[ad_1]

This week, I’ll be covering:

- The Key To Limiting Event Risk

- NVDA – From 0.63To 3.45 IN JUST UNDER 24 HOURS!

- PFE – From 0.48 to 1.83, IN JUST UNDER 24 HOURS!

- NFLX & NVDA: Riding The Trend Through This Week’s Turbulence

Did you know that swing trading is one of the most popular strategies in the market today?

Traders who use this manner of trading use a combination of technical and fundamental analysis to find trades that they plan to hold anywhere from a couple of days to a few weeks.

But with the ongoing threat of escalating geopolitical tensions, and with Federal Reserve governors always trying to move markets with their widely publicized comments, now more than ever holding trading positions over the course of several days exposes traders to significant overnight risk.

There is good news, however.

So what is it?

I am one of RagingBull’s top options trading gurus, friends.

Which means I have developed a means of teaching retail traders just like you how to harness the leverage of options.

Remember, when you buy one Call contract, you control 100 shares of stock (1 options contract = 100 shares of the underlying stock).

Therefore, you don’t need to expose yourself to holding your trades for multiple nights.

What you do need, however, is the knowledge to be able to identify the kind of market “Structure” and the types of market catalysts with the best odds of producing explosive 1-day price movement.

And friends, you are NOT going to find many weeks better than this when it comes to potentially MASSIVE market catalysts.

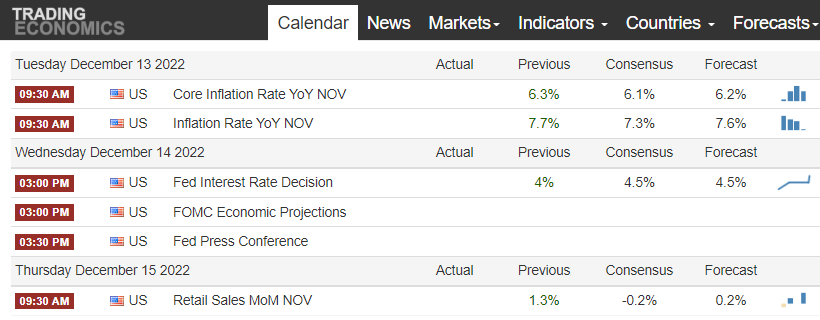

We’re talking inflation data (CPI), the FOMC rate decision, and Retail Sales data.

This is basically the trifecta of the biggest potential market catalysts.

So, what’s your plan on how to trade this week?

Are you planning on blindly buying calls ahead of these announcements because that’s what you feel comfortable doing?

Or are you just going to sit on the sidelines because you’re not sure how to approach things?

Well, I’ve got a plan, and it’s not that difficult.

And RIGHT NOW, for a LIMITED TIME, you can be part of the amazing community of retail traders that are about to learn this plan at an INCREDIBLE discount.

Friends, we’re talking about my HUGELY popular Mobile Closer Service, where I teach you how to place trades in the last hour of the day then close them out at the next day’s open.

Not only will you have access to 250 of my BEST Swing Trade ideas delivered live and via INSTANT app alerts, but I am also throwing in BOTH of my Smart Money Scanners as part of this deal.

Not sure you’re ready for all that this deal has to offer?

Just Call Drew at 443-218-2831…he’ll walk you through everything.

Here’s some more exciting stuff that’s been happening in my Full Scope universe…

OHHH Boy! It was another epic week for EXPLOSIVE trade ideas in the LIVE LottoX 0-DTE Trading Room!

Here are just a couple of the ideas the Options Master, Ethan Harms and I presented to members during this past Thursday’s 0-DTE session:

NVDA Long

Contract: $172.50 Calls

We said, “Ethan’s seen a big intra-day move already on this name, and likes it as a play to the upside. These are trading around $.63.”

BOOM! The contract saw explosive price movement, jumping as much as +448% IN JUST UNDER 24 HOURS!

PFE Long

Contract: $51 Calls

We said, “Ben sees this name also getting a ton of volume, and likes it as an honorable mention into tomorrow. These are trading around $.48.”

And sure enough, the contract saw a 281% upward run IN JUST UNDER 24 HOURS!

This throwback came from Thursday’s LottoX Live session.

Okay, that’s enough looking back…because as much as I hope these helped you find some winning trade ideas, I want to talk about what’s cooking now in the Fat Cat Kitchen…

Riding The Trend In NFLX & NVDA Through This Week’s Turbulence

Friends, when successful traders are handed the kind of economic calendar we’re all facing this week, they find that the best way to approach their trades is to find strong trends and ride them.

That’s why I am paying close attention to NFLX and NVDA this week.

Friends, NFLX gapped out of its mid-October earnings report and it hasn’t looked back.

Technically, TTM_Squeeze is confirming the trend higher in price, as key moving averages continue to support the price trend.

Nearly two months removed from its last earnings report, though, this will soon become an earnings play again as traders start to take positions on the approach to the next report.

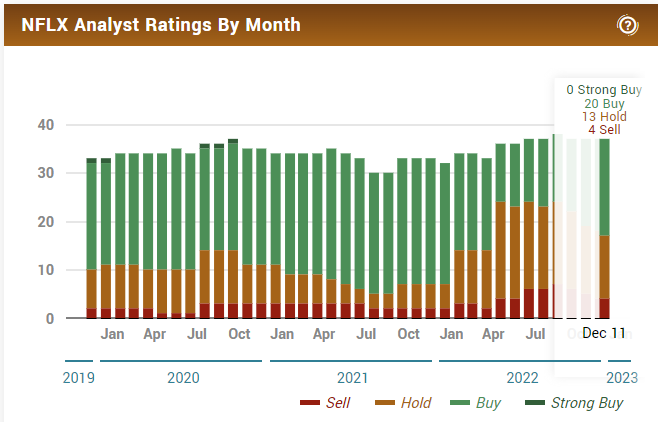

And right now, there is still plenty of potential for analyst upgrades, with 13 still sitting with Hold recommendations and 4 maintaining Sell recommendations.

Don’t forget, when you want new buyers to come into a stock, you DO NOT want there to be a full slate of analysts Buy recommendations that already exists, because then it’s too late.

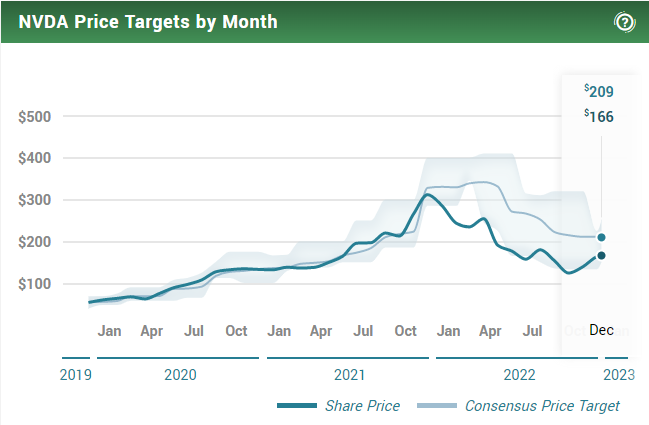

For NVDA, the current trend also looks very strong.

While there is always the possibility that price can back-and-fill higher in the weeks ahead (i.e., the trend won’t maintain a straight line upwards), I do very much like that the stock price is still well below the consensus analyst price target of $209.

And according to BOTH of my Smart Money Scanners, these two stocks have seen a lot of unusual trading activity in recent weeks.

We’re all about building your trust here at RagingBull, so call and / or email Drew Maddock (443) 218-2831 drew@ragingbull.com if you have questions or just want to talk.

Now, before I leave you today I must mention that RagingBull very own CEO, Jeff Bishop, Is planning to hold a MAJOR announcement regarding access to his most popular service this week.

With 20+ years of trading and education experience, Jeff has built a POWERHOUSE trading service that you’re gonna want to hear more about.

Let’s have a great rest of the week and until next time!

[ad_2]

Image and article originally from ragingbull.com. Read the original article here.