. Suffice it to say, despite the fact that we saw rising margins in Q3 and the fact that management is steering the firm toward its high-margin products, base bottom-line profitability may not be as elevated as many envisage at present.

In saying this, management has used existing cash to both buy back stock aggressively and pay the above-mentioned dividend. These initiatives demonstrate confidence in where management believes the company is headed and are pinned on the expectation of a meaningful increase in forward-looking profitability

Interest Coverage Ratio

The interest coverage ratio lets us know how much of the company´s operating profit is dropping to the bottom line. Obviously regarding the dividend, the higher this ratio, the better as a low-interest expense and elevated earnings protect the payout in the long run. Over the past four quarters, $900 million of interest expense was paid from an operating profit balance of $2.15 billion. This gives us an interest coverage ratio of 2.39, which is definitely on the low side for a dividend-paying company.

Earnings Expectations

Despite recent downward revisions, HPE is still expected to deliver bottom-line growth this year to be followed by approximately 8% earnings growth next year. Remember, though, that these are estimates and take into account the company’s backlog and that the company will continue to be able to take advantage of strong trends in cloud and data which are clearly evident in this space. From our standpoint, all eyes now point to Q4 to see if the company can hit or beat estimates, but more importantly, keep forward-looking expectations strong.

Conclusion

HPE reported in-line numbers on its third-quarter earnings call but decreased guidance a tad for both earnings and free cash flow. We see this stock as a rangebound play as interest coverage remains high and earnings revisions could easily accelerate to the downside in upcoming months. The stock remains a hold for us where, if we had a position, we would collect the dividend and sell covered calls to reduce our breakeven as much as possible. We look forward to continued coverage.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.