[ad_1]

denizbayram

Investment Thesis

Peabody Energy (NYSE:BTU) is a very compelling investment on a valuation basis. That being said, since I wrote about Peabody last month, a lot has changed. And frustratingly not for the better.

Here I address the recent impact of natural gas prices on the coal industry.

And why I believe that although this is unwelcome news, the bull case remains intact.

What’s Happening Right Now?

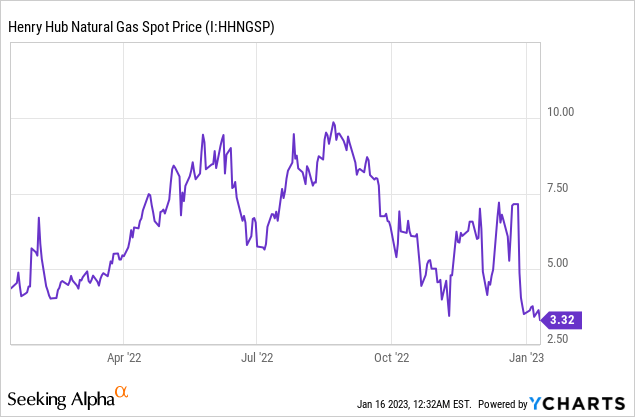

Natural gas has slumped in the past few days. More specifically, at one point in the past month, natural gas prices fell by 40%.

Recall, approximately 50% of Peabody’s prospects are tied to thermal coal. With the remainder tied to metallurgical coal. That is coal that’s used in steel production.

However, the problem for Peabody is that thermal coal had been extremely profitable for Peabody in 2022. In fact, Australian thermal coal has reportedly benefited from a very strong thermal market in 2022.

But now that natural gas prices in the US have fallen so substantially, natural gas prices in the US will be competing with seaborn thermal coal.

To be clear, there is a bit more to the story than this. After all, it’s not only that natural gas prices are cheap and in many cases an alternative to thermal coal.

But companies also need to convert natural gas to Liquified Natural Gas (“LNG“) and export it to the desired locations, which adds to the final natural gas price. Not to mention, the cost of producing and transporting the coal, as well as, the cost of extracting and delivering natural gas.

Simply put, it’s not always a direct formula. On the other hand, very approximately, when natural gas prices fall below $4 mmbtu, it can sometimes be advantageous to rely on natural gas rather than coal, for energy usage.

This comes with a high cost, particularly right now, as tankers are already so busy. And this again reinforces my point that it’s not a simple story. There are a lot of nuances affecting Peabody’s bottom-line prospects in 2023.

That being said, this is my contention, the outlook for Peabody’s 2023, isn’t as sparkly as it seemed to be when we came out of 2022.

But does Peabody’s valuation more than factor this in already?

BTU Stock Valuation — 3x 2023 Free Cash Flow

This is where the story thickens further. On the one hand, Peabody is roughly expected to make about $1.5 billion of free cash flow in 2023. This puts its stock at approximately 3x its free cash flow.

And of course, that’s very cheap compared to nearly everything will in the wide stock market. Indeed, to the best of my knowledge, there’s no other sector in the market that is priced as cheaply as coal.

On the other hand, if natural gas prices were to remain depressed for a substantial amount of time, many energy plants that were forced to use thermal coal as their primary energy source in 2022, may be in a position to reconsider their stance.

What Other Catalyst Faces Peabody?

Peabody’s balance sheet carries a $550 million restrictive liability. This has meant that while many other coal companies have been able to return capital to shareholders in 2022, Peabody has not.

The thesis here is that coal is supposed to be a “dead” industry. That means that many coal companies are intent on returning capital to shareholders.

Or put another way, there’s a widely held view, that I don’t agree with, but the view exists, that coal’s use will be faded out substantially by 2030. With the UK’s prerogative being more aggressive and seeking to reduce its reliance on coal by 50% starting 2025.

Even if I believe that these targets are more aspirational than set in stone, the fact remains that there is a lot of energy and capital resources set on reducing energy plant’s dependency on coal.

The Bottom Line

Here’s the summary, Peabody’s outlook has developed some issues in the past month. However, I maintain that paying 3x this year’s free cash flows remains very compelling.

Furthermore, I suspect that at some point in 2023, Peabody’s restrictive debt covenant could be addressed, meaning that Peabody will be able to increase its capital return program.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.