[ad_1]

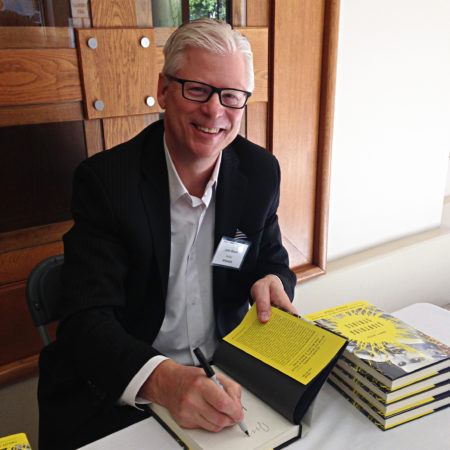

This commentary on the CPI comes to us courtesy of John F. Wasik, an esteemed journalist and author whose credits include the New York Times, Reuters, 19 books and many more publications.

The Consumer Price Index (CPI) is a curious onion. It’s certainly pungent, but you can’t fully understand it until you peel it apart. And when you dice it up, it means different things to different people.

To people living on the edge, high inflation will definitely make you cry. But I am always perplexed at how little explanation goes in covering this number, which is released every month by the Labor Department’s Bureau of Labor Statistics.

Most reporters will note that the CPI is a composite of other costs of living such as food, energy and housing. The “big” number that’s reported monthly shows a 30-day increase (or rarely, a drop). More importantly, it is a benchmark for loss of purchasing power. If your income isn’t keeping up with your actual cost of living – then inflation means a dollar buys less today than it did last month.

If you missed the latest CPI press release, inflation was running at a 6.5% annual pace in December. Not stellar news, of course, but good news in certain sectors of the economy. At least it’s heading south.

Under reported: How Social Security lags behind the CPI

The low-hanging fruit is always asking the question, “Who gets hurt the most?” Generally, it’s those folks on fixed incomes or making minimum wage. They typically don’t have the disposable income to cover the gap between rising prices and their paychecks. Sure, Social Security offers a “cost-of-living adjustment,” yet an under-reported story is how much these payments lag what retirees are actually paying for out-of-pocket health and long-term care.

As you might imagine, the AARP does a competent job of explaining the back story on how inflation impacts retirees. But there’s another layer to this story that’s largely ignored.

How does inflation hurt fixed-income folks over time? For that, it’s worth checking out lesser-known sources such as the Senior Citizens League (TSCL) which does some meaningful analysis of the CPI and senior expenses.

Peeling back the CPI onion is a matter of basic subtraction. “Since 2020,” the TSCL reported last month, “price hikes for virtually everything posed the biggest challenge for older Americans, particularly lower-income senior households who depend on Social Security for most, or even all, of their income. This year the average monthly Social Security benefit for retirees is less than $1,656.”

For retirees, the cost of economic pain

How do you quantify that economic pain? “Many retirees have been forced to spend through savings far more quickly than planned and those without savings have turned to food pantries and low-income assistance programs in higher numbers,” TSCL added. “From January through December the 5.9% Social Security COLA received in 2022 fell short of actual inflation every month by 46% on average and left the average Social Security benefit of $1,656 short by more than $42 per month and more than $508 for the year.”

Ultimately that means more people going to food pantries (which I’ve seen in my area) and increased poverty. Digging even deeper, the TSCL breaks out the biggest contributors to retirees’ higher living costs: Home heating oil, airfares, flour, health care, etc. The human side of these numbers is daunting. How are these people making it if their heating bills are up double digits? How is local/state/federal government helping them (or not)?

Again, there’s another under-reported layer to this story. The Labor Department, to its credit, actually offers some tips. Going beyond the CPI press release, you’ll find a “Spotlight on Statistics,” which offers insights into the impact on high- and low-income households. From there, you can match up the government stats with a reporting narrative that veers beyond one number.

John F. Wasik is a veteran business journalist/writer who has contributed to The New York Times, Wall Street Journal, Forbes.com, Reuters and Bloomberg. He is also a speaker and the author of 19 books, including “Lincolnomics” and “Keynes’s Way to Wealth.” The opinions expressed are his own.

John F. Wasik is a veteran business journalist/writer who has contributed to The New York Times, Wall Street Journal, Forbes.com, Reuters and Bloomberg. He is also a speaker and the author of 19 books, including “Lincolnomics” and “Keynes’s Way to Wealth.” The opinions expressed are his own.

[ad_2]

Image and article originally from talkingbiznews.com. Read the original article here.