[ad_1]

Inox Green Energy IPO Review: Inox Green Energy Services Limited is set to be listed on the Indian exchanges. The IPO will open for subscription on November 11th, 2022, and close on November 15th, 2022. It is looking to raise Rs 740 Crores, out of which Rs 370 crores will be a fresh issue and the remaining Rs 370 Crores will be an offer for sale.

In this article, we will look at the Inox Green Energy IPO Review 2022 and analyze its strengths and weaknesses. Keep reading to find out!

Inox Green Energy IPO Review – About The Company

Inox Green Energy Services Limited is a subsidiary of Inox Wind Limited. It is one of the major wind power operation and maintenance (“O&M”) service providers within India.

The company is engaged in the business of providing long-term O&M services for wind farm projects, specifically the provision of O&M services for wind turbine generators (WTGs).

The company also offers a variety of services including wind resource assessment, site acquisition, infrastructure development, and EPC of WTGs, along with providing long-term O&M services for wind power projects.

The competitors of the company

There are no listed companies in India that are comparable in all aspects of business and services that Inox Green Energy Services provide.

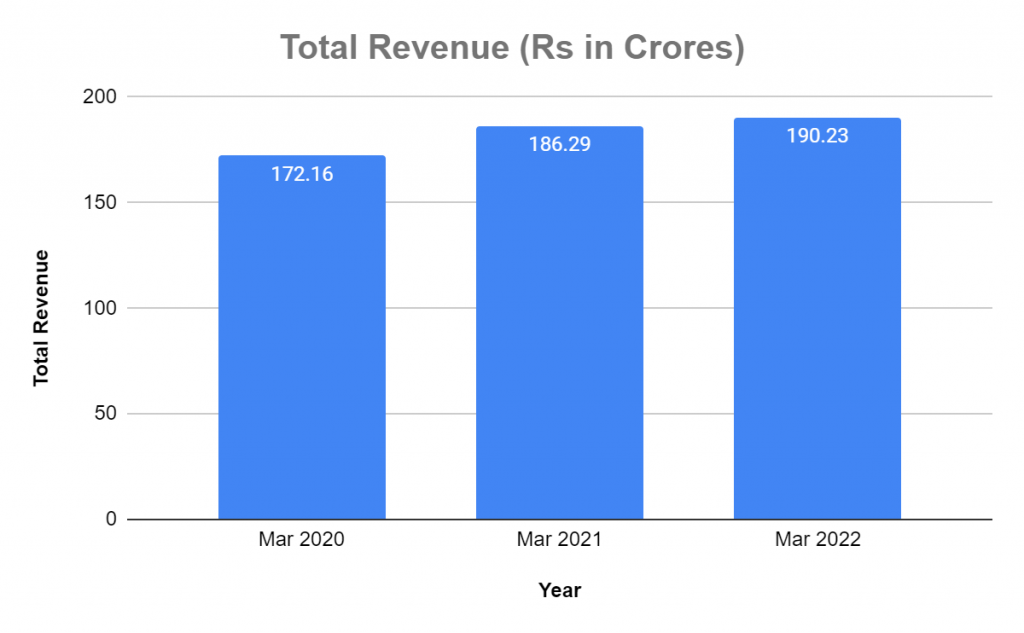

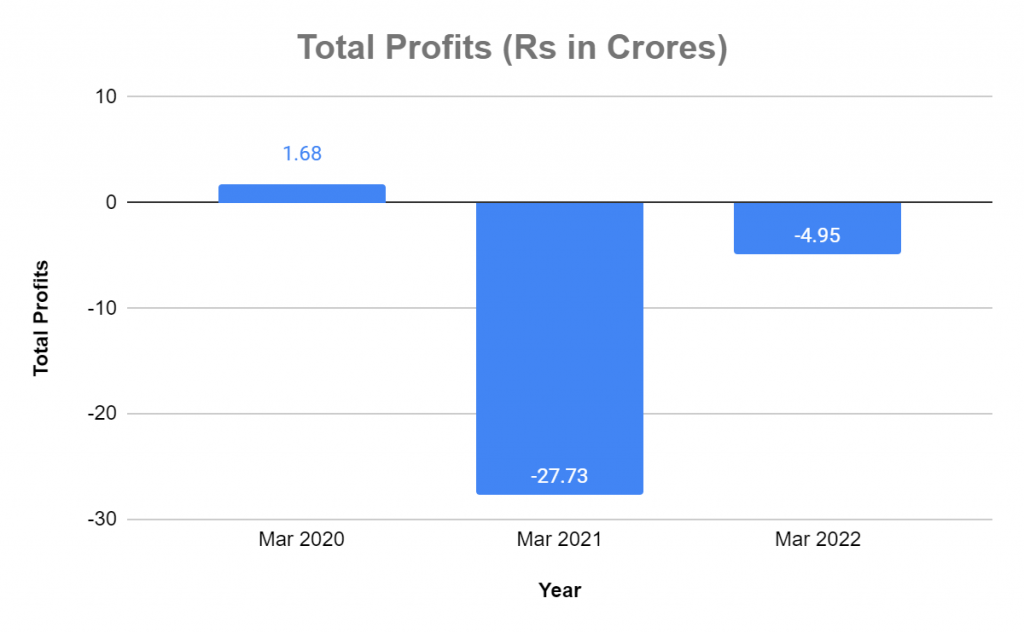

Inox Green Energy IPO Review – Financial Highlights

Inox Green Energy IPO Review – Industry Overview

According to the International Energy Agency (“IEA”), India is the third largest energy-consuming country in the world and has become one of the largest sources of energy demand growth globally.

CRISIL Research expects the energy required to grow at 3.0-4.0% CAGR over fiscal 2022 to 2026 after a minor decline of 1.2% in fiscal 2021 on account of the economic downturn induced by the COVID-19 outbreak.

Recently, Prime Minister Modi made a commitment at the COP26 global climate summit held in Glasgow in November 2021 to have 50% of India’s power generated by renewable energy by 2030 and for India to achieve carbon neutrality by 2070.

Thus, the growth prospects of the wind sector in India are promising with capacity additions of 18-20 GW expected over the next five years which would entail investments of approximately ₹1.4 trillion over the period (Source: CRISIL Report).

Strengths

- The company has a strong, wide, and diverse existing portfolio base.

- The company is engaged in the green energy business and thus has favorable national policy support.

- The company is supported and promoted by its parent company Inox Wind Limited, which already has a strong presence in the industry.

- The company has a strong established relationship with its suppliers.

- The company has a reliable cash flow supported by long-term O&M contracts with high-credit quality counterparties.

Weaknesses

- The company is subject to risks such as Technology failures or advancements that could disrupt its operations.

- There are outstanding legal proceedings involving the Company, its Subsidiaries, Directors, Promoter, and Group Companies.

- The demand for their services is primarily dependent on the demand for electricity in India. Any changes will affect the business.

- The wind energy projects in the country are still resisted by the people which can be a threat to the company’s business.

- The company is exposed to multiple competitive factors like the performance of WTGs, reliability, product quality, technology, price, scope and quality of services, and training offered to customers.

Inox Green Energy IPO Review – GMP

The shares of Inox Green Energy traded at a premium of 13.85% in the grey market on November 10th, 2022. The shares tarded at Rs 74. This gives it a premium of Rs 9 per share over the cap price of Rs 65.

Inox Green Energy IPO Review – Key Market Information

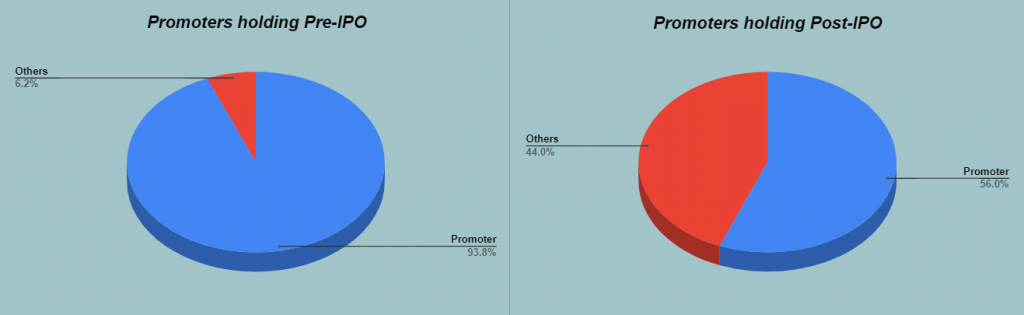

Promoters: Inox Wind Limited

Book Running Lead Managers: Edelweiss Financial Services Limited, DAM Capital Advisors Limited, Equirus Capital Private Limited, IDBI Capital Markets & Securities, and Systematix Corporate Services Limited.

Registrar To The Offer: Link Intime India Private Limited

| Particulars | Details |

|---|---|

| IPO Size | ₹740 Crore |

| Fresh Issue | ₹370 Crore |

| Offer for Sale (OFS) | ₹370 Crore |

| Opening date | November 11, 2022 |

| Closing date | November 15, 2022 |

| Face Value | ₹10 per share |

| Price Band | ₹61 to ₹65 per share |

| Lot Size | 230 Shares |

| Minimum Lot Size | 1 (230 Shares) |

| Maximum Lot Size | 13 (2990 Shares) |

| Listing Date | November 23, 2022 |

The Objective of the Issue

The Net Proceeds from the Fresh Issue are proposed to be utilized for:

- Repayment and/or pre-payment, in full or part, of certain borrowings, availed by the company including redemption of Non-Convertible Debentures in full.

- General corporate purposes.

In Closing

In this article, we looked at the details of Inox Green Energy IPO Review 2022. Analysts remain divided on the IPO and its potential gains. This is a good opportunity for investors to look into the company and analyze its strengths and weaknesses. That’s it for this post.

Are you applying for the IPO? Let us know in the comments below.

You can now get the latest updates in the stock market on Trade Brains News and you can even use our Trade Brains Portal for fundamental analysis of your favorite stocks

Start Your Financial Learning Journey

Want to learn Stock Market and other Financial Products? Make sure to check out, FinGrad, the learning initiative by Trade Brains. Click here to Register today to Start your 3-Day FREE Trail. And do not miss out on the Introductory Offer!!

[ad_2]

Image and article originally from tradebrains.in. Read the original article here.