[ad_1]

hapabapa

Moderna (NASDAQ:MRNA) remains more than 50% below its market highs set in the depths of the COVID-19 pandemic as the company’s revolutionary vaccines meant that it had $10s of billions of revenue in the pipeline. However, the company is continuing to work on its revolutionary pipeline and we expect it’ll be able to generate substantial long-term returns.

Moderna 3Q 2022 Financial Performance

Moderna has continued to have strong financial performance, highlighting its asset strength.

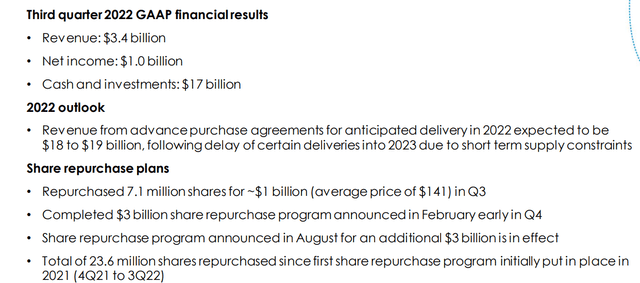

(Source: Moderna Financial Performance – Moderna Investor Presentation)

The company has $17 billion in cash and investments, with 23% of its market capitalization as cash. The company earned $3.4 billion in revenue in the quarter with $1.0 billion in net income. Annualized, that’s $4 billion in net income, which gives the company a P/E ratio (outside of cash) or roughly 15. That’s a strong P/E ratio.

The company expects $18.5 billion in annual revenue for the year, after certain deliveries have been delayed into 2023. The company has completed its announced $3 billion share repurchase program and has another $3 billion share repurchase program in effect. The company has paid an average of $141/share in the most recent quarter, a respectable price.

We’d like to see the company hold off on share repurchases until it has a strong and diversified long-term business.

Moderna Current Positioning

Overall, the company remains relatively well positioned and diversified across its assets.

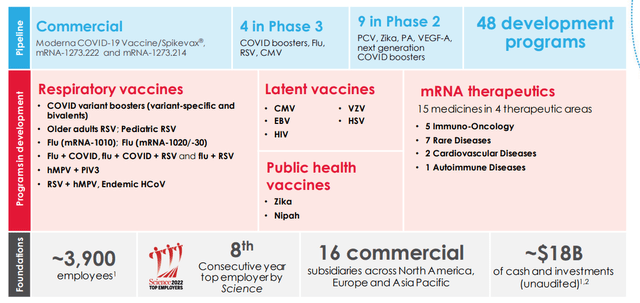

Moderna has 4 vaccines in Phase 3 trials including Covid, Flu, RSV, and CMV. The company’s COVID business is already well established, but Flu, RSV, and CMV are more important to building long-term franchises while enabling the company to use its technology to create more powerful vaccines. Overall, the company has 48 development programs.

The company’s strength depends on whether it can use its revolutionary platform to develop new vaccines for a number of underserved or treated diseases. Something like HIV could be a company maker all by itself should the company be able to develop effective therapeutics. Numerous similar respiratory diseases to COVID are also huge opportunities.

The company’s current pipeline and positioning are promising but investors have longer waits to see whether things pan out.

COVID-19 Hasn’t Ended

It’s worth noting that COVID-19 hasn’t ended despite the mass reopening of the majority of the world.

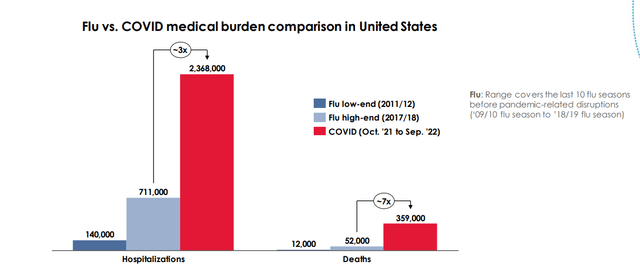

So far the medical burden of COVID-19 has been dramatically higher. Of course, part of this was immunity building up. However, long-term, even with herd immunity, COVID-19 is expected to have a medical burden equivalent to or greater than the flu. That means that vaccine demand will likely remain at least at the flu level or higher.

The company has roughly $5 billion in deferred revenue to 2023. It’ll continue to work on combination vaccines (Flu + COVID-19) in addition to simply COVID-19. The company sees annual revenue potential in the market at $12 billion, based on flu volumes and a $20 dose, which means a long-term revenue potential for the company of roughly $6 billion.

Moderna Capital Allocation

Moderna is continuing to invest in its business on a significant scale, so whether or not it pans out remains to be seen.

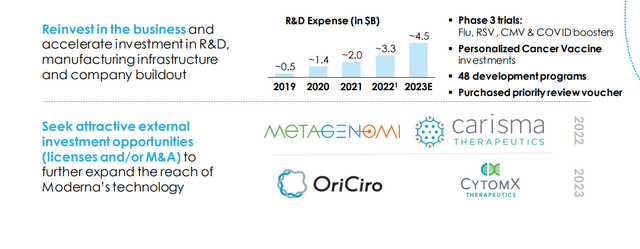

Moderna is rapidly ramping up its R&D expenditures, especially from before the COVID-19 pandemic. The company’s forecast 2023E R&D expenses are expected to be $4.5 billion or an almost 50% increase from 2022. A substantial part of this cash will be spent on Phase 3 trials which have the potential to open up new sources of revenue for the company.

The company is also investing in other drugs with enormous potential but much earlier on. That includes personalized cancer vaccines and 48 development programs. The company has purchased a priority review voucher from the FDA, which could potentially help to accelerate the development of its drug portfolio.

Our View

Moderna is a unique company. The company earned numerous billions in cash from its completely unique platform that released one of the few major vaccinations for COVID-19. On top of the cash flow earned from that, it enabled the company to prove its platform of mRNA vaccinations that could revolutionize numerous other fields.

As a result, the company now has a number of drugs in various stages of trials. These could pan out to make a substantial business for the company enabling future revenue and profits. Given the revolutionary nature of the company’s business, we see this as being likely.

Thesis Risk

The largest risk to our thesis is that the company is spending billions of its capital budget to build a business. Building a major pharmaceutical company and pipeline from scratch is incredibly difficult. There’s no guarantee that this pans out for Moderna and if it doesn’t, the company will struggle to generate future shareholder returns.

Conclusion

Moderna is a high risk business, there’s no doubt about it. However, the company is also potentially on the cusp of something enormous, something that could enable it to substantially increase the strength of its long-term business including both revenue and shareholder returns. We see enormous potential in the company after its recent share price weakness.

The company continues to have substantial execution risk and it’s rapidly using its cash on both share buybacks and R&D spending. It continues to earn respectable revenue from its COVID-19 business that we expect to continue. Let us know your thoughts in the comments below.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.