[ad_1]

Valentina Shilkina/iStock via Getty Images

As the stock has pulled back, I believe passive income investors have an opportunity to add one of the highest-quality business development companies, Oaktree Specialty Lending Corporation (NASDAQ:OCSL), to their income portfolio.

Oaktree Specialty Lending has a very defensively structured investment stack and an excellent portfolio quality in terms of non-accruals.

Given Oaktree Specialty Lending’s perfect credit quality score as a result of carefully selecting credit exposure, I believe OCSL deserves to trade at a premium to net asset value.

Buy The Pullback And Get OCSL For Net Asset Value

Oaktree Specialty Lending’s stock fell in December, creating an appealing entry point for one of the best-managed business development companies in the industry.

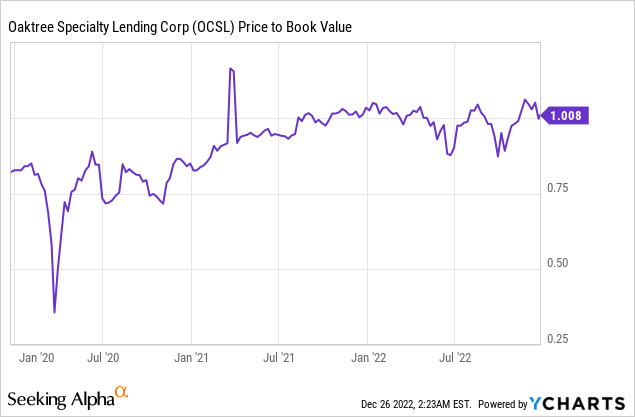

OCSL dropped from $7 to $6.65 before rising to $6.77 yesterday. While OCSL is not overbought or oversold, I believe that the opportunity to purchase one of the best business development companies (“BDCs”) in the sector should not be passed up, as the BDC’s stock can now be purchased for just net asset value.

Perfect Credit Quality Sets Oaktree Specialty Lending Apart From Peers

Other than Oaktree Specialty Lending, I am not aware of any other business development company with perfect credit quality, which means its loan portfolio is fully performing.

The non-accrual ratio, which BDCs and other financial services companies use to measure the amount of delinquent loans, was 0% in the third quarter (fiscal fourth quarter), indicating that the BDC has the best credit quality in its portfolio that a BDC can offer its investors.

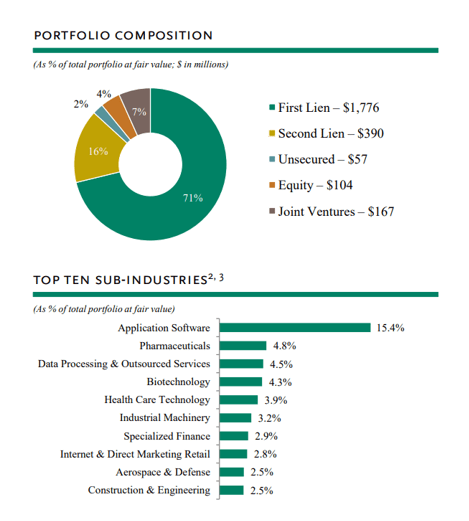

Furthermore, Oaktree Specialty Lending’s portfolio has a clear focus on First and Second Liens, with strict industry diversification to keep credit and portfolio risks to a minimum.

The BDC invested 87% of its total capital in secure first and second liens, which provide capital providers with a high level of protection in the event of a borrower default. A BDC’s industry diversification can be viewed as an added layer of protection.

Oaktree Specialty Lending primarily invests in industries, such as Software Applications or Pharmaceuticals that generate stable cash flows and are not as vulnerable to wild fluctuations in the economy as more cyclical companies.

Portfolio Composition (Oaktree Specialty Lending Corp)

Why I Think That OCSL Deserves A Premium Valuation

The company has perfect asset quality, which is why I believe Oaktree Specialty Lending deserves to trade at a premium net asset valuation. Oaktree Specialty Lending distinguished itself from its peers by having no non-accruals in its loan portfolio at the end of the September quarter (as well as throughout the first nine months of the year).

The stock of Oaktree Specialty Lending is currently trading at net asset value (implied P/NAV-ratio of 1.0x). With that said, Oaktree Specialty Lending traded at premium NAV valuations earlier this year. Given the BDC’s exemplary credit quality, I believe OCSL is a business development company that deserves to trade at a premium to net asset value in the future.

Why OCSL Could See A Lower Valuation

Oaktree Specialty Lending’s credit quality could deteriorate both theoretically and practically if the much-discussed recession of 2023 occurs.

Having said that, I believe OCSL is a particularly strong BDC for passive income investors with below-average investment and dividend risks due to its focus on First and Second Liens, high credit quality, and dividend coverage by net investment income.

A significant deterioration in credit quality, on the other hand, could result in an increase in non-accruals and a discount NAV valuation.

My Conclusion

I purchased more OCSL on the pullback because I believe Oaktree Specialty Lending is one of the best-managed managed business development companies in the industry. As a result, I recommend OCSL to passive income investors who require consistent and predictable passive income.

As a recession becomes more likely, I am all for investing in BDCs that have successfully navigated the credit cycle and have exemplary portfolio performance, and Oaktree Specialty Lending has both.

I also believe that Oaktree Specialty Lending Corporation is a BDC that deserves to trade at a premium net asset valuation due to its skilled approach to credit selection and lack of investments in non-accruals.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.