[ad_1]

FeelPic

Investment Thesis

Kimberly-Clark Corporation (NYSE:KMB) is facing headwinds from moderating demand and high inflation. I believe KMB’s revenue growth should be adversely impacted in the near term from market share loss and potential trade-down risk resulting in volume decline. However, price increases should partially offset the impact of volume decline. For margins, while price increases and cost-saving initiatives should help, inflation in pulp and paper prices and volume deleverage are a headwind. KMB’s expensive valuation along with near to medium-term headwinds keeps me on the sidelines and I have a neutral rating on the stock.

Revenue Analysis and Outlook

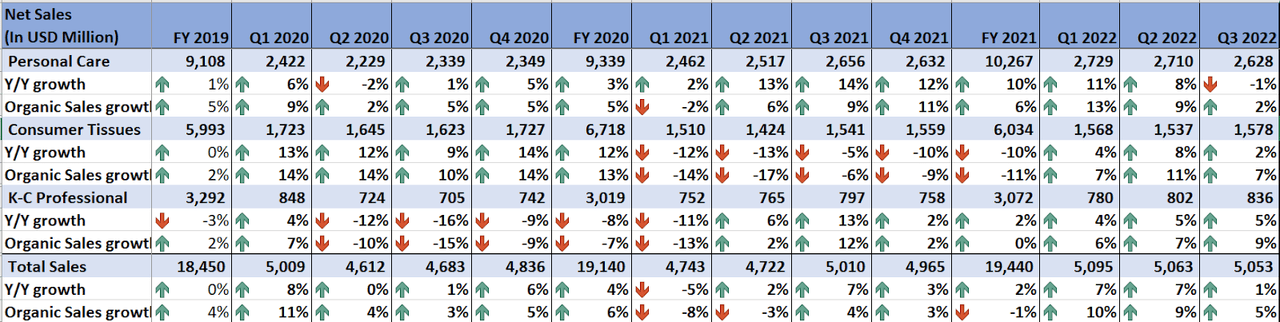

During the pandemic, Kimberly-Clark’s net sales benefited from increased demand in the Consumer Tissue business as more people across the globe prioritized the safety and hygiene of their families and households. However, this was partially offset by a decline in demand for K-C Professional business (which is an away-from-home cleaning and tissue business) as a result of offices being closed due to the lockdown. Things changed after the pandemic and the tough comps in the Consumer Tissue business resulted in an organic sales decline for KMB in 2021 which was partially offset by market share gain in the Personal Care business and recovery in the K-C Professional business as a result of offices reopening.

KMB Sales Growth (Company Data, GS Analytics Research)

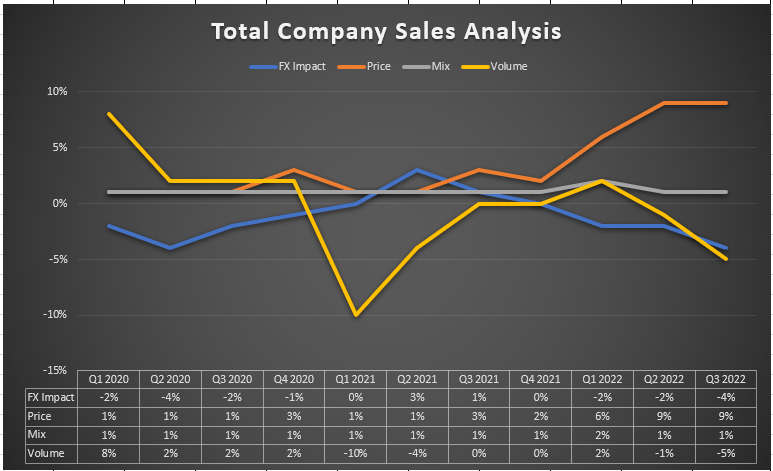

The company entered 2022 with good growth momentum across segments. However, this momentum slowed in the third quarter of 2022 with KMB’s sales growth getting impacted by weakening consumer demand in an inflationary environment and FX headwind. Historically, KMB’s volume growth has remained somewhat resilient even during periods of moderate price increases. However, this trend didn’t hold up this time due to steep price increases. The company increased prices by ~9% on average last quarter which resulted in a ~5% volume decline. The volume decline was broad across the segments with 7% in Personal Care, 3% in Consumer tissues, and 5% in K-C Professional.

Impact of Pricing, Mix, Volume and FX on KMB Sales (Company Data, GS Analytics Research)

Looking forward, weakening consumer purchasing power in the current inflationary environment is a concern for the company’s top-line growth in 2023. According to management, 60% of U.S. consumers are holding well against rising prices and have higher savings than 3 years ago. They still prefer KMB’s value proposition and quality products. The rest 40% of the consumers, living paycheck to paycheck, are more price elastic and shifting buying patterns as they are buying fewer quantities and trading down to opening prices, resulting in demand softening. In addition, the recessionary environment in Europe is also resulting in weakening demand.

One of the things which have made this slowdown worse is the extremely high level of inflation. This high inflation means that the company has to raise prices to maintain its margins in this slowing macroeconomic environment which creates a double whammy. Hence, the near-term revenue outlook is challenging.

In the long term, while the company’s continuous innovation, good execution, and end-market expansion are a plus, there is also a secular risk from declining birth rate given the company derives a meaningful amount of its sales from diapers.

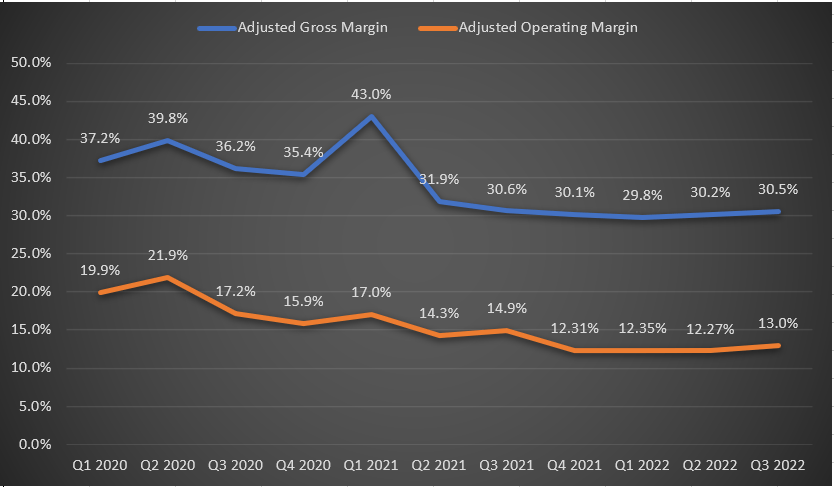

Margin Outlook

The company’s margins have been impacted by inflationary costs and supply chain disruptions in recent years and have fallen significantly below pre-pandemic levels. In the last two years, the company has incurred ~$3 billion of inflationary costs headwinds, including ~$1.5 billion in 2022. While the company was able to offset some of this drag from price increases and cost savings, it was far from enough. The company’s adjusted gross and operating margins in Q3 2022 were 520 bps and 550 bps lower than Q3 2019 levels (i.e., pre-pandemic levels), respectively.

KMB Margins (Company Data, GS Analytics Research)

Looking forward, I believe that input cost headwinds from rising pulp and paper prices should continue to adversely impact margins. Pulp and paper is a major raw material in manufacturing diapers, tissues, and wipes, which comprises more than 50% of KMB’s product categories. While KMB’s margin should benefit from price realization, there is a limit to how much price increase management can implement without severely impacting volume growth and losing market share. The company is working on cost-cutting to offset some of the inflationary challenges and generated ~$80 mn in savings in Q3 2022. These productivity initiatives should continue in 2023 as well.

While I believe management’s efforts to restore margins should help the company offset inflationary headwinds and improve margins, I don’t see the company regaining its pre-Covid margins in the near future.

Valuation and Conclusion

KMB is currently trading at a forward P/E of 21.49x FY2023 consensus EPS estimate of $6.37, which is slightly at a premium from its historic 5-year average forward P/E of 19.22x. While the company is one of the favorites among dividend investors given its ~3.4% yield and this high yield should limit the downside, I don’t find its fundamentals and valuations compelling enough to take a long position. Hence, I have a neutral rating on the stock.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.