[ad_1]

Nastassia Samal

iShares Expanded Tech-Software Sector ETF (BATS:IGV) tracks the performance of the S&P North American Expanded Technology Software Index. The ETF holds a diversified portfolio of software companies, such as Microsoft, Apple, and Adobe, and is traded on the NASDAQ stock exchange. It is one of the most popular ETFs among investors seeking exposure to the technology software sector, but IGV had a terrible year in 2022, with its price falling by 47.54% from its 2021 highs. The recent decline in IGV is due to the market uncertainty caused by Covid-19, the change in interest rates, and the increase in inflation. The market risk is seen in commodity markets, particularly gold, resulting in a wide consolidation of gold prices. The high level of risk has decreased the value of stocks, creating a buying opportunity on the stock market. IGV is still trading at an inflection point, such that a breakout above $280 would indicate further upside, whereas a drop below $235 would indicate further downside. This article will discuss the technical evolution of IGV’s price patterns and the associated risk in the current market environment.

Why IGV is Good Investment?

IGV underperformed the market throughout the year, but the pullback in 2022 could be a good investment opportunity due to the ETF’s wide range of diversification, access to the technology software industry, low cost, and convenience. IGV’s portfolio of software companies is diversified, which helps to mitigate investment risk and potentially reduce overall volatility. The ETF enables investors to gain exposure to the technology software sector, which has significant upside potential. In contrast, ETFs have lower expenses than actively managed funds, which can result in a higher long-term return for investors. Consequently, investing in IGV is a convenient way for investors to gain exposure to a diverse range of software companies without having to conduct research and select individual stocks. Long term, the expense ratio is a crucial factor for any ETF, as cheaper funds can significantly outperform more expensive ETFs. IGV’s annual operating expense is 0.40%, which is less than other ETF. It also has a twelve-month dividend yield trailing of 0.01%.

Technical Developments in IGV

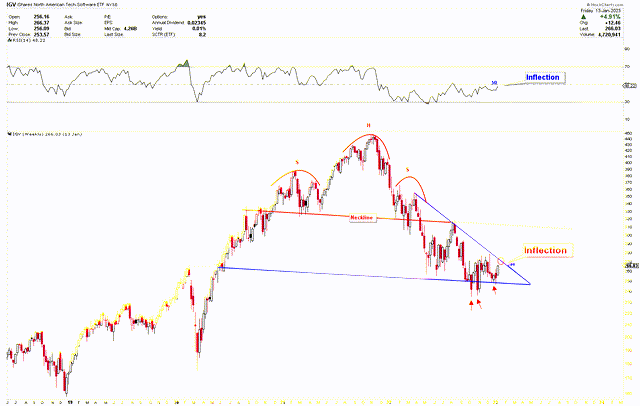

Since IGV slipped from its high of $448.79 in November 2021 to its low of $235.41 in October 2022, the price has experienced significant volatility during this drop of 47.54% in just a few months. The drop is observed using the IGV chart below. The ETF’s significant decline has created a strong bearish head-and-shoulders pattern, which was confirmed by the breach of the neckline at $300 in April 2022. This breakout from the neckline has caused the ETF to reach the low point of $235, where a double bottom has created strong support. IGV has recently rebounded from support and is now testing the inflection point. The resistance at $280 is regarded as an inflection point because the price is encountering strong resistance despite bullish fundamentals. Any breach of this point of inflection at $280 would be bullish for the IGV.

iShares Expanded Tech-Software Sector ETF (stockcharts.com)

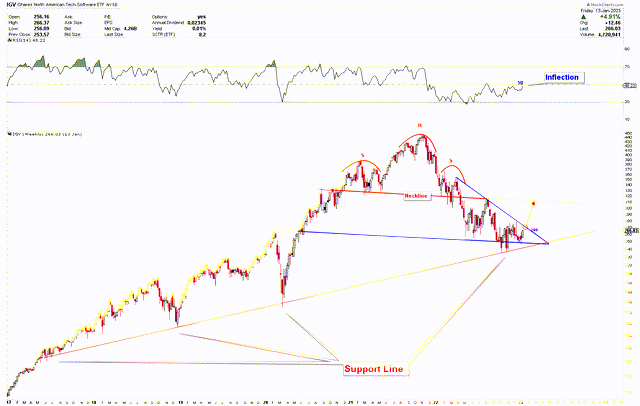

IGV is currently bouncing off of this support, which is depicted on a different chart below. A double bottom at this support line is referred to as a strong buying signal, but for the ETF to move higher, it must first break above the inflection point. A breach of the inflection points at $280 would propel the price directly towards the red dotted line at $300-$310.

iShares Expanded Tech-Software Sector ETF (stockcharts.com)

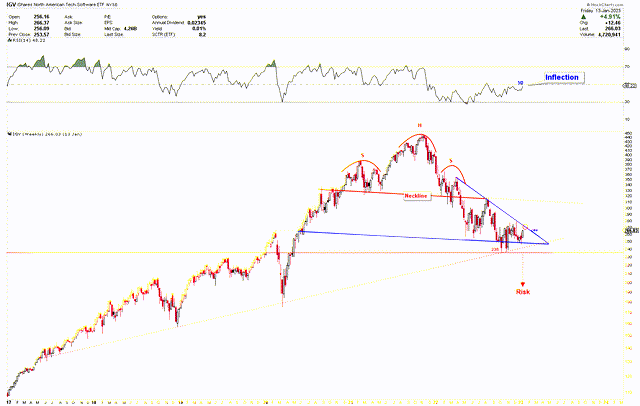

Market Risks

Investing in IGV is currently regarded as a high-risk investment due to the emergence of extremely bearish patterns. However, based on recent events, a bottom is forming at the current support level. The risk in IGV is elevated until the ETF breaks the red-dotted trend line, which will confirm the next rally. On the other hand, the ETF has not breached the inflection point, therefore the risk is high. However, based on recent developments in the price structure of precious metals and the US economy, IGV is likely to break higher. The chart below depicts the situation if IGV falls below $235, which is the high-risk level.

iShares Expanded Tech-Software Sector ETF (stockcharts.com)

Bottom Line

According to the preceding discussion, IGV declined last year but began 2023 on a positive note. Recent market developments in the United States, including rising interest rates and inflation, have contributed to the commodities market, which is a positive indicator for stocks and ETFs. IGV remains with a bearish structure but is currently testing the inflection point after bouncing off the strong support line. The break of the IGV’s inflection point at $280 would be a positive indicator of a rally toward the $300-$310 region. A breach of $310 would be a bullish indicator in which investors would begin to invest with minimum risk. Currently, the price is low and has the potential to rise. In conclusion, IGV’s bottom is still not confirmed until the $280 inflection point breakout; however, based on recent price action, the ETF is likely to break higher.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.