[ad_1]

Faiz Dila/iStock via Getty Images

Lumen Technologies Inc. (NYSE:LUMN) continues to face pressure in its legacy business, resulting in a 6.3% decrease in sales YoY.

Having said that, Lumen has continued to cover its generous dividend payout with free cash flow and has reaffirmed its 2022 guidance based on adjusted EBITDA and free cash flow.

The stock trades at an appealing free cash flow multiple, and the company is on the verge of a catalyst that could propel the stock price higher.

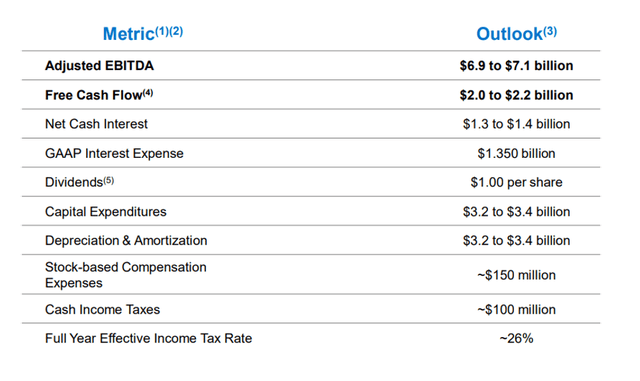

Reiterated Guidance For 2022

Lumen Technologies reiterated its 2022 adjusted EBITDA and free cash flow guidance, which remains unchanged at $6.9 billion to $7.1 billion in adjusted EBITDA and $2.0 billion to 2.2 billion in free cash flow. The reaffirmation of Lumen Technologies’ guidance is excellent because investors have been concerned about the company’s dividend payout’s sustainability.

Because AT&T (T)‘s dividend was not covered by free cash flow, the question was whether Lumen Technologies could still earn its payout.

Adjusted EBITDA (Lumen Technologies)

Lumen Technologies generated $668 million in free cash flow in 2Q-22, which exceeded the company’s dividend payments of $260 million. Despite Lumen Technologies’ business challenges, the free cash flow pay-out ratio was only 39%, indicating that the company’s dividends are quite safe.

Lumen Technologies’ generous $0.25 per share quarterly dividend, which costs the company slightly more than a quarter-billion dollars every three months, is funded by free cash flow. Lumen Technologies anticipates paying approximately $254 million in quarterly dividends in the future, based on the number of currently outstanding shares.

Lumen Continues To Have A Very Attractive Valuation

With $2.0 billion in free cash flow expected in 2022, the stock trades at a 5.6x free cash flow multiple, which is appealing given that the telecommunications company covers its dividend with free cash flow.

Furthermore, Lumen Technologies is reducing free cash flow risk by repaying debt, which relieves pressure on free cash flow due to lower interest expenses.

Lumen Technologies will have to do more to address its significant debt load, but it will help the company reduce interest costs in the future. Lumen Technologies had $28 billion in long-term debt at the end of the second quarter, about half a billion less than at the end of 2021.

Having $28 billion in liabilities is not pocket change for a company with a total market value of only about $11 billion. Lumen Technologies has prioritized debt repayment, and the company reduced its net debt by $900 million in the first two quarters of 2022.

Lumen Technologies’ interest expenses have also decreased significantly in recent quarters, but more needs to be done to create a sustainable balance sheet for the telecommunications company.

Catalyst: $7 Billion Cash Infusion

Lumen Technologies will sell two businesses in 2021: its local incumbent carrier operations in twenty Midwest/Southeast states and its Latin American business operations.

Both transactions recently cleared significant regulatory hurdles (see here and here), paving the way for Lumen Technologies to receive a significant cash infusion.

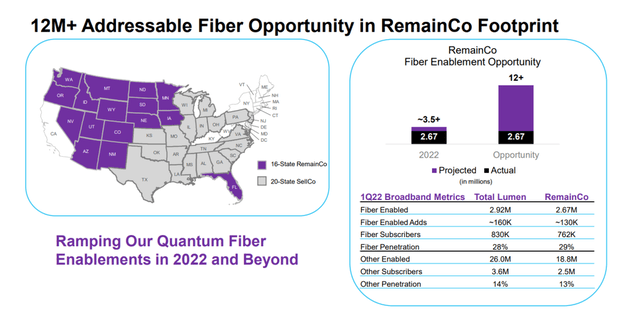

Lumen Technologies will receive $7 billion in proceeds from asset sales, which will be used for a variety of business purposes, including an accelerated debt payback and investments in Lumen Technologies’ quantum fiber operations, which are driving the company’s robust subscriber growth.

Lumen Technologies’ quantum fiber operations added 25K new subscribers in 2Q-22, so this is definitely an area where management may want to invest more money in the future. Lumen Technologies expects the proceeds from the asset transactions to appear on its balance sheet within the next five months.

Quantum Fiber Opportunity (Lumen Technologies)

Why Lumen Technologies Stock Could Fall

Lumen Technologies’ legacy business’s sales problems will not disappear overnight. To relieve pressure on free cash flow, the telecommunications company must either aggressively repay more debt, which it has already begun to do, or aggressively invest in its fastest growing segment, quantum fiber.

Lumen Technologies’ balance sheet still has far too much debt, and interest costs are weighing on profits and free cash flow.

My Conclusion

Lumen Technologies is a telecommunications company that, like the rest of the industry, is experiencing slow or negative sales growth in its legacy business, while the fiber/broadband segment offers opportunities for new growth.

Lumen reiterated its 2022 guidance, which included free cash flow, which alarmed investors because AT&T failed to earn its dividend pay-out with free cash flow in 2Q-22.

Having said that, Lumen Technologies pays a very attractive 9.4% stock yield, which is still covered by free cash flow, and the upcoming cash infusion catalyst could see the company repay even more debt by the end of the year.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.