[ad_1]

NicolasMcComber/E+ via Getty Images

The search for stable monthly income against record-high inflation led to PIMCO Dynamic Income Opportunities Fund (NYSE:PDO). The closed-end fund last paid out a monthly per-share cash dividend of $0.1279, in line with the prior payout, for a 12% yield. Further, this yield does not include the periodic special year-end per share dividend of $0.96, a simply staggering amount that essentially works out to be 7.5 months of extra regular monthly income. To be clear here, PDO pays out a fat near 12% regular dividend yield and periodically tops this off with a payout that would amount to 7.3% if taken on its own. This special dividend is more than you can get from a swathe of REITs and CEFs. The dual combined 19% yield raises the crucial question; how safe is PDO and is this all a yield trap?

There is a long list of investors who have been sucked into an investment based solely on the yield just to see their position lose significant value and for the yield to be cut. Indeed, the yield is simply a function of the payout on price and investors can routinely be caught chasing the fat yield of securities in a death spiral. Avoiding this should form the core of any CEF-based fixed-income investment. PDO allows retail investors to gain access to a large and heavily diversified portfolio of fixed-income investments. This includes corporate bonds, municipal notes, agency and non-agency mortgage-backed securities, and preferred securities. There are niche and exotic securities like Romanian sovereign debt, convertible notes, and diversification within diversification with the corporate bonds spread across utilities, banks and industrial companies. Altogether, the CEF holds over 300 positions and employed a significant amount of leverage, around 43% of total assets, through reverse repurchase agreements.

Income, Stability And Compounding Returns

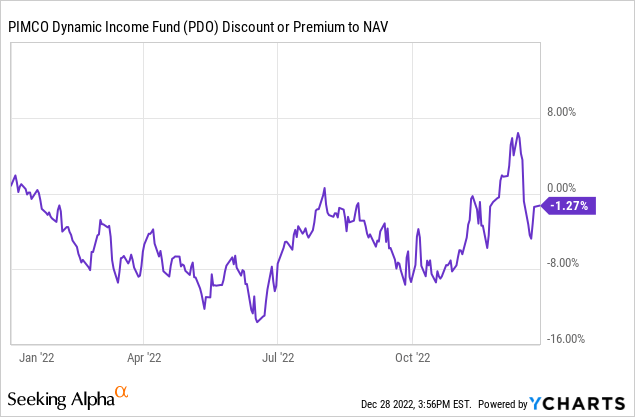

CEFs issue a fixed number of shares when they IPO. PDO went public in January of 2021, selling 100 million common shares at $20 per share. Shares outstanding currently stand at 110.18 million with underwriters having exercised an option to buy additional shares. As the market price of CEFs is determined by normal supply and demand dynamics, they can often trade at discounts and premiums to their underlying net asset value.

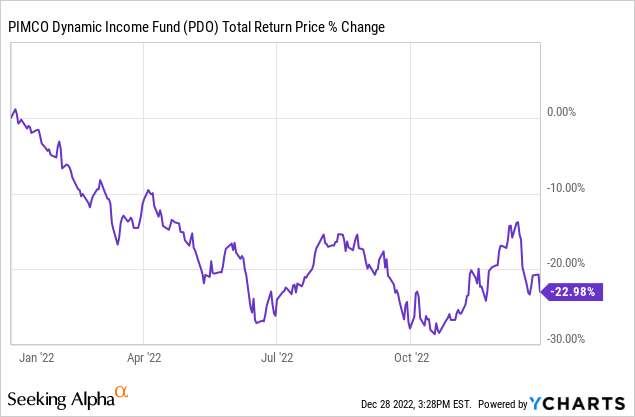

PDO currently trades at $12.83, falling around 23% on a total return basis year-to-date and of course down from its $20 IPO price. The CEF also currently trades at around a 1.27% discount to its NAV.

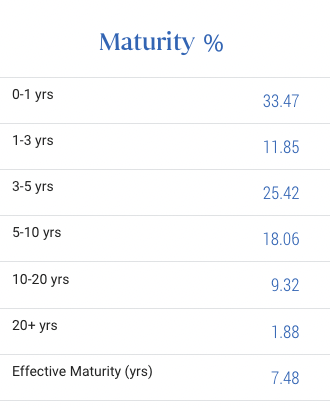

It’s important to note that PDO has a termination date on January 2033. This will see all its positions sold off and monies returned to shareholders. This reduces the expected volatility and means the CEF is unlikely to trade at a marked discount or premium to its NAV. As of the end of November, the CEF had a fiscal year-to-date distribution coverage ratio of 102% and strong UNII as of the end of this period drove the special year-end dividend. With a third of the portfolio maturing within a year, the CEF is partially well-positioned to recycle some of its assets to higher rates when they mature.

PIMCO

A Torrid Macro Environment In 2023

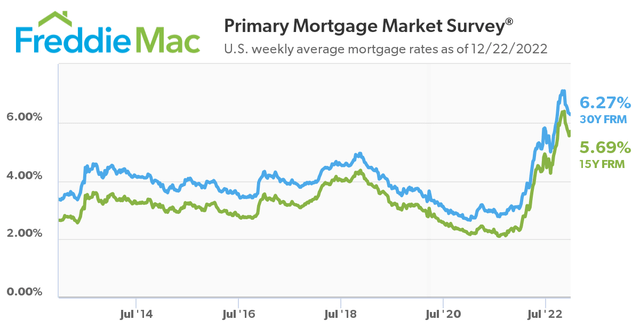

The CEF is down so markedly this year because of rising interest rates partially driven by an energy crisis caused by Russia’s war in Ukraine. In response, the Fed has had to hike interest rates aggressively to combat the specter of runaway inflation. There are a few takeaways for PDO’s investors here. Firstly, interest rates are set to increase even more. Fed fund rates are expected to increase to between 5% to 5.25% next year, a 17-year high. Secondly, the 30-year fixed-rate mortgage rate has spiked to its highest level since 2008, albeit pulling back in recent weeks from over 7%.

This matters because of PDO’s exposure to non-agency mortgages, this currently accounts for 19.50% of their NAV. The underlying value of this is driven by the US real estate market which is facing significant stress as a result of rising mortgage rates. Real estate transactions have slowed down and house prices are forecasted to retract by up to 20% next year. There are some early signs of the music about to stop with investor home purchases falling by 30% year-over-year nationwide in the third quarter of 2022, the most marked decline since the 2008 financial crisis. This macro backdrop will continue to drive near-term returns for PDO with a view of conditions only improving from 2024.

According to KKR, inflation is already likely to be past its peak with a number of forecasts stating this should fall close to the 2% target inflation rate towards the end of 2023. This could be aggregated with bullish forecasts by Goldman Sachs that the US economy will be able to steer away from a recession next year. Fundamentally, falling inflation, no more Fed rate hikes, and robust economic growth would be the background for PDO to recover some NAV. I intend to DRIP shares with the intention to hold this as a core position for the long term. I believe the 12% yield, special dividend, and the potential soft landing will likely make this a prudent investment decision.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.