[ad_1]

imaginima

The iShares Core MSCI Total International Stock ETF (NASDAQ:NASDAQ:IXUS) captures non-US exposures and can help you achieve geographic diversity in your portfolio. But do you really want random geographic diversity? No you don’t, especially if you live in the US. FX is a penalty that goes for a lot of foreign holdings right now. You need strong reasons to buy foreign stocks, and ETFs don’t have strong reasons for any of their holdings. USD will continue to strengthen from its advantaged position as a reserve currency amid rate hikes. Besides the FX concern, the sectoral exposures are fine in IXUS, but we notice that the large-cap exposures mean the companies are exposed to the weaker areas of their respective sectors in the current, weak market environment. So while there’s a good amount of recession resistance, we aren’t compelled into this ETF.

IXUS Breakdown

Let’s have a quick look at the breakdowns for the ETF.

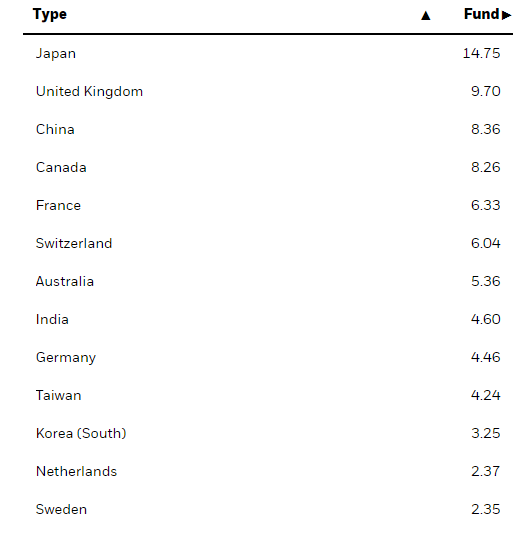

Geography (iShares.com)

From an FX perspective, there is some concern. Japan is 15% of the portfolio, and the BoJ continues to buy bonds and pump out cash whenever the yields reach policy limits as dismal yields repel investors. In other words, Japan’s demographic concerns and general economic concerns are being taken seriously, and with inflation having been relatively low in that economy, there really was no reason to increase rates. Rates will not rise in Japan, while they do in the rest of the world, and the once vaunted safe haven Yen is now the trashiest cash out there.

Other economies are increasing rates. Certainly the BoE is biting the bullet knowing that the economy will suffer regardless. But the USD is the reserve currency – rate hikes are not created equal – and the USD is advantaged in a rate hiking environment as people have a reserve preference for the dollar.

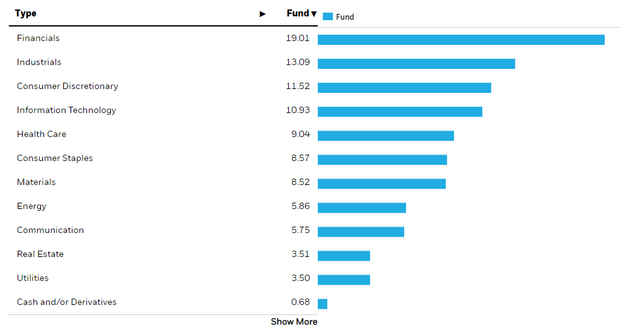

On a sectoral basis things look better. We have discussed the benefits of financials right now as both insurance companies benefit from higher yields on fixed income portfolios and banks benefit from a large spread between savings and lending rates. The problem is that a lot of the exposures here are full-service banks, which means they are suffering on the advisory, asset management and investment banking side.

Industrials are certainly a mixed picture because many are exposed to inflation and issues in the supply chain.

IT is also mixed. While some exposures are quality, many mirror industrial exposures because they are semiconductor production related. Semiconductors have gone from under to oversupplied, and this is a market that will see the top of the cycle now.

Consumer discretionary is clearly not where you want to be in a down market.

Conclusions

The P/E is just above 12x, and the yield is just below 4%. It looks like square value multiples, but the increment looks poor. Financials will be a strong point, and thankfully that occupies a lot of the portfolio, but there are a lot of other areas that won’t fare very well in a tougher market environment, especially in Europe where the consumer is doing worse than in the US, which is less affected by inflation. If the yield were higher, it might be worth it, because it looks sustainable, but with other ways to get a head-start on returns where capital appreciation is less reliable, like in REITs, we pass on IXUS.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.