[ad_1]

Chip Somodevilla

Investment Thesis

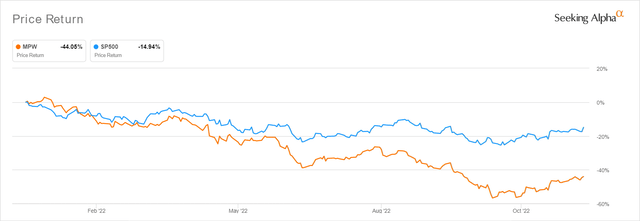

MPW YTD Stock Price

The Medical Properties Trust (NYSE:MPW) stock has recorded an impressive 29.38% rally over the past eight weeks, since its rock-bottom levels in early October. The recovery is also significantly aided by management’s raised FY2022 guidance and the upbeat October CPI reports, which lifted the S&P 500 Index by 14.06% at the same time. With 81.8% of analysts now projecting a 50 basis point hike, we expect the tsunami of confidence to further lift the whole market, as witnessed by the Bank of Canada’s recent moderation in late October.

Only time will tell how things unfold over the next two weeks. If analysts are right, it will bring about the best Christmas present indeed, since the forward-looking stock market may start recovering sustainably from these bloodbath levels. Thereby, triggering the start of a bull run.

Otherwise, a nightmare before Christmas, triggering another painful October bottom test. Ouch.

MPW Delivered Brilliantly – Putting Down Most Bears, If Not All

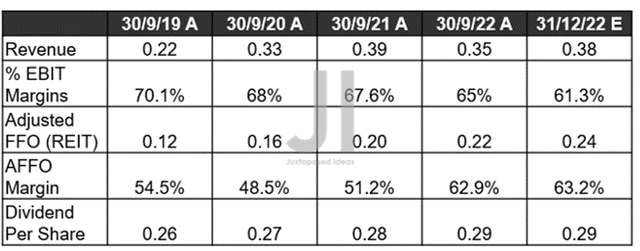

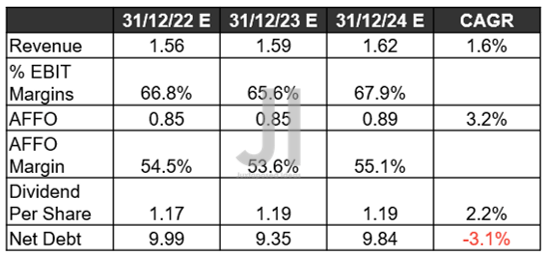

MPW Revenue, AFFO ( in billion $ ) %, EBIT %, and Dividends

Despite the negative Steward speculation, MPW went on to report an exemplary FQ3’22 earnings call, while delivering reassuring news about the former’s execution. The company delivered sustained EBIT margins of 65%, notably attributed to its effective cost-cutting strategies, which deftly reduced its operating expenses by -11.68% QoQ and -1.08% YoY, despite the raging inflationary pressures. Furthermore, it also reduced its interest expenses by -6.42% YoY and depreciation & amortization expenses by -4.29% YoY.

Therefore, it is not surprising to see MPW record an improved AFFO of $0.22B and AFFO margins of 62.9% in FQ3’22, exceeding estimates by 4.76% and 8.9 percentage points, respectively. In addition, Mr. Market has upped the ante, with an ambitious revenue projection of $0.38B and an AFFO projection of $0.24B for FQ4’22. As a result, further expanding its AFFO margins to 63.2% then. We’ll see.

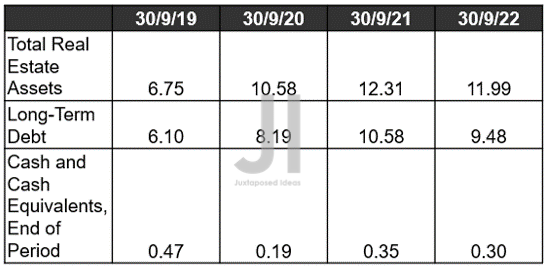

MPW Cash/ Equivalents, Debts, and Assets ( in billion $ )

S&P Capital IQ

Furthermore, with a successful disposition strategy, MPW managed to aggressively reduce its debts by -6.51% QoQ and -10.49% YoY. Impressive indeed, since its balance sheet remains robust at $0.3B in FQ3’22, with little debt maturing in the short term, as discussed in our previous analysis and the company’s recent call. Furthermore, its immediate liquidity is robust, with the availability of a $1.5B revolving facility and another $657M from the upcoming transaction in Yale and Springstone by early 2023.

MPW Projected Revenue, AFFO ( in billion $ ) %, EBIT %, Dividends, and Debt

S&P Capital IQ

Furthermore, MPW’s top and bottom line growth remained intact since our previous analysis in October 2022, indicating Mr. Market’s growing optimism that management will continue executing steadily. Furthermore, the company is expected to hold its debt levels relatively stable over the next two years, potentially indicating the increased availability of market capital for asset expansion as the inflation rate and, consequently, the interest rate falls. We’ll see, since things are still quite volatile for now.

However it goes, we are confident that MPW will maintain its dividend payouts and growth as it has done for the past consecutive sixteen and nine years, respectively. There is no question about it, due to the company’s robust AFFO generation and stellar execution thus far. In the meantime, we encourage you to read our previous article, which would help you better understand its position and market opportunities.

- Medical Properties Trust: Ready To Catch A Falling Knife?

So, Is MPW Stock A Buy, Sell, or Hold?

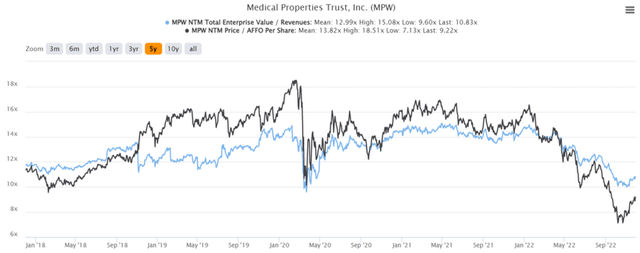

MPW 5Y EV/Revenue and Price/ AFFO Per Share Valuations

MPW is currently trading at an EV/NTM Revenue of 10.83x and NTM Price/ AFFO Per Share of 9.22x, lower than its 5Y mean of 12.99x and 13.82x, respectively. Otherwise, still moderately under-valued, based on its YTD mean of 12.58x and 11.76x, respectively. Despite the notable 25.91% premium from our previous article, the stock is still relatively attractive at $13.12, due to the consensus estimates’ bullish price target of $17.50 and a 33.38% upside.

Perhaps there is still some Steward overhang in MPW’s valuation, due to the worsening macroeconomics. Nonetheless, management has also deftly outlined its tenant’s improved operating performance, with FY2022 potentially delivering EBITDA of up to $80M and FY2023 with more than $350M. Therefore, though MPW has had to extend a 5Y unsecured loan of $150M in FQ2’22, we expect the tenant to fully honor its rent obligation with minimal interruptions. The company also continued to report an excellent 99% of contractual rent collection by FQ3’22, with the rare exception of a $24M rent deferment due to the slower reimbursements from Supplemental Medicaid. However, MPW investors need not fret, since repayment plans have also been worked out through 2023. As a result, creating an exceptional opportunity for those looking to load up on MPW, due to the notable valuation discount.

Therefore, we still rate MPW stock as a Buy, naturally only for those with higher risk tolerance. This is because the Fed may not pivot as early as expected, depending on the November CPI reports against the Thanksgiving and Black Friday festivities. If the decline of the inflation rate is not satisfactory, we may see another bottom retest indeed, since the Fed may launch its fifth consecutive 75 basis points hike by December. Furthermore, terminal rates may be raised to over 6%, indicating a prolonged period of elevated interest rates. Thereby, triggering more volatility in the short term.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.