[ad_1]

Dzmitry Dzemidovich

Kimco Realty Corporation (NYSE:KIM) is a well-managed, high-quality shopping center-focused real estate investment trust that is benefiting from a strong retail REIT recovery.

Rents and occupancy rates are improving, and the trust provides dividend growth as well as a well-covered 4.1% dividend yield to passive income investors.

The business’ fundamentals are improving, and the real estate investment trust recently increased its guidance for 2022 funds from operations. All of this contributes to KIM being a highly appealing REIT for passive income investors.

Strong Recovery In Fundamentals

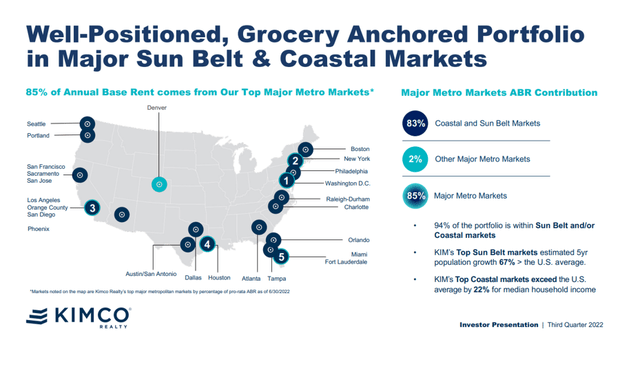

The trust’s real estate portfolio is concentrated in coastal markets, which generate 85% of its annual rental income. Key markets include major metropolitan areas with above-average household income, such as New York, Philadelphia, Washington, DC, Seattle, and Los Angeles.

The REIT is particularly focused on necessity-based shopping, which includes supermarkets, pharmacies, restaurants, clothing stores, and bank/business services.

Grocery Anchored Portfolio (Kimco Realty Corp)

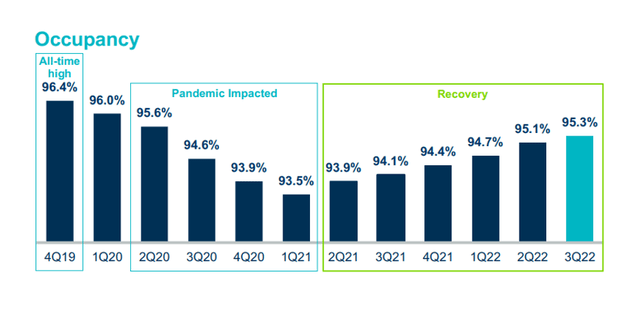

Kimco Realty’s fundamental recovery continued in the third quarter, affecting all key metrics such as occupancy, lease rates, and releasing spreads.

The occupancy rate is the most telling indicator of Kimco Realty’s ongoing recovery from the Covid-19 pandemic. The occupancy rate at the real estate investment trust was 95.3% in the September quarter, marking the sixth consecutive increase since 1Q-21.

Concurrently, Kimco Realty’s real estate portfolio has benefited from a significant increase in lease rates. The trust’s portfolio lease rate per square foot increased 2% YoY to $19.43. Consistent rent increases per square foot demonstrate the trust’s resilient demand for retail lease space, and rising rents have supported the trust’s fund-from-operations growth.

Very Low Dividend Pay-Out Ratio

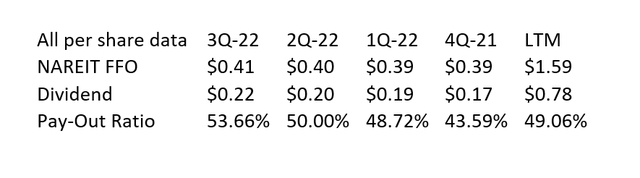

The extent to which a real estate investment trust covers its dividend with funds from operations demonstrates its quality. Funds from operations is a unique REIT disclosure that approximates cash flow by adding back non-cash expenses like depreciation and amortization to net income and adjusting for non-recurring gains, such as gains on asset sales.

Kimco Realty earned $0.41 per share funds from operations in the third quarter and paid out only $0.22 per share, for a dividend pay-ratio of 54%. The trust’s dividend pay-out ratio was just under 50% in the previous year, which is an extremely low pay-out ratio for any REIT, residential or commercial.

Realty Income Corporation (O), widely regarded as the gold standard in the retail REIT industry, had a dividend pay-out ratio of 76% in the previous twelve months.

Dividend (Author Created Table Using Trust Information)

Kimco Realty increased its dividend payout from $0.17 per share per quarter in 4Q-21 to $0.22 per share per quarter in 3Q-22, representing a 29% YoY increase for passive income investors. The dividend was increased by 4.5% for the fourth quarter. The new quarterly dividend is $0.23 per share, for a forward dividend yield of 4.1%.

Kimco Realty’s Guidance For 2022 And Valuation

The real estate investment trust increased its guidance for 2022 funds for operations from $1.54 to $1.57 per share to $1.57 to $1.59 per share. Working with the new guidance results in a 14.3x funds from operations multiple. Realty Income is trading at a 16.5x funds from operations multiple.

Why Kimco Realty Could Run Into Trouble

Kimco Realty, as a shopping center-focused real estate investment trust, may be more exposed to the cyclical part of the real estate market.

Having said that, Kimco Realty’s real estate exposure is primarily to vibrant coastal markets, with a focus on necessity-based shopping. Given the low payout ratio, I don’t see any risks to the dividend.

A reversal in occupancy and rent per square foot trends, on the other hand, would necessitate greater caution in the future for Kimco Realty.

My Conclusion

Kimco Realty, in my opinion, provides significant value to passive income investors. The real estate investment trust is seeing a broad recovery in its fundamentals, from occupancy to rent growth per square foot, a very low dividend pay-out ratio of around 50%, recently increased dividend, and its funds from operations guidance for 2022.

Furthermore, the trust has a very appealing FFO multiple, implying a high margin of safety for investors seeking passive income.

I believe the trust is much better than its valuation suggests, and I recommend KIM to passive income investors.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.