[ad_1]

Nordroden

I put out a strong buy recommendation on the iShares MSCI Global Metals & Mining Producers ETF (BATS:PICK) on November 10 last year, arguing that cheap valuations, elevated inflation, and strong long-term oil demand would send the ETF higher. The rise in the PICK relative to the underlying metals price index and the drop in inflation expectations suggest the outlook is now less positive, but the ETF remains good value and should continue to outperform the market over the long term.

The PICK ETF

The iShares MSCI Global Metals & Mining Producers ETF seeks to track the investment results of an index composed of global equities of companies primarily engaged in mining, extraction or production of diversified metals, excluding gold and silver. The ETF charges a management fee of 0.39% per year, which is reasonable in the context of the high volatility of the fund. The ETF also pays a strong dividend yield of 6.1%, although this is likely to decline over the coming months as analysts expect a 20% decline in payouts across the sector this year.

PICK Top Holdings (Bloomberg)

PICK is well diversified in terms of company exposure, with BHP the largest stock in the index with a weighting of 14%, followed by Rio Tinto at 7%. The price of iron ore is therefore a key driver of performance. In fact, the ETF closely tracks the performance of the S&P GSCI Industrial Metals Index, so is ideal for investors looking to benefit from rising metals prices.

Recent Outperformance Relative To Metals Prices And Inflation Are Unsustainable

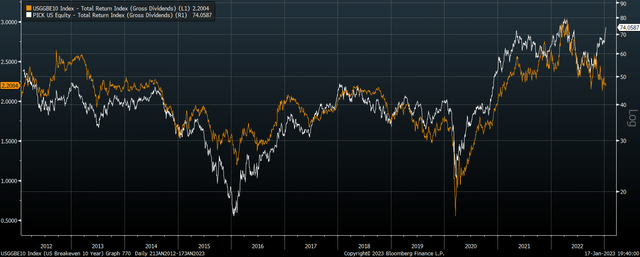

The PICK ETF has surged over the past six months, outperforming the SPX by 37% since its July low. This has occurred even as the industrial metal price index has risen relatively modestly. As the chart below shows, the PICK’s total return performance has surged relative to the price of the underlying metals that the mine.

PICK Total Return Performance Vs Metals Price Index (S&P, Bloomberg)

The PICK’s rally has also occurred amid a decline in inflation expectations as measured by 10-year US breakeven inflation expectations. Over the past decade, there has been an incredibly close correlation between the ETF’s performance and inflation expectations, and the recent decoupling is a possibly warning sign that the PICK’s rally is unsustainable for now.

PICK Total Return Performance Vs 10-Year Breakeven Inflation Expectations (Bloomberg)

Still Deeply Undervalued Relative To The Broader Market

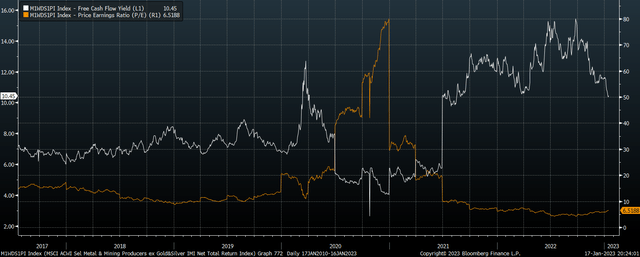

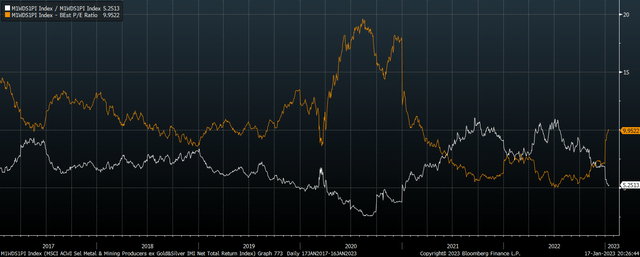

Despite the near-term headwinds from the recent outperformance relative to metals prices, the PICK should continue to outperform the SPX over the coming years. The trailing price-to-earnings ratios on the metals and mining index is just 6.5x, less than one-third of the SPX. These ratios are also supported by free cash flow yields, with the metals and mining index offering a 10.5% FCF yield versus 4.9% for the SPX.

PICK PE Ratio and FCF Yield (Bloomberg)

The huge profit margins in the sector, currently at 14%, are likely to decline over the coming months as they largely reflect the record high metals prices seen over the past 12 months, which are now 20% off their all-time highs. The forward PE ratio reflects this, trading at a slightly more elevated at 10.0x, while the forward FCF yield is slightly lower at 8.0%. However, even these figures make the PICK significantly undervalued relative to the broader market.

PICK Forward PE Ratio And FCF Yield (Bloomberg)

The strong free cash flow yields in the metals and mining index are reflected in its dividend yield, which sits at a solid 5.4%, over 3x that of the SPX. Analysts are expecting to see a 20% decline in dividends over the next 12 months as free cash flows decline, but even the forward yield of 4.2% is attractive relative to the SPX.

Summary

The rally in the PICK over recent months has been impressive, having risen far more than the price of the underlying metals price index. The ETF has also decoupled from market expectations of long-term inflation, suggesting some near-term headwinds may be brewing. However, valuations remain attractive, with a free cash flow yield of over 10%. I continue to see the PICK outperforming the SPX over the coming years and remain long the ETF.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.