[ad_1]

Merkuri2

Paramount Global (NASDAQ:PARA) has underperformed the S&P 500 (SPX) significantly since we urged investors to be cautious in our previous update. We also saw marked technical weakness, suggesting that the market could be pricing further headwinds.

Since then, macro headwinds have intensified, with the adverting industry going through a maelstrom as businesses pulled back ad spending given a potential recession. Despite that, Connected TV (CTV) is expected to thrive over the next few years. eMarketer articulated that “the next few months will be challenging for advertising, but not all areas will be affected the same way. CTV and retail media are in great shape.”

Accordingly, eMarketer forecasts suggest that “between 2021 and 2026, the US CTV ad market will more than double.” Furthermore, ad-supported streaming would likely grow substantially faster than subscription-based streaming services. According to Omdia estimates, ad-supported streaming revenue would increase at a 5Y CAGR of 13.8% Vs. subscription-based streaming’s 5Y CAGR of 6.6% from 2022-27.

As such, Paramount investors should be assured to know that the company’s well-diversified platform spanning TV, direct-to-consumer (DTC), and films should help mitigate the macro and competitive headwinds moving ahead.

Despite that, the company needs to move faster in charting its path toward sustainable profitability for its D2C segment. Investors should recall that the company’s D2C ad business is consolidated under EyeQ, which is essentially Pluto TV and Paramount+, a consolidated approach with subscriptions and ad-supported streaming.

Management highlighted in an early December conference that it sees a solid value proposition for advertisers with cost per thousand impressions (CPMs) in the “mid-high teens versus some other guys are going out at $50, $60.” In addition, management highlighted that its pricing strategy is “very intentional” to go after a larger TAM.

Notwithstanding, the company’s market share is still expected to remain relatively low compared to the CTV leaders in the market. Accordingly, EyeQ is projected to garner a total share of 5.6% of the CTV space in 2023, compared to 2022’s 5.4%.

As such, Paramount’s value proposition is not expected to lift its share gains tremendously despite supposedly offering tremendous relative value. eMarketer also cautioned that Paramount “lags behind on innovation even as it pushes adoption of its Paramount+ streamer. But that could be a tall order, considering consumers feel it has an inferior ad load than competitors.”

Hence, it could explain why Loop Capital was negative in its December update, suggesting that the company “does not have a clear path to streaming profitability.”

While the proposed consolidation of Showtime (Paramount’s premium cable network) with Paramount+ is expected to “unlock value,” we need to see better execution from management to bolster investors’ confidence.

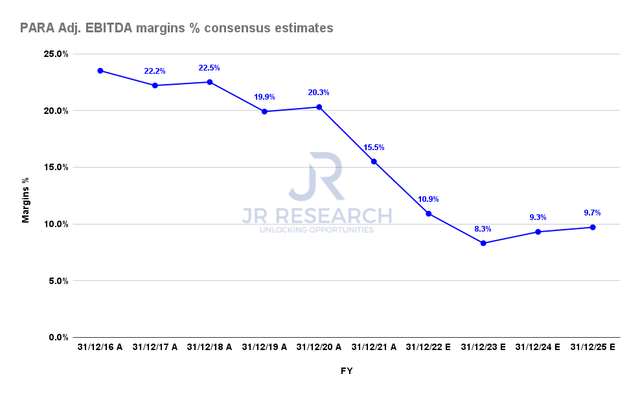

PARA Adjusted EBITDA margins % consensus estimates (TradingView)

As such, Paramount needs to reverse the decline of its falling profitability while managing the secular decline of Linear TV. However, we believe Linear TV’s impending downfall could have been overstated, even as ad budgets could continue moving to CTV.

eMarketer also warned that CTV could continue to face significant challenges without a credible measurement system that could improve transparency for advertisers.

Also, it may be helpful to note that Berkshire Hathaway (BRK.A) (BRK.B) is PARA’s most significant investor. As such, Paramount’s highly profitable TV margins could continue to undergird the company’s penetration in the D2C segment against less profitable streamers. Also, if Linear TV were to be in a much faster decline than anticipated, we believe Warren Buffett would likely not be PARA’s most fervent supporter.

Notwithstanding, while PARA has continued to recover remarkably from its November lows, we believe a pullback should help to improve the reward/risk profile for investors.

At an NTM EBITDA multiple of 10x, it’s way above its peers’ median of 7.3x (according to S&P Cap IQ data) while facing potentially declining forward profitability. Also, its 10Y average of 9.2x suggests there isn’t a discernible valuation dislocation at the current levels for investors to exploit.

Rating: Hold (Reiterated)

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.