[ad_1]

bjdlzx

PDC Energy (NASDAQ:PDCE) looks capable of generating over $900 million in positive cash flow during the second half of 2022. This is expected to help fund continued share repurchases as well as a variable dividend (related to 2022 results) that should be $2+ per share.

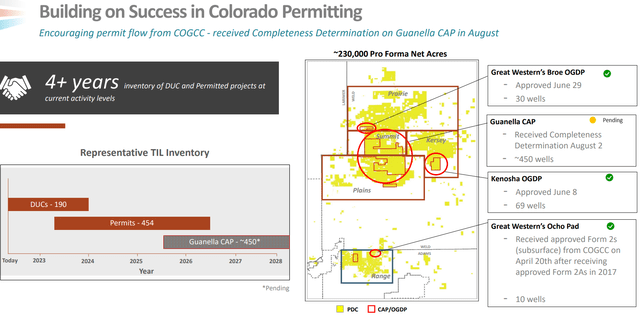

PDC’s estimated value is around $73 to $79 per share in a long-term $70 WTI oil and $4.00 NYMEX gas scenario. It is progressing well in terms of getting Colorado permits, which I’ve previously noted as a significant potential catalyst. The hearing for its Guanella Comprehensive Area Plan (which could add several years to its permitted inventory) is currently scheduled for December.

Colorado Permits

PDC has made substantial progress with its Colorado permitting situation. It received unanimous approval for its Broe and Kenosha development plans in June, which gave it permits for 99 wells.

It also received a completeness determination on its Guanella Comprehensive Area Plan in early August. This moves the process along to the technical review phase and a 60-day public comment period. The tentative hearing date before the oil and gas commission is set for December 7.

Getting the Guanella CAP approved would be a major boost for PDC, as that would add approximately 450 locations and give it permitted inventory that should last past 2028 at current activity rates.

2H 2022 Outlook

PDC now expects its 2H 2022 production to average 250,000 BOEPD including 82,000 barrels of oil per day.

At current strip prices (including roughly $90 WTI oil and $8 NYMEX gas), PDC is projected to generate $2.461 billion in oil and gas revenues before hedges during the second half of the year. PDC’s 2H 2022 hedges have around negative $502 million in estimated value.

|

Barrels/Mcf |

$ Per Barrel/Mcf (Realized) |

$ Million |

|

|

Oil (Barrels) |

15,088,000 |

$89.00 |

$1,343 |

|

NGLs (Barrels) |

13,292,160 |

$30.00 |

$399 |

|

Natural Gas [MCF] |

105,719,040 |

$6.80 |

$719 |

|

Hedge Value |

-$502 |

||

|

Total Revenue |

$1,959 |

PDC has an estimated $1.027 billion in cash expenditures for the second half of 2022, including $540 million for capex. This leads to a projection that it can generate $932 million in positive cash flow in the second half of 2022 at $90 WTI oil.

|

$ Million |

|

|

Lease Operating Expense |

$152 |

|

Transportation, Gathering and Processing |

$64 |

|

Production Taxes |

$177 |

|

Cash G&A |

$60 |

|

Cash Interest |

$34 |

|

Capital Expenditures |

$540 |

|

Total Expenses |

$1,027 |

PDC may also pay out $67 million in dividends during the second half of 2022 at its current quarterly dividend rate of $0.35 per share.

Net Debt And Share Count

PDC had $1.658 billion in net debt at the end of Q2 2022, so it is projected to reduce its net debt to $793 million by the end of 2022 based on current strip prices. This does not include the effect of further share repurchases or variable dividend payments.

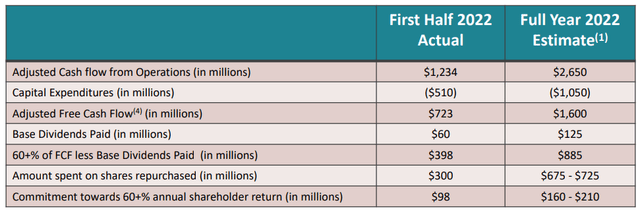

PDC has estimated that it will spend $400 million on share repurchases in the second half of 2022, while it would also have another $185 million to allocate towards a variable dividend to reach its target of a 60+% return (of free cash flow less base dividends) to shareholders.

PDC’s Expected 2022 Results (pdce.com)

Thus PDC may end 2022 with $1.378 billion in net debt after factoring in these various payments. PDC’s share repurchases may bring its share count down to around 91 million at the end of 2022.

Notes On Valuation

Assuming that PDC’s Guanella CAP gets approved, I estimate PDC’s value in a long-term (after 2022) $70 WTI oil and $4.00 NYMEX gas scenario at approximately $73 per share. A scenario where 2023 commodity prices follow current strip ($80 WTI oil and $6.00 NYMEX gas) before reverting back to long-term $70 oil and $4 gas would make PDC’s estimated value $79 per share instead.

In addition, PDC Energy is likely to announce a $2+ per share variable dividend related to its 2022 results.

PDC Energy expects to grow production by around 5% in 2023 from 2H 2022 levels, which would give it around 262,500 BOEPD in average production.

Conclusion

PDC Energy has been making progress with its Colorado permits, getting 99 permits approved in June. Its Guanella CAP is scheduled for a hearing in December and approval would add another 450 wells to its permitted inventory. This would give PDC enough permitted inventory until at least 2028 at its current activity pace.

Getting the Guanella CAP approved would make PDC’s shares worth an estimated $73 to $79 per share in a long-term $70 WTI oil and $4.00 NYMEX gas scenario. PDC may also offer a 5+% dividend yield (based on its current price) over the next year including its variable dividend.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.