[ad_1]

caio acquesta/iStock Editorial via Getty Images

Summary

The incoming Lula and PT (workers party) has stated their desire to have Petróleo Brasileiro S.A. – Petrobras (NYSE:PBR) play an active role in Brazil’s energy development that includes investing in renewable electric generation, refining capacity as well as exploration and production or E&P. This entails a substantial increase in capex with the danger of lower returns as well as fuel price interference that combine to limit free cash flow and dividends. Under this worst-case scenario, the share would be fairly priced at US$8 which would require PBR to fall to around US$6.5 to trigger a buy call.

Next key data points that could pressure or support the shares is when and whom the Government appoints to the board and who is the new CEO.

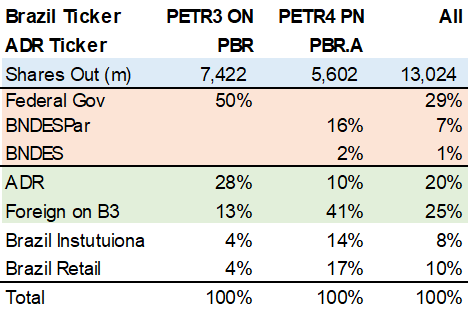

The Brazil Government can make changes to PBR strategy

The federal government owns 50.2% of the ON or voting shares. Via the ministry of energy, the government, without congressional approval, can elect a majority of board members loyal to the PT who in turn select a new management team. This will take shape shorty, with a call for an extraordinary shareholders meeting. Thus, Lula can dictate strategy at PBR, if it’s not clearly detrimental to the solvency of the company. This is why the shares have sold down post election and many analysts downgraded PBR, risk highlighted in my previous analysis Petrobras: Political Risk Too High To Hold Shares.

BPR Shareholder Breakdown (Created by author with data from PBR)

What is the worst case scenario

Main negative assumption is if Capex doubles from US$16bn to US$32bn annually. Under a change of strategy dictated by the PT, PBR would be at the forefront of the renewable transition via building or funding solar, wind, biodiesel etc. initiatives in Brazil. The BNDES (national development bank) would likely validate these projects and add “credibility” for the developments.

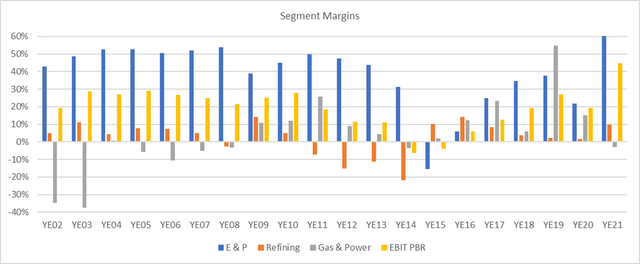

Most wind and solar projects have a lower return than E&P. Note that this is not new for PBR, it has been a relevant power investor in the past with poor results and increased risks as the Government used PBRs power capacity to soften hydro weakness. It currently owns 13 thermal natural gas plants with 5.3GW of capacity.

In addition, it’s very likely PBR decides to build a massive new refinery that can process the low sulfur (light crude) oil from the pre salt operations. This would keep more oil in Brazil vs the export market. On the surface this may look positive, PBR would gain crack spreads. However, as has been the practice in the past, Petrobras ran negative refining margins to keep fuel prices from impacting inflation at the behest of the federal government.

PBR segment EBIT margins (Created by author with data from PBR)

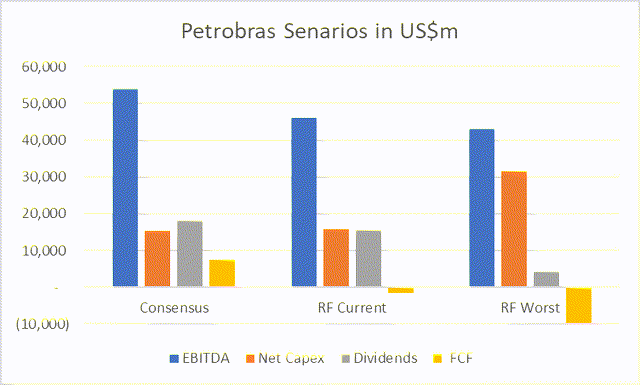

A negative cash flow cycle begins

A negative cash flow cycle begins as higher capex and flat or lower EBITDA needs to be funded by an increase in debt which carries higher financial expenses that then requires a cut to dividends. Thus PBR would see higher debt, lower dividends on flat EBITDA which drives valuation lower vs consensus and the current base scenario.

Negative FCF Cycle (Created by author with data from PBR and Capital IQ)

Detailed FCF and Valuation Scenarios (Created by author with data from PBR and Capital IQ)

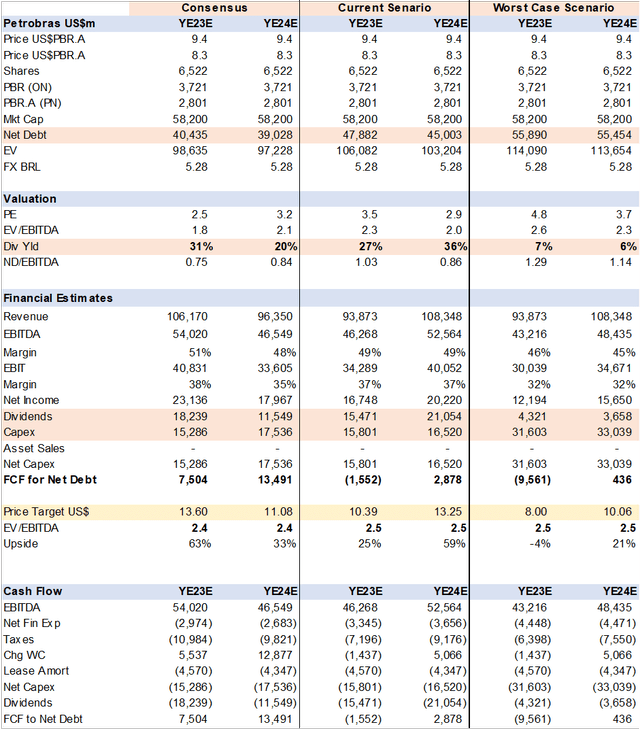

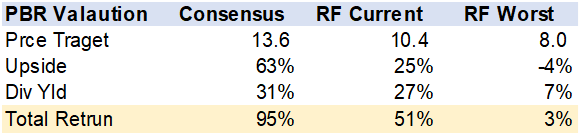

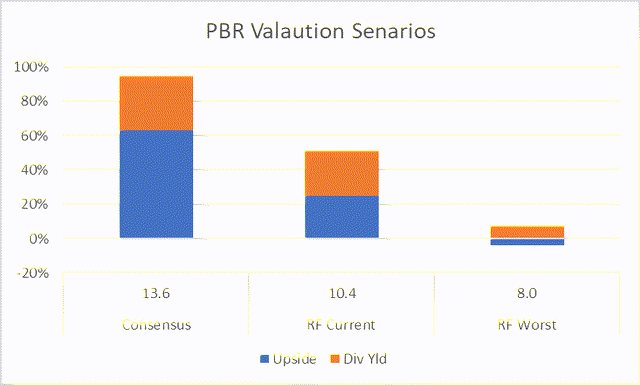

Valuation

Under consensus estimates, PBR still has considerable upside and many of the analysts have not assumed or priced in a change in strategy i.e. higher capex and the impact on cash flow, debt and dividends. The Consensus prices the shares at a forward 2.4x EV/EBITDA multiple.

Under my worst-case scenario, on US$80bbl Brent, the total return is 3%. One could then conclude that much of the worst has been priced in. However, to become a buyer of Petrobras I would need to see the shares at 20% below this US$8 or around US$6.5.

Petrobras has two share classes, (PBR) and (NYSE:PBR.A), the price discrepancy can be relevant and quite frankly they should perform identically. The main benefit to the PBR shares, called ON or Ordinary, is that they have voting rights, that are irrelevant given the Brazil Federal government’s 50.2%. While the PBR.A shares have a higher potential dividend hence they are called PN or Preferred share.

Valuation for PBR and PBR.A under three scenarios (Created by author with data from PBR and Capital IQ)

PBR Valuation under three Scenarios (Created by author with data from PBR and Capital IQ)

Conclusion

PBR is still not yet a buy, in my view, given the potential negative impact the incoming Lula Government may impose to Petrobras’s cashflow cycle, debt, dividend payout and valuation.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.