[ad_1]

wildpixel

Stocks had a strong open yesterday but were dragged lower through the remainder of trading after a profit warning from chipmaker Nvidia weighed on sentiment in the tech sector. There is also a lot of anxiety building about Wednesday’s Consumer Price Index report for July. The consensus expects to see a decline from the peak of 9.1% to 8.7% on lower energy prices, while the core rate ticks up from 5.9% to 6.1%. Still, investors looked for bargains in energy and materials names with both sectors finishing the day nearly 1% higher after having corrected sharply during the past three months over recession fears.

Finviz

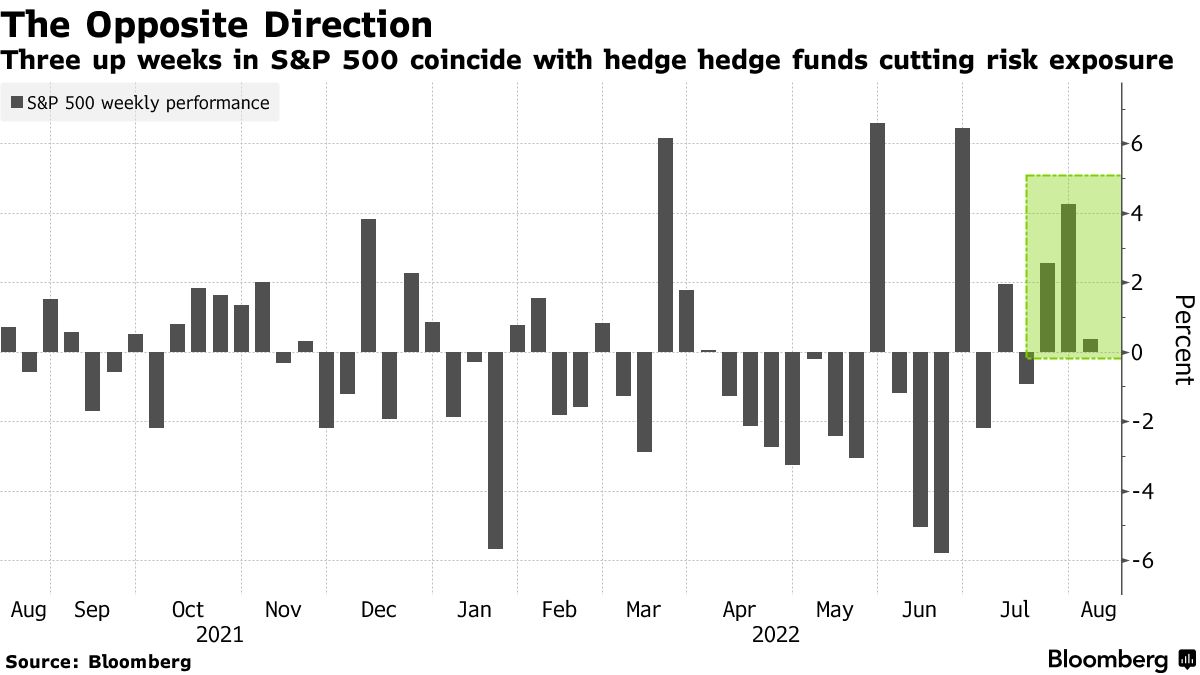

Tomorrow’s inflation report is really yesterday’s news, but it is important from the standpoint of convincing a growing number of investors that the peak rate is behind us. Tomorrow’s news can be found in expectations for inflation, and on that front we made major headway yesterday. Regardless, Wall Street pundits continue to beat their bear-market drums, convinced that Friday’s blowout jobs report will force the Fed to strangle the stock market with a rate hike of as much as 1% next month, according to strategists at Citigroup. This has the professional investment community reducing risk during what Wall Street is calling a bear-market rally.

Bloomberg

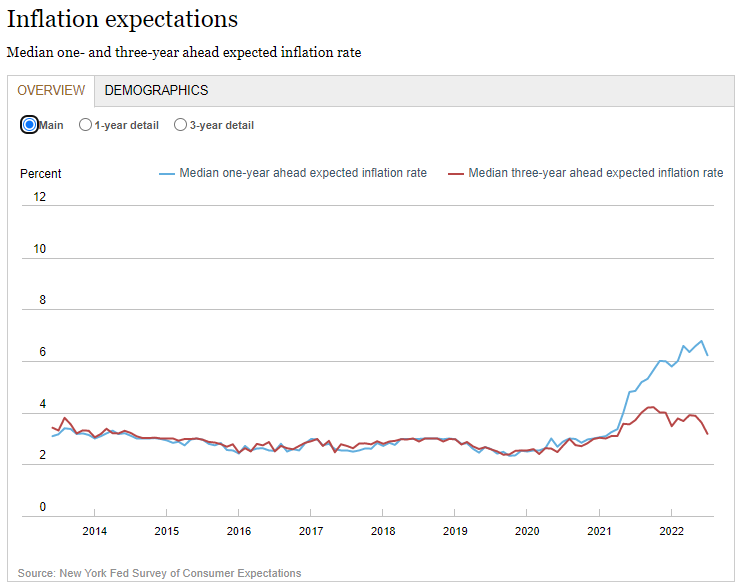

I can’t explain why the pundits won’t change their tune after the New York Fed’s July Survey of Consumer Expectations. The median one-year outlook for inflation is clearly rolling over, falling from 6.8% to 6.2% in just one month. The median-three-year outlook fell from 3.6% to 3.2%. Most importantly, the outlook for lower prices was broad based, but strongest among household with incomes below $50,000, which has been the demographic hardest hit by inflation. Lastly, the five-year outlook fell from 2.8% to 2.3%, which is within the crosshairs of the Fed’s targeted range.

New York Fed

This tells me that the Fed may be done raising short-term rates at either the September or November meeting with a Fed funds rate of 3%, which equates to an additional 75 basis points. The futures markets, still focused on the strong jobs report for July, is holding 3.5% as the highest probability for the peak. Therein lies the catalyst for the stock market’s continued recovery during the second half of this year. As the rate of inflation falls faster than the consensus expects, along with expectations for inflation, the futures market will reflect a less aggressive tightening campaign by the Fed. That should result in lower shorter-term rates (2-year yield), eliminating the inversion in the yield curve between 2- and 10-year yields and coinciding with a soft landing.

The stock market recovery I am looking for will not be without bouts of volatility, and I still think the S&P 500 is due for a pullback to solidify the June low and refresh the uptrend, but we are making real progress.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.