[ad_1]

Justin Sullivan

Shares of PayPal (NASDAQ:PYPL) are down 70% from their all-time high, but the potential for appreciation may be under-rated considering that the financial services company recently received a $2.0B investment from activist investor Elliott Management. Since PayPal generated $1.3B in free cash flow per quarter in the last year and shares are cheap based off of P-E, the activist investor may push for a higher dollar amount to be spent on stock buybacks!

Elliott Management’s investment in PayPal

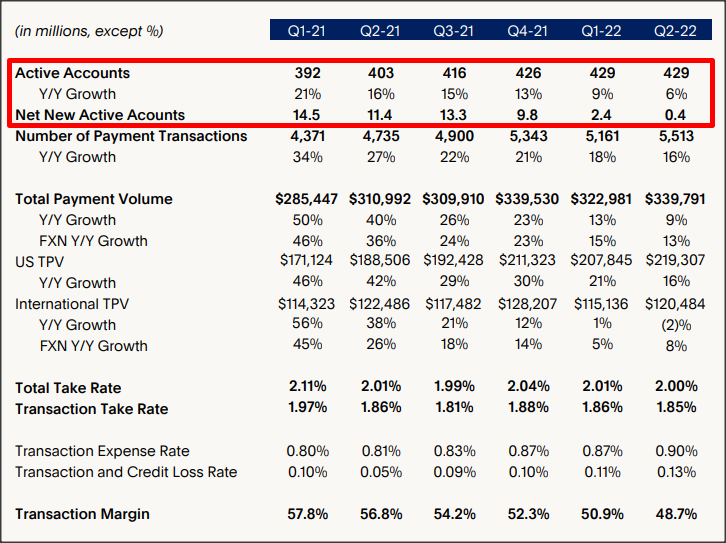

PayPal has been a big winner of the COVID-19 pandemic. The payments company added millions of new active accounts during the pandemic, when e-Commerce and online transactions soared. PayPal’s active accounts grew by 124M between Q4’19 and Q2’22, but PayPal’s net new active account growth is slowing now… which has also led to a down-grade in the company’s guidance earlier this year.

PayPal ended the second-quarter with 429M active accounts in its payments ecosystem, adding just 0.4M net new active accounts. On a year-over-year basis, PayPal saw just 6% growth in its important active accounts figure, and the second-quarter was the sixth consecutive quarter of growth deceleration. The decline in active account growth also hurt PayPal’s net revenue growth, which decelerated to just 9% in Q2’22.

PayPal: Q2’22 Active Account Growth

While PayPal’s business growth is clearly slowing, in part because the pandemic is no longer fueling digital payment volumes with the intensity it did during 2020, PayPal has one thing going for it that likely attracted Elliott Management to invest $2.0B in the financial services company: Very strong consistent free cash flow generated from PayPal’s large payments ecosystem. PayPal is a trusted source for online payments and the 429M-strong account base makes PayPal the fintech with the largest reach in the sector.

PayPal, despite slowing active account growth, is demonstrating a strong ability to generate consistent free cash flows: the firm generated $5.2B in free cash flow in the last year, or $1.3B a quarter. The firm’s free cash flow margin in the last year was 20%. PayPal has said that it continues to expect at least $5B in FCF in FY 2022.

|

Q2’21 |

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

Growth Y/Y |

|

|

Revenues ($M) |

$6,238 |

$6,182 |

$6,918 |

$6,483 |

$6,806 |

9% |

|

Free Cash Flow ($M) |

$1,059 |

$1,286 |

$1,550 |

$1,051 |

$1,291 |

22% |

|

FCF Margin |

17% |

21% |

22% |

16% |

19% |

2 PP |

(Source: Author)

Possibility of higher stock buybacks

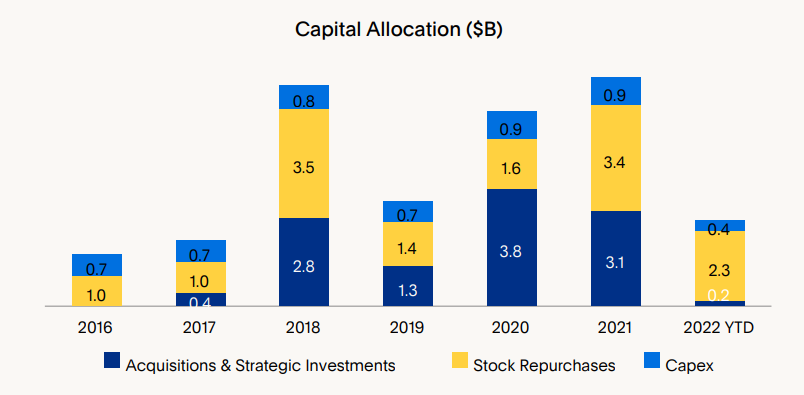

Elliott Management has a reputation as a hard-charging activist investor that pushes for cost-savings, divestitures and stock buybacks to unlock value. The cost-savings so far proposed by PayPal amount to $900M, but more may follow.

PayPal also already announced a $15B stock buyback, likely at the pressure of Elliott Management, but I expect this stock buyback plan to be up-sized significantly going forward. With current free cash flow running at $1.3B a quarter, PayPal could announce an up to $25B stock buyback which would be equal to roughly five years worth of free cash flow, not assuming any additional debt or cost savings that would boost FCF.

PayPal already is repurchasing stock, but Elliott may push for even more buybacks, especially if PayPal’s stock keeps under-performing. PayPal repurchased $2.3B of its stock in the first six months of FY 2022 and about $2.0B annually between FY 2016 and FY 2021.

PayPal Stock Buybacks FY 2016-2021

Now is the time for stock buybacks

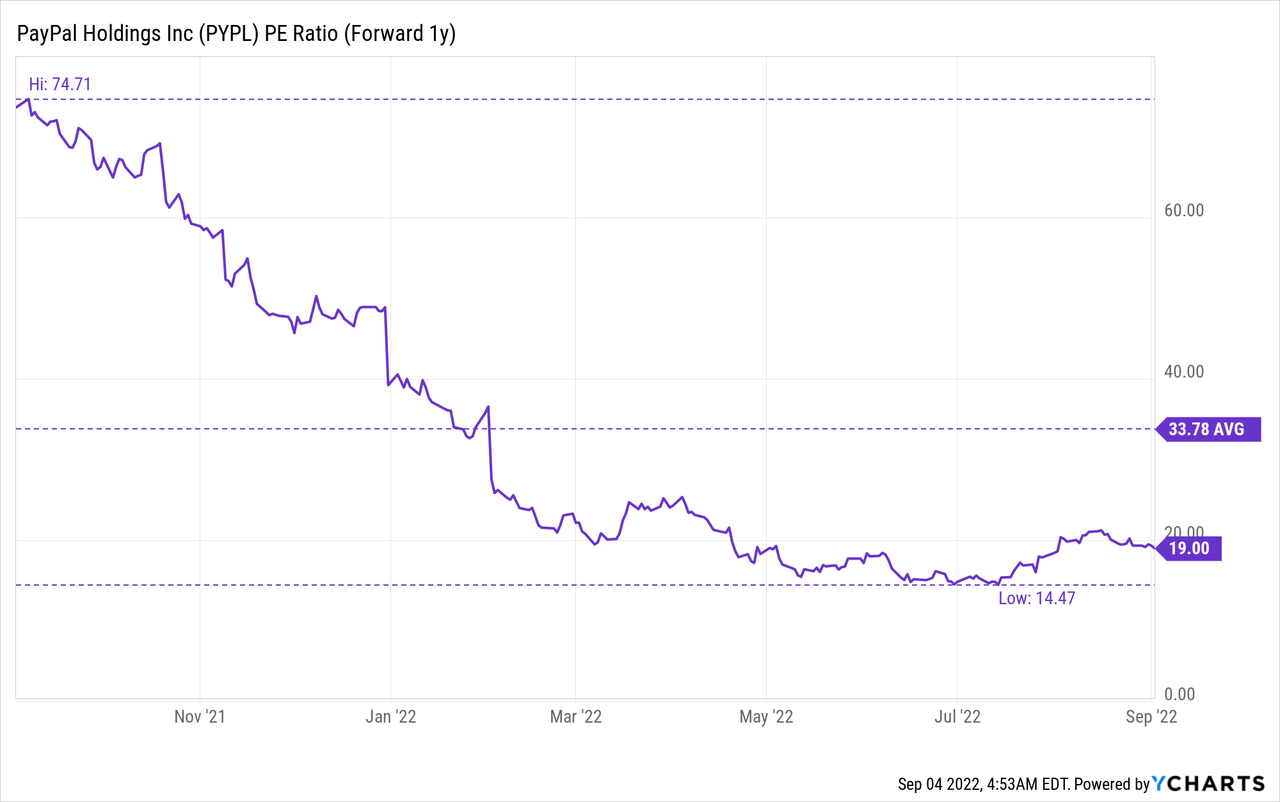

With PayPal’s shares being down 70% from their all-time high, there was never a better time to buy back a ton of discounted shares than now. Elliott Management and PayPal know this, too, which is why I expect an up-sized stock buyback program to be announced in the next few months.

PayPal is expected to generate non-GAAP EPS of $3.87-$3.97 in FY 2022 which implies a P-E ratio of 23.2 X. Based off of next year’s estimated EPS of $4.79, the stock trades at an earnings multiplier factor of 19.0 X, which is well below last year’s average P-E ratio of 33.8 X.

Risks with PayPal

PayPal’s biggest commercial risk at this point is that active account growth could dip into negative territory in the short term, which would be a major issue for the stock. PayPal’s growth in active accounts slowed down dramatically in FY 2022, and it may get worse before it gets better. The revenue guidance for FY 2022 (11% growth) is not great and growth may slow down further if the macro picture deteriorates. A decline in platform key metrics could push shares of PayPal into a new down-leg despite the presence of an activist investor.

Final thoughts

I am looking forward to PayPal announcing an increase in its planned stock buybacks. PayPal’s shares trade at a very attractive P-E ratio compared to last year, which speaks for an increase in stock buybacks. PayPal’s large free cash flow and estimated cost-savings of $900M could easily finance an up-size in the stock buyback. Since Elliott Management has a history of pushing for change, cost savings and stock buybacks, PayPal has an important catalyst working in its favor that could result in an upwards revaluation of the firm’s shares!

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.