[ad_1]

JuSun

The December sell-off in stocks has created a number of bargain opportunities in the high yield space. While there’s no telling if we’ll see a rebound in January, I see many names as being cheap enough, and it’s better to buy into a stock when many risks are already priced in.

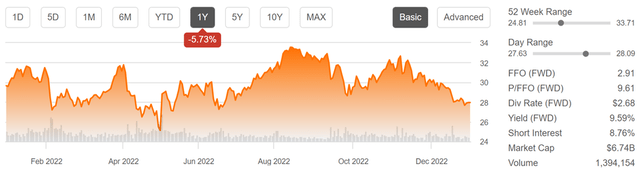

Such I find the case to be with Omega Healthcare Investors (NYSE:OHI) which as seen below, is now again trading at the low end of its price range over the past 12 months, pushing the dividend yield up to 9.6%. In this article, I highlight why OHI may be a solid pick for income investors to start the new year.

Why OHI?

Omega Healthcare Investors is the largest publicly-traded owner of skilled nursing facilities. It’s been publicly traded for 30 years, and at present, has 916 properties spread across the US and UK, comprising 92K beds and leased to 63 operators. It’s also geographically diversified with exposure to nearly every U.S. region, and its top 3 states are Florida, Texas, and Indiana.

OHI is generally thought of as being a “higher risk” REIT due to its exposure to the SNF industry, which is well known for having tighter rent coverage ratios than other property types, due to their government pay model resulting in thinner margins. However, higher risk doesn’t necessarily translate to lower returns.

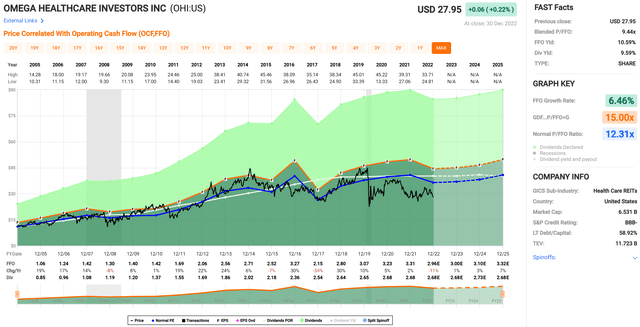

That’s because OHI has had a depressed share price for long stretches of time while paying a steady and sometimes growing dividend for nearly 2 decades. This, combined with a high dividend yield and reinvestment of dividends have translated into strong shareholder returns.

As demonstrated below, OHI’s total return over the past 10 years has far surpassed that of the Vanguard Real Estate ETF (VNQ) and until recently, matched that of the REIT favorite among retail investors, Realty Income Corp. (O).

OHI Total Return (Seeking Alpha)

Of course, many investors know that OHI has seen its share of headwinds over the past year, as some tenants have experienced trouble covering their rent. SNFs are labor intensive, and some operators have struggled with higher labor costs as a result of inflation. This has resulted in significant operator restructurings over the past year, combined with asset sales.

It appears, however, that the picture is starting to get better, as occupancy is slowly improving and many states have responded to labor inflation by implementing strong Medicaid reimbursement rate increases.

This has resulted in improvements in OHI’s operating metrics in recent months, as it saw a 91% rent collection rate in October. This compares favorably to the end of Q3, during which operators representing 12% of OHI’s contractual rent and mortgage obligations did not pay all of their obligations.

Moreover, while OHI’s AFFO per share of $0.76 is down from $0.85 in the third quarter of 2021, it still more than covers the $0.67 quarterly dividend rate. The dividend is also covered by from a funds available for distribution perspective, with a FAD payout ratio of 94.5%.

Looking forward, I see the long-term thesis for OHI as being intact, considering the growing adult senior population, with all baby boomers being older than 65 by the year 2030. It also shouldn’t be ignored that SNFs remain the setting with the lowest cost of care, making it an ideal destination for hospital discharges. I also see potential for OHI to emerge stronger over the next couple of years, as management has taken a number of actions to focus the portfolio on higher quality properties, as reflected during the last conference call:

Specific actions taken to protect long-term shareholder value over the last 32 months include: One, the sale of $1.6 billion in assets, which generally strengthen our operator future credit metrics by exiting underperforming facilities within master leases and in some cases resulted in completely exiting the operator relationship.

Two, while we harvested $1.6 billion in capital, we have deployed an equivalent amount $1.6 billion via asset purchases, construction, loans, and leverage neutral stock buybacks. Three, in addition to acquiring and disposing assets, we have transitioned dozens of facilities to new or existing operators. The net result of our active asset management is a stronger operator platform as we narrowed our operator base from 70 operators in Q1 2020 to 63 operators today.

Meanwhile, OHI maintains a strong balance sheet with a net debt to EBITDA ratio of 5.3x, sitting below the 6.0x level generally deemed safe by ratings agencies for REITs. It also carries a significant $1.4 billion worth of liquidity with no debt maturities until August of 2023, and has strong fixed charge coverage ratio of 4.1x, sitting above the 1.5x required by debt covenants.

Lastly, I see the recent sell-off as being a good time to layer into OHI. At the current price of $27.95, it carries a forward P/FFO of 9.6, sitting well below its normal PE of 12.3. While analysts expect just 3% to 5% annual FFO/share growth over the next two years, I see this and potential headwinds as being more than baked into the share price. Analysts have an average price target of $32.23, translating double-digit total return potential.

Investor Takeaway

Overall, I see OHI as being an attractive investment opportunity at the current price, with many headwinds already being baked in. Management is positioning the company for the long-term by cleaning up the portfolio while maintaining a strong balance sheet. I see the long-term thesis as being intact and the dividend remains protected with potential for coverage to improve in 2023. Income investors may want to considering layering into the stock at its current depressed levels.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.