[ad_1]

Beton studio

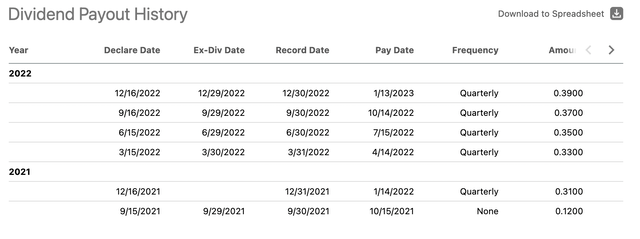

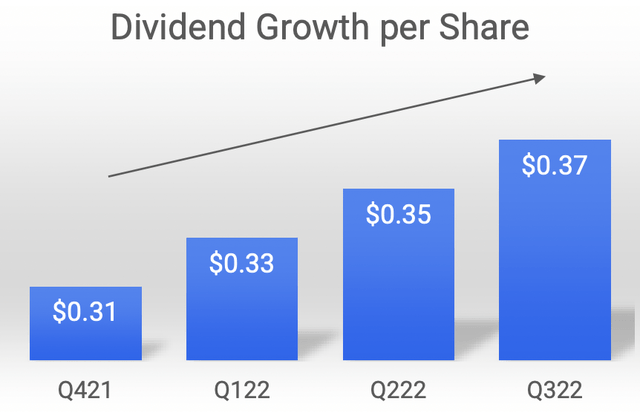

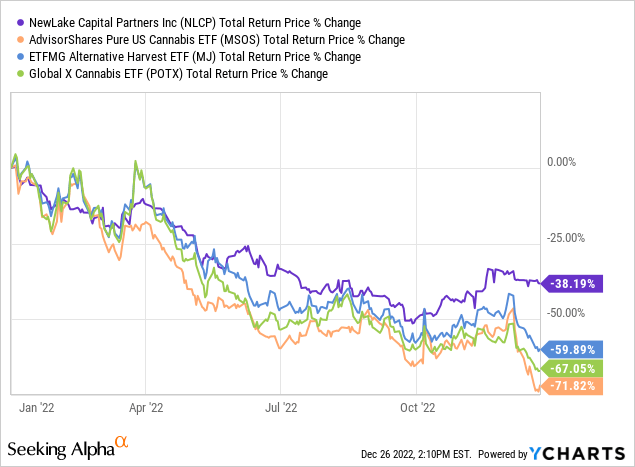

Despite being down 38% year-to-date on a total return basis in a year that saw the total capitalization of its listed North American cannabis peers heavily contract, NewLake Capital (OTCQX:NLCP) perhaps represents the most attractive investment in the cannabis space. There’s a lot to be excited about here. The last quarterly cash dividend payout of $0.39 was a 5.4% increase from the prior dividend and means a yield of 9.34% on the current price of the commons. The payouts haven’t stood still, with NewLake almost in a race against itself to raise them.

The company only went public in August last year but has raised its dividend 5 times since its inaugural payout of $0.12 per share. REIT investors would very rarely be able to buy into such hyper dividend growth at such a fat payout as yield is a function of price and such fundamentals against any other REIT property type would have seen the common shares rapidly bid up.

Hence, the current depressed price of NewLake is attractive from an entry point and I’ve taken it as an opportunity to accumulate shares. To be clear here, I don’t expect this relative discount to disappear soon, NewLake is not listed on a more official exchange which of course limits its pool of institutional and retail investors. Swathes of the latter are likely prevented from holding non-Nasdaq or NYSE stocks in non-specialized general investment brokerage accounts.

Critically, I see this as a long-term mispricing opportunity that allows the quiet accumulation of shares at a discount to their book value per share which stood at nearly $20 as of the end of the last reported fiscal 2022 third quarter. The long-term outcome of DRIPed and fast-rising dividend payouts is wealth creation. I think this will happen even against an industry that has struggled to get on its feet since 2018 and the wave of state legalizations.

Finding Value In An Industry Collapsing

REITs derive their value from the health of their tenants. Strong tenants meet their lease obligations and are more likely to pay higher rents in the future. Hence, it’s understandable that NewLake’s common shares year-to-date have tracked its industry lower.

Returns for cannabis returns have been nothing short of woeful in the years following 2018. The whole industry has been characterized by a nearly-directionless meandering between periods of downward volatility only briefly interrupted by short-term market-driven trading euphoria like the short period before the October 17, 2018 start date for recreational Canadian cannabis sales. Whilst NewLake purely focuses on the US, the fate of both countries has been intertwined with the Canadian operators owning significant stakes in the US multi-state operators through aggressive investment roadmaps. There has been a raft of bankrupt Canadian cannabis companies this year, a development that has heightened the importance of the freer and more attractive US cannabis market.

NewLake provides real estate capital to state-licensed US cannabis operators. The triple-net lease REIT acquires both industrial and retail properties mainly through sale-leaseback transactions, third-party purchases, and build-to-suit projects. The triple-net lease means its tenants are responsible for paying all property-related expenses including taxes, insurance, and maintenance.

What The Future Holds For NewLake

As of the end of its fiscal 2022 third quarter, the REIT owned 31 properties spread across 12 states for 1.7 million square feet. The portfolio was 100% leased with around 92% of fully committed capital dedicated to cultivation facilities and the remaining 8% to retail. The underlying portfolio fundamentals are healthy with a 12.2% weighted average yield against an average lease term of 14.9 years and a 2.7% weighted average rent escalations.

The company has also had no defaults or rent deferrals and held just $3 million in debt as of the end of the third quarter with cash and equivalents at $45 million. This is being aggregated with a $90 million revolving credit facility to form NewLake’s near-term liquidity.

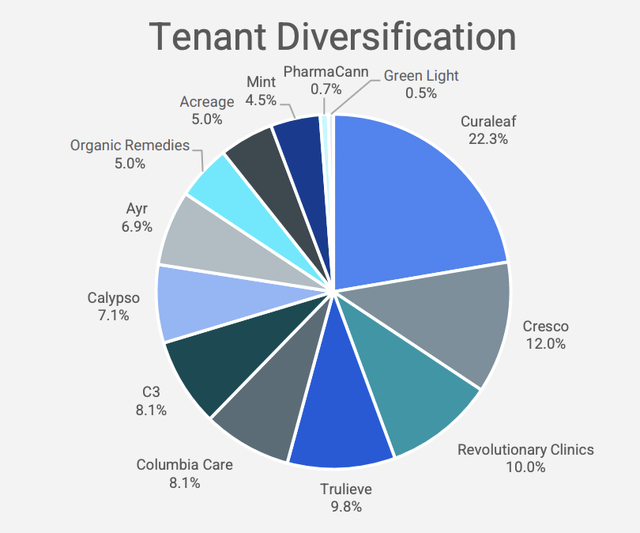

Further, the portfolio is diversified across a number of listed US MSOs with Curaleaf (OTCPK:CURLF), Cresco Labs (OTCQX:CRLBF), and Trulieve (OTCQX:TCNNF) all forming the largest of its tenants. Overall, 65% of its tenants are public with around 35% private. Whilst the common shares of these are down in a year that more gyrated to broader macroeconomic conditions and a hawkish Fed, the majority of NewLake’s tenants are adjusted EBITDA positive.

The company’s fiscal 2022 third quarter saw rental revenue come in at $12.1 million, an increase of 49.6% over the year-ago quarter. FFO of $10.3 million, was also an increase from $6.6 million in the year-ago period. The FFO per share of $0.47 was a beat by $0.03 on consensus estimates and more than enough to cover the company’s dividend payout for the quarter. It’s understandable that it has also provided a level of operational flexibility for NewLake to launch a $10 million share buyback program.

Hence, this isn’t a yield trap, but the industry remains in a regulatory grey area and faces an uncertain future with federal US cannabis legalization in a still uncertain timeline. I’ve been bearish on the sector since legalization, but I’m a buyer here even though I don’t think we will see near-term outperformance. Bulls might also need to be aware that the company still has a very short history as a public company and presently strong execution might stumble.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.