[ad_1]

primeimages

Author

Happy New Year to all of my readers! We took a couple of weeks off from these regular blog posts at the end of the year, but let’s dig in and see what January has in store for us.

Global stock markets

Looking around the globe, we find a few major stock markets with bullish setups. Most are leaning bearish to perhaps strongly bearish.

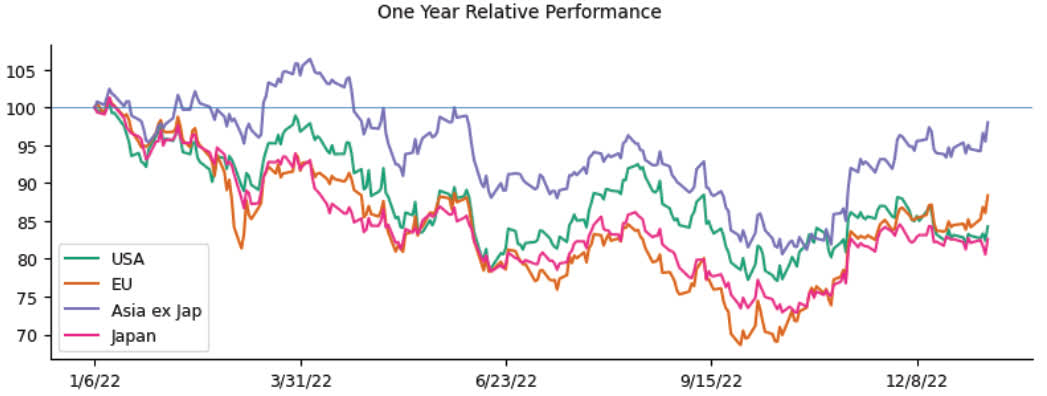

Relative strength also gives us some insight. The chart at the top of this post shows the relative performance of large, regional indexes over the past year. (Be aware that these types of charts are highly sensitive to the selected starting point. Moving it just a week can, in some cases, make a big difference in the arrangement of data points at the right edge of the chart. In this case, the message is relatively robust, with the US lagging in the most recent period.)

We also look at global relative performance in other ways and rank a list of 36 country indexes. The S&P 500 is currently 30 on that list of 36, with Turkey, Poland, Italy, Denmark, and China taking the top slots. Relative strength shifts around a lot, but this is not the positioning we would expect from a global market set to rally in the immediate future.

Other technical factors give us cause for concern, but trading markets under stress is not easy. If our concerns are justified and the market trades lower (with higher volatility), we’ll still have many periods of impressive rallies along the way. We suggest longer-term players look to take steps to protect themselves from both sideways markets and declines.

The week ahead

Here’s a look at potentially market-moving data points to be released this week.

We’re including Fed speakers on this list because the market is making significant intraday moves in response to these speeches. Does this make any sense whatsoever? Is there any reason to expect materially significant information to be released in these speeches? If you’re asking those questions, you’re asking the wrong questions! Our job is to deal with the market as it is, not the market that would exist in a logic-driven world.

- Monday: None (12:30 Bostic speaks)

- Tuesday: None (9:00 AM Powell speaks)

- Wednesday: EIA Petroleum

- Thursday: CPI, Jobless Claims, (Bullard and Barkin speak)

- Friday: Import and Export Prices, Consumer Sentiment (Harker speaks)

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.