[ad_1]

JHVEPhoto

Jefferies Financial Group (NYSE:JEF) is an interesting company for anyone with value investor instincts. While the performance has been bad along with the sector in 2022, we think that a positive environment in 2023 is coming. Sumitomo Mitsui (SMFG) is considering expanding its stake in its beleaguered partner, with the show of confidence at the turn of the year appearing to give the stock a huge boost with a 15% rise on Wednesday. However, we think that while investors might be getting excited, consider that the headline figures are likely to look bad on the earnings call next week, and management is unlikely to speculate on a positive outlook. The price could remain volatile. Still, we think there’s a lot of reflexivity in Jefferies’ price for 2023 and investors should stay tuned.

A Look At Jefferies’ Q3

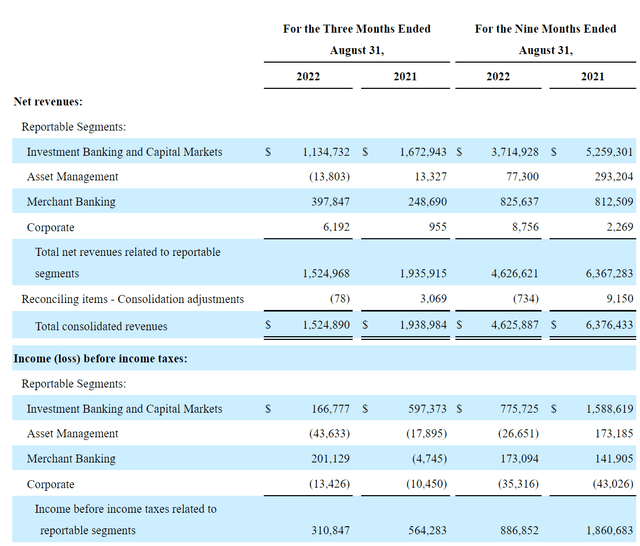

Q3 looked rough as it did for many financial advisory firms out there. The IB and Capital Markets business saw pretty substantial declines YoY around the 30% mark. This is being driven, as it was last quarter, by issues in equity capital markets (ECM) and debt capital markets (DCM). Flatlined equity markets have meant some companies reporting that IPO plans have been cancelled, and issues in the debt capital markets comes from the interest rate hikes making debt more expensive, but likely also issues with the secondary markets for higher yielding debt and overall declines in sponsor activity who usually engage with these markets. Advisory across peers has been more resilient, and that should be the component of JEF’s earnings that showed greater resilience. In fact, advisory revenues are only down around 20% YoY, while ECM and DCM activities were down by more than 50%, especially debt which has cratered.

The Capital Markets business, which involves trading and brokerage services, increased thanks to volatility in equity and fixed income markets, especially equity markets.

Segments (SEC.gov)

Asset Management is suffering on outflows but also lower fees on poor performance. Meanwhile, the merchant banking business is doing pretty well thanks to Vitesse Energy, which we’ll discuss in a moment.

Upcoming Q4 Earnings

The upcoming earnings are likely to look grim. In merchant banking, Idaho Timber will no longer be consolidated, and a reversal in energy prices is going to impact Vitesse Energy’s contribution. With Merchant Banking being one of the resilient holdouts this quarter, a slip due to Idaho Timber’s sale and commodity price pressures are going to be visible in the results.

Moreover, there is no evidence at all showing that corporates are speculating on an economic recovery, and sponsors seem to still be moving slowly as the higher yield, leveraged finance markets suffer both from dislocations in the secondary markets due to volatility, but reticence of financiers to issue capital as reserves may grow and equity shrinks. ECM and DCM will be as bad as before, if not worse as delayed plans become scrapped plans on weak capital markets. Our view is that markets should improve markedly in 2023, but this is not a widely held view it seems, and corporates can’t be expected to speculate on a turnaround at this stage.

Advisory is tougher to call. Declines have been substantial enough where strategic considerations may be an impulse for more strategic M&A. Megadeals are certainly out of the picture as they rely on financing markets, but advisory might surprise, but only a little. Expect more of the same here.

Asset management will continue to perform poorly given the state of the markets, while capital markets could eke out a similar performance in sequence thanks to similar VIX levels throughout this quarter as last.

With the upcoming Q4 ending in November, there is no chance that any change in narrative will be reflected in results. Expect all businesses to be performing just as poorly as the Q3 against even stronger 2021 comps, as 2021 saw sequential growth throughout.

Final Thoughts

Vitesse Energy is going to be spun off, and accounts for around 30% of the Merchant Banking revenue. A spin-off is good as it doesn’t depend as much on investor reception like an IPO. It could create value, and can be considered an appropriate pseudo-dividend where energy stocks are in a decent, supply constrained environment.

Overall, Jefferies depends on a return to certainty more so than a return to strong growth, since the uncertainty is what is stopping sponsors, who have losing portfolios right now due to zealous 2021 allocations, as well as corporates who are more conservative. The value of its MB parts also depend on better valuations in equity markets, which will come from lower equity risk premia. After Vitesse is spun-off, there remains quite a bit of real estate exposure. This will need better rate outlooks to be realised at good valuations.

The Q4 will likely look bad and probably won’t trigger favourable movements in price, but we think that with inflation expectations as well as headline rates easing off highs, the Fed will eventually pivot. The strength in the US economy in the face of rate hikes until now is also reassuring of a soft landing. It makes sense that Sumitomo Mitsui would choose this moment to average down on JEF. The benefit of these IB and advisory companies is that they’ll recover on certainty before economic recovery, if there is indeed a lag between the two. Market participants only need to be able to anticipate better times for things to pick up, especially in ECM and DCM, which is about 20% of the IB and Capital Markets revenue in 2022.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.