[ad_1]

cemagraphics

It’s been a while since I last visited Juniper Networks (NYSE:JNPR) and the stock has done rather well since my bullish stance in August. Over this time, JNPR has given investors an 18% total return, far surpassing the 7% decline in the S&P 500 (SPY) over the same timeframe by a 25% margin. In this article, I revisit the stock, and evaluate whether if it’s still a buy and highlight a potential alternative.

Juniper Networks Is Great, But This Pick Is Better

Juniper Networks is one of the leading providers of networking and cybersecurity solutions that have been adopted by organizations around the world. The company was a pioneer in the development of software-defined networking and has continued to innovate in this space. Over the trailing 12 months, JNPR generated $5.2 billion in total revenue.

JNPR is set to benefit from the growing demand for networking and cybersecurity solutions. As more and more businesses move to the cloud and rely on the internet to conduct their operations, the need for reliable and secure networking and cybersecurity solutions will only continue to grow.

This is reflected by JNPR’s strong revenue growth of 19% YoY and 11% sequentially, to $1.4 billion during the third quarter. Also encouraging, JNPR is growing its bottom line at a faster rate, with adjusted net income growing by 26% YoY, driven in part by strong adjusted operating margin, which grew by 60 basis points YoY to 17.2%.

Looking forward, JNPR has a promising outlook in its AI-driven networking segment, with its Mist WIFI and EX switching seeing record sales with 50% YoY growth. It is positioned to take market share in the cloud and service provider segment, with strong demand for its high capacity product line, as noted by management during the last conference call:

We are continuing to see strong demand for our 400-gig products with our cloud and service provider customers and now have nearly 400 wins for wide area use cases across our MX, PTX and ACX products. We also saw another quarter of strong order growth for our ACX cloud metro portfolio, and our Paragon software automation suite. We plan to introduce new hardware and software automation capabilities in future quarters that will further enhance our competitive position in this attractive portion of the service provider market.

However, demand may slow in 2023, as management noted supply chain issues that could lead to extended lead times. Hence, management is guiding for just 7% revenue growth this year. Size matters in this space, and as fellow Seeking Alpha contributor Chetan Woodun noted, Juniper’s competitor, Cisco (CSCO) is better positioned from a supply chain resiliency standpoint:

However, with more economies of scale due to its capacity to order massive volumes of components, Cisco is seeing less per-unit costs. This enables the company to spread its relatively higher revenues on lower costs resulting in better gross margins.

Cisco’s engineering team has been redesigning about 100 products that are uniquely used by Cisco for the last 6 to 9 months as part of the supply chain risk mitigation, allowing for a wider diversity of components. This is in addition, to constantly evaluating and redesigning its global supply chains to add more resiliency during the last 15-20 years.

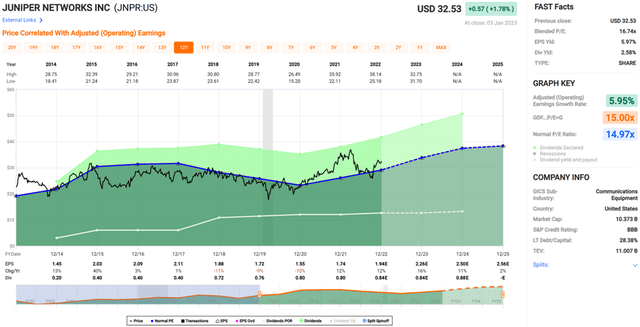

Meanwhile, I don’t find JNPR to be particularly attractive at the current price of $32 and change, with a blended PE of 16.7, sitting above its normal PE of 15 over the past decade. Analysts also have a consensus Hold rating with an average price target of $34.61 implying little to no upside a the current price.

JNPR Valuation (FAST Graphs)

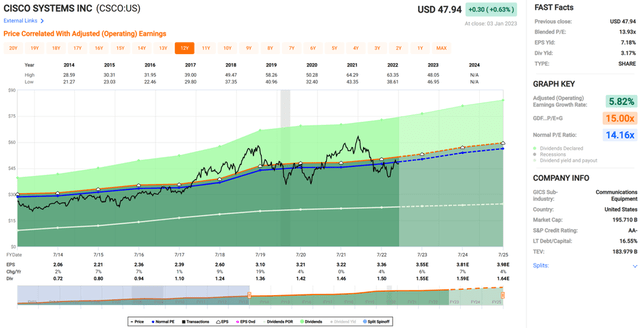

Comparatively speaking, I find Cisco to be more attractive at present. At the current price of $48, CSCO is trading at a blended PE of 14, sitting just under its normal PE of 14.2. Plus, Cisco carries a stronger AA- rated balance sheet compared to Juniper’s BBB rating. Cisco currently yields over 3%, and has the same payout ratio as Juniper at 44%.

CSCO Valuation (FAST Graphs)

Investor Takeaway

JNPR is positioned to benefit from the growing demand for networking and cybersecurity solutions. Although, supply chain issues may lead to slowed growth in 2023, JNPR could still take market share from its competitors in the cloud and service provider space, with AI-driven solutions and newer high-capacity offerings.

Having said that, it appears that the market is valuing JNPR properly at this point, leading to little or no upside potential in the near term. As such, I find industry juggernaut Cisco to be more attractive at present, with its stronger balance sheet, higher dividend yield with same payout ratio as that of Juniper’s, and lower valuation. Given what is often seen as a “pair-trade” between the two networking giants, I rate JNPR as a Hold and CSCO as a Buy at present.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.