[ad_1]

KFin Technologies IPO Review: KFin Technologies Limited is coming up with its Initial Public Offering. The IPO will open for subscription on December 19th, 2022, and close on December 21st, 2022. It is looking to raise Rs 1,500 Crores, the whole of which will be an offer for sale.

In this article, we will look at the KFin Technologies IPO Review 2022 and analyze its strengths and weaknesses. Keep reading to find out!

KFin Technologies IPO Review – About The Company

KFin Technologies Limited, incorporated in 2017, is a leading technology-driven financial services platform. The company provides comprehensive services and solutions to the capital markets ecosystem including asset managers and corporate issuers across asset classes in India.

The company also provides several investor solutions including transaction origination and processing for mutual funds and private retirement schemes in Malaysia, the Philippines, and Hong Kong.

As per CRISIL Report, it is India’s largest investor solutions provider to Indian mutual funds, based on the number of Asset Management Companies (AMC). It has a 60% market share as it provides services to 25 out of 42 AMCs in India.

In addition to that, it is the only investor and issuer solutions provider in India that offers services to asset managers such as mutual funds, alternative investment funds (“AIFs”), wealth managers, and pension as well as corporate issuers in India.

KFin Technologies Limited is one of the two operating central record-keeping agencies (“CRAs”) for the National Pension System (” NPS”) in India as on September 30, 2022.

Business verticals of the company

Investor solutions- It includes Account Setup, Transaction Origination, Redemption, Brokerage Calculations, and Compliance / Regulatory Reporting Recordkeeping.

Issuer solutions- It entails Folio Creation and Maintenance, Transaction Processing for IPO, FPO, etc. Corporate Action Processing, Compliance / Regulatory Reporting Recordkeeping MIS, Virtual Voting e-AGM, e-Vault.

Global business Domestic mutual service: It undertakes Mortgage Services, Legal Services, Transfer agencies, Finance, and Accounting.

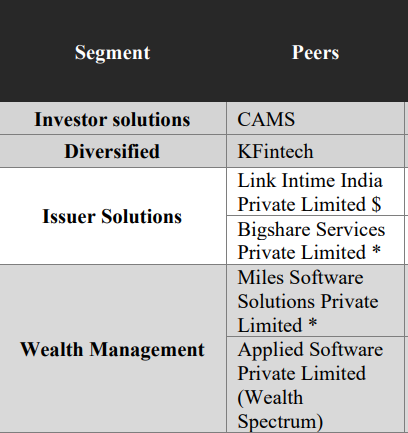

The competitors of the company

(Source: DRHP of the company)

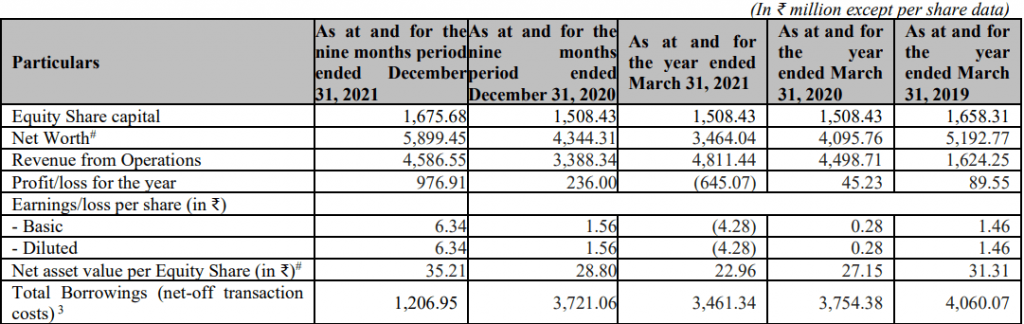

KFin Technologies IPO Review – Financial Highlights

(Source: DRHP of the company)

Strengths

- It is a leading technology-driven financial services platform with a strong track record of growth and market leadership.

- The company has a strong and diverse multi-asset servicing platform and is well-positioned to benefit from domestic and international markets.

- The company has a long-standing and diverse client base.

- The company has an Asset-light business model with a recurring revenue model, high operating leverage, profitability, and cash generation.

- The company is led by an Experienced management team, backed by a strong board and marquee shareholders.

Weaknesses

- The company is susceptible to major disruptions in case of any technical failure or breaches of data security.

- The company’s business is highly dependent on the sentiments of the financial markets, domestic and international.

- The company is exposed to the risk of employee misappropriation, fraud, or misconduct which could lead to significant legal liability and reputational harm.

- The company is subject to stringent regulations and periodic inspections by the SEBI and the PFRDA. Any noncompliance to them can adversely affect could lead to penalties and restrictions.

- There are certain outstanding legal proceedings involving the Company.

KFin Technologies IPO Review – Key IPO Information

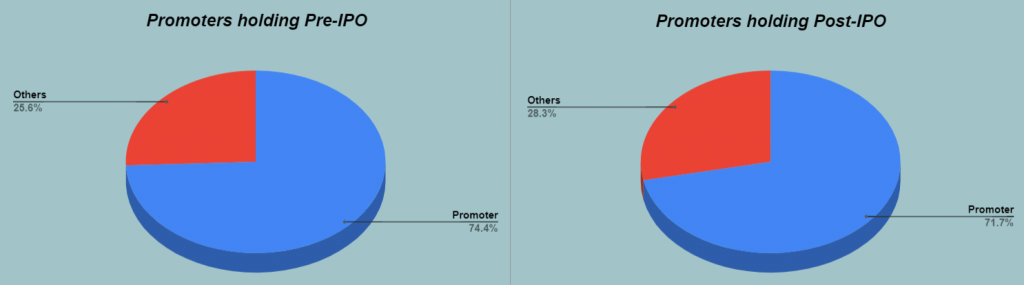

Promoters: General Atlantic Singapore Fund Pte. Ltd.

Book Running Lead Managers: ICICI Securities Limited, Kotak Mahindra Capital Company Limited, IIFL Securities Limited, Jefferies India Private Limited, and J.P. Morgan India Private Limited.

Registrar To The Offer: Bigshare Services Private Limited

| Particulars | Details |

|---|---|

| IPO Size | ₹1,500 Crore |

| Fresh Issue | – |

| Offer for Sale (OFS) | ₹1,500 Crore |

| Opening date | December 19, 2022 |

| Closing date | December 21, 2022 |

| Face Value | ₹10 per share |

| Price Band | ₹347 to ₹366 per share |

| Lot Size | 40 Shares |

| Minimum Lot Size | 1 (40 Shares) |

| Maximum Lot Size | 13 (520 Shares) |

| Listing Date | December 29, 2022 |

The Objective of the Issue

The Net Proceeds from the Fresh Issue are proposed to be utilized:

- Carry out the Offer for Sale.

- Achieve the benefits of listing Equity Shares on the Stock Exchanges.

In Closing

In this article, we looked at the details of KFin Technologies IPO Review 2022. Analysts remain divided on the IPO and its potential gains. This is a good opportunity for investors to look into the company and analyze its strengths and weaknesses. That’s it for this post.

Are you applying for the IPO? Let us know in the comments below.

You can now get the latest updates in the stock market on Trade Brains News and you can also use our Trade Brains Screener to find the best stocks.

Start Your Financial Learning Journey

Want to learn Stock Market and other Financial Products? Make sure to check out, FinGrad, the learning initiative by Trade Brains. Click here to Register today to Start your 3-Day FREE Trail. And do not miss out on the Introductory Offer!!

[ad_2]

Image and article originally from tradebrains.in. Read the original article here.