[ad_1]

vm

Thesis

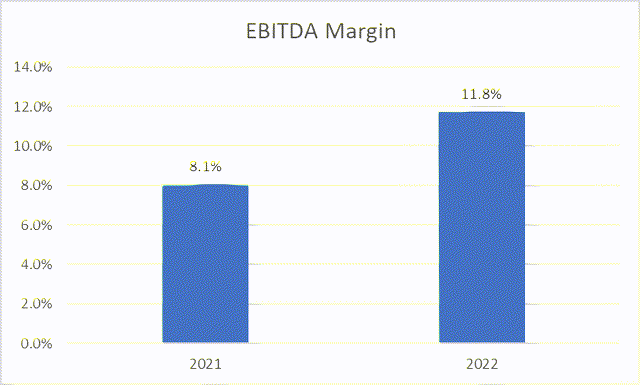

Mayville Engineering Company, Inc. (NYSE:MEC) has been making improvements in sales growth (driven by both volume and price, as costs are being passed on to customers), and therefore improvements in profit margins. EBITDA almost doubled in the last quarter compared to the year prior, leading to an improvement in EBITDA margin from around 8% last year to almost 12% today. These improvements have not been reflected in the share price, and when comparing the company with a set of peers, the stock is undervalued, with a potential upside of more than 15%.

Introduction

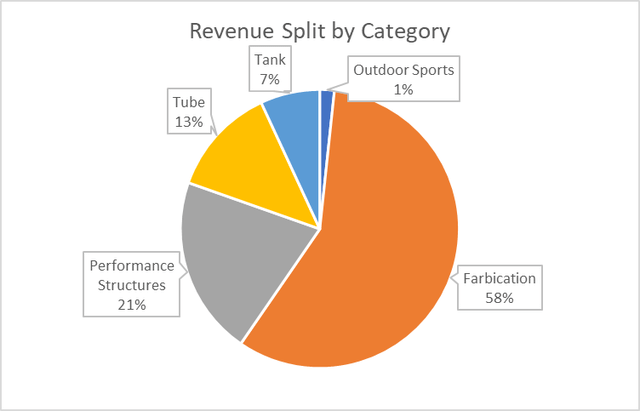

MEC is a manufacturer of metal fabrication and machining components and services. The company services a range of markets that include automation, agriculture, and military, among others, and has 19 production sites across the US. The largest component of the business is the fabrication category, with the full split by product category illustrated below.

The company’s share price has fallen over the past year, dropping by almost -12%, roughly in line with the overall market drop. However, MEC fell slightly further up until the recent bounce experienced in November, implying that there was a surprise upside from the recent earnings call.

Financial Analysis

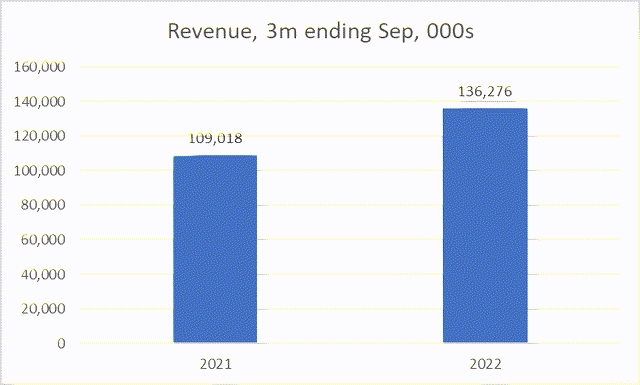

The company’s net sales improved in the latest quarter compared to the same quarter a year prior (last 3 months ending September). Sales grew by around 25% to hit $136m in the quarter, compared to almost $110m in the year prior. The growth was driven by multiple factors, such as improved volumes, price incentives, and price pass-throughs (the company is showing resilience to the inflationary environment, which is positive news).

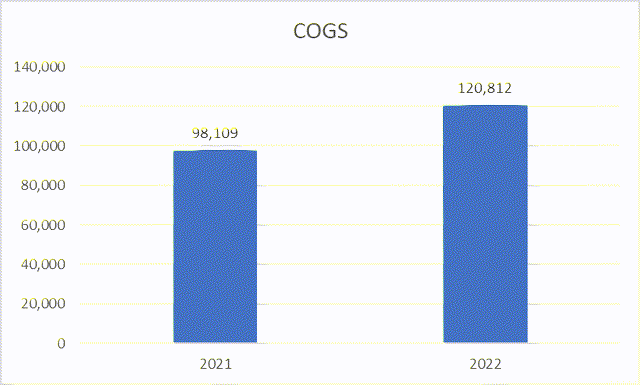

The sales growth managed to outpace growth in COGS, as the cost of sales growth was only 23% year on year, leading to a decrease in COGS as a % of sales to drop from 90% to 88.7%. This resulted in a manufacturing margin improvement from 10% to 11.3% in the latest quarter, a much-needed improvement, which lead to growth of 42% in manufacturing margins overall, as manufacturing costs were absorbed and commercial pricing increases were successfully passed on.

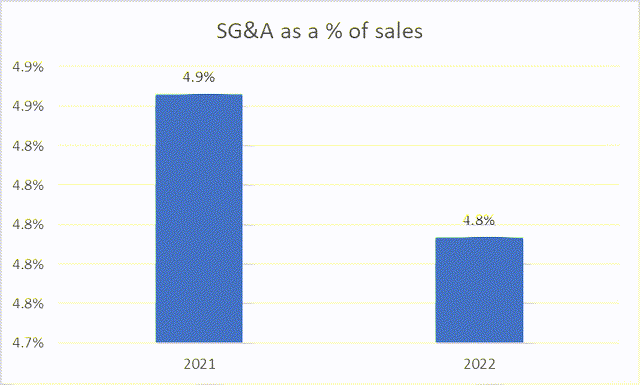

In other positive news, costs also improved elsewhere in the business, where SG&A as a % of sales dropped from 4.9% to 4.8% in the latest quarter. While this is only a small improvement, it is still very much beneficial and trickles down to an improvement in the bottom line.

Furthermore, other costs also improved, such as amortization of intangible assets, profit sharing, employee stock expense, and impairment of assets.

All these small improvements made across the PnL have trickled down into a significant improvement in EBITDA for the quarter compared to the year prior. EBITDA almost doubled from $8.8m to around $16m, leading to a substantial increase in the EBITDA margin from around 8% in the quarter in 2021 to almost 12% today.

Valuation

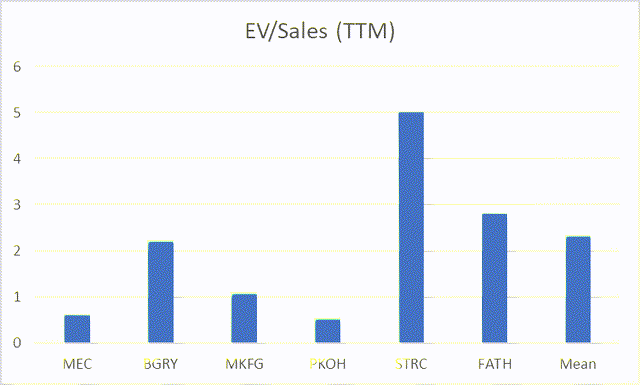

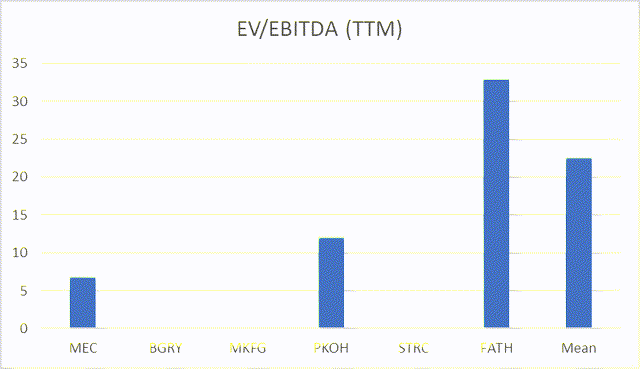

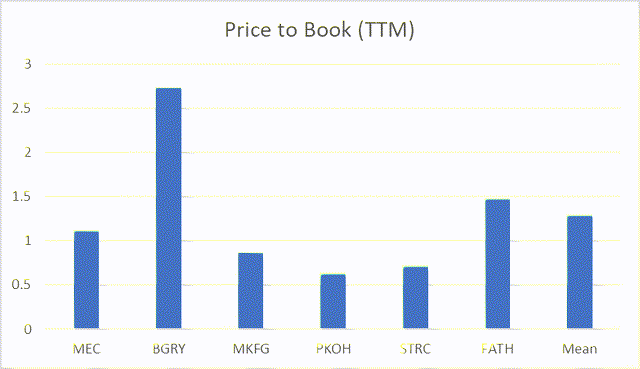

If we collate a set of peers, then we can compare multiples and understand if MEC is potentially undervalued, overvalued, or even fairly-valued.

If we look at EV/Sales, then we can see that MEC is substantially undervalued compared to peers, implying that there is a large margin of potential upside available, potentially by more than 100%.

If we look at EV/EBITDA (unfortunately some tickers were omitted given that lack of available data) we can see the same picture, MEC looks to be substantially undervalued compared to peers.

And if we take a look at P/B, MEC remains undervalued, albeit at a much smaller discount compared to peers as the valuation looks to be more in line and less extreme.

Overall, this valuation indicates that MEC is undervalued compared to peers, with a potential upside of more than 15%, potentially as high as 100%. Clearly, investors are not taking into account recent improvements made in the company, such as sales growth driven by both volume and price (indicating that the company not only has sustainable demand but is able to push inflationary pressures onto customers), and the improvement in the bottom line leading to an increase in EBITDA margin, reaching double digits, and improving overall cash flow.

Risks

- One risk to potential upside is improvements made in other costs, such as staff stock ownership and profit sharing/bonuses, are only temporary. If they were to rise back up to their previous level in the next quarter or year, then we would see the improvements in profit margin almost wiped out entirely. Given that these costs are low as the share price is currently depressed, there is a high likelihood that they will rise again as the stock continues to rise and become positive on the year. If this were the case, then the stock price would probably no longer be undervalued compared to peers.

- A second risk would be a taper in sales growth, and growth in costs would end up outpacing growth in revenue. This would be the case if cost and price increases can no longer be passed on to customers. Again, if this were to happen, this would remove some of the recent improvements made in the bottom line and the share price would no longer be undervalued.

Conclusion

Overall, MEC has made improvements in both the top and bottom line in the latest quarter, compared to the year prior, where these improvements have not been fully reflected in the share price, resulting in MEC being undervalued compared to peers with potential upside of more than 15%, potentially up to 100%.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.