[ad_1]

5./15 WEST

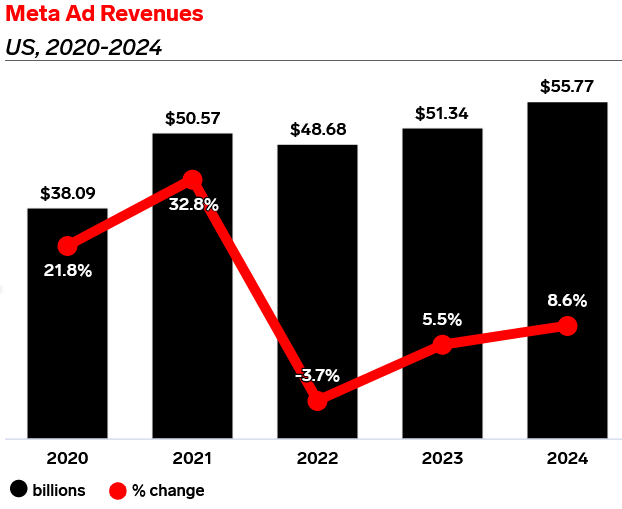

Meta’s (NASDAQ:META) Advertising Revenue shrank in 2022. The company attributed the YoY decline to 1) Economic environment, and 2) Social Network Ads Competitors.

According to eMarketer forecast, Meta Ad revenue will recover to positive mid-high single digit growth rates. I think this forecast has not sufficiently counted the pressure Meta will face in growing its ARPU (Advertising Revenue Per User) or retaining its share of Advertising budgets. This article mainly explains why I think Meta’s Ads growth potential is limited, and why advertisers may want to shift budget away from Meta.

For reference, here are two previous articles I published.

Meta Ads Business Growth At Risk

Meta Bets on WhatsApp to Replicate WeChat Success

eMarketer

Meta’s Social Network Users

Facebook & Instagram together is undoubtedly the No.1 Social Network platform by number of users. However, this is not the only metric determining the success of Social Network Ads. User time spent and user distribution by generation all remain crucial when we evaluate the Ads dollar potential.

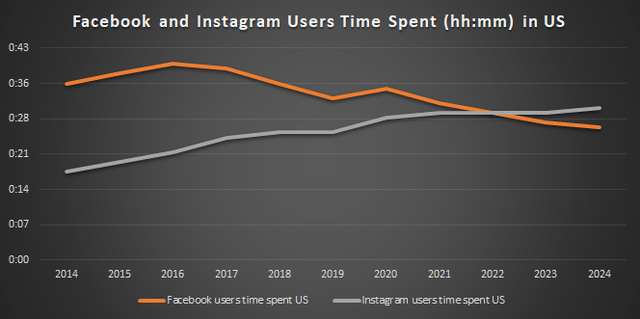

Since 2020, Facebook users time spent has been trending down. Instagram users time spent grows slightly year over year, but remains around 30 mins. According to eMarketer, TikTok’s users time spent in US is 56 mins. This proved how popular short-form video is nowadays.

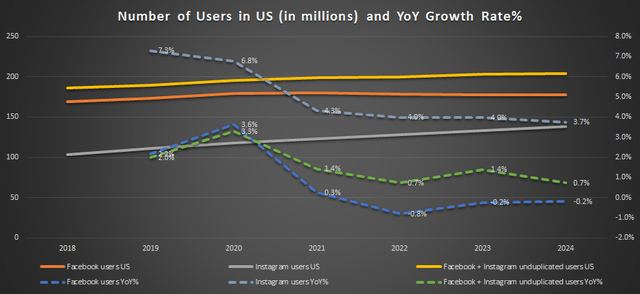

If we look at Facebook and Instagram users in US, the muted growth is not a surprise. The forecast from eMarketer basically extrapolated the growth rates for 2023 and 2024. My opinion is that Meta’s user growth will be further pressured as other Social Network products are gaining traction. Social Network plays several roles in our life: 1) connecting with others in the social community; 2) consuming digital contents for entertaining purposes; 3) establishing and enriching social images. Although the human will embrace all products that allow them to fulfill these purposes, their available time is limited, and they want to be where they can find their friends. Therefore, Social Network is an oligopoly market, and not likely not all current players can thrive. Considering Facebook/Instagram has no more than 30% users from Gen Z, vs. 44% – 55% Gen Z users on TikTok and Snapchat, I think Meta’s Social Network leader position will be threatened.

In my modeling, I captured 6% ARPU decline YoY, and flat MAU YoY, bringing Meta’s FY26E revenue down by $15B (-12%). Overall I believe I am making relatively conservative assumptions about META’s downside.

Meta’s Ads CPM May Push Advertisers away

Most digital Ads are auction-based, and it’s not surprising that a crowded market with excess demand will push the Ads pricing (CPM) higher. This is what happens on the market.

According to eMarketer, 2022 data from marketing agency VaynerMedia and reported by FT shows the CPM (cost per 1,000 impressions) from video advertising on TikTok is almost half that of Instagram Reels. Measurement firm Measured reported the average Q3 2022 Meta CPM at $14, versus $8 for TikTok. Comparing their CPMs two years ago, Facebook’s CPM rose by 16%, while Instagram CPMs increased by 55%.

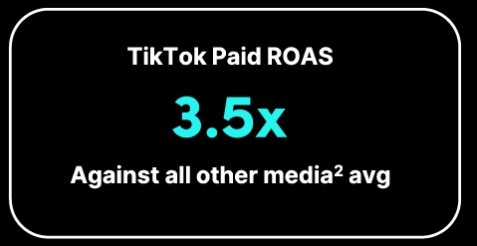

2023 is going to be a tough year for Ads platforms as most of the companies have budgeted very conservatively for their marketing in 2023. Marketing is one component (Operating Expense) of their P&L, and normally marketing budget is planned as a % of revenue. There is not A magic number as companies at different stages, from different verticals, and with different marketing goals may vary materially. For example, start-ups or less-than 5-year-old companies could spend 12-20% of their revenue on marketing, whereas more established companies could spend 6-12% of revenue to achieve comparable results. Long story short, considering the current economic environment, Advertisers likely want to hold their 2023 marketing budget nearly flat (if not reducing), and remain hyper sensitive to CPM and ROAS. I am skeptical about META’s capability of retaining Ads budget considering its CPM is 2x of TikTok’s, and its ROAS is lower than TikTok’s.

TikTok

What’s META Stock Worth?

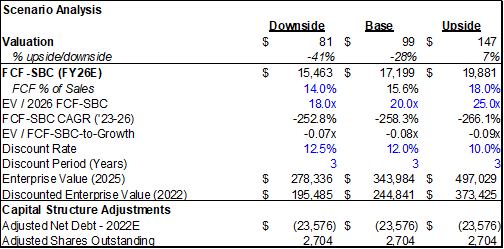

I modeled the above concerns into Meta’s stock valuation, mainly in the form of slightly reduced revenue YoY. My base case indicates $99, -26% from its current price, and my best case suggests $147, +7% vs its current price.

For downside and upside scenarios, I have factored in 1) difference of capital cost (Discount rate), 2) difference in trading multiples (EV/2026 FCF-SBC), and 3) difference in operating margins (FCF % of Sales).

my own valuation

Conclusion

Social Network Ads is Meta’s cash cow. When its social network position is challenged, its MAU and ARPU will both be pressured. Investors should be cautious when evaluating Meta’s growth potential this year.

In addition, investors should keep an eye on the development of Instagram Reels. Being able to accelerate its short-form video strategy is going to be crucial for Meta to fuel its future growth.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.