[ad_1]

imaginima

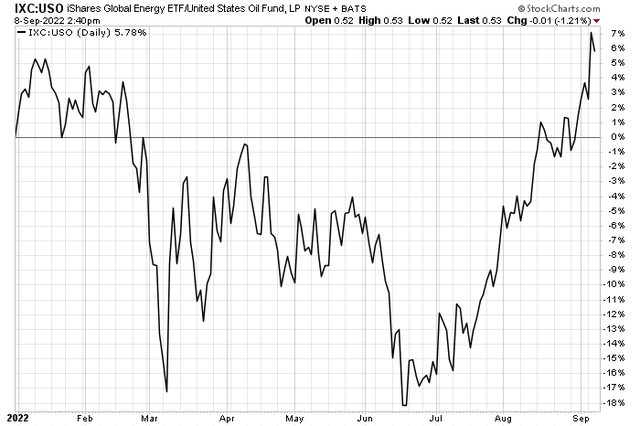

The Energy sector has been resilient despite falling oil prices lately. That’s generally more of a favorable sign for the equities rather than a bearish indicator for the commodity. For the many Energy market bulls, they can point to low valuations and high free cash flow yields among many domestic and foreign firms. One major China player fits the mold.

Global Energy Stocks Strong Despite Falling Oil

According to Bank of America Global Research, PetroChina (NYSE:PTR) is a fully integrated oil company, and the largest oil & gas company in China. It is engaged in a range of petroleum-related activities: 1) E&P: explore, develop, and produce crude oil and natural gas, 2) R&C: produce a wide range of refined and chemicals products, 3) Marketing: refined and chemical products through wholesale and retail networks, and 4) Natural Gas & Pipeline: transmit and store oil, refined products, and natural gas.

The Beijing-based $140 billion Oil, Gas & Consumable Fuels industry stock in the Energy sector is a major player in the global energy market. For dividend investors, the company’s big 8.4% yield comes at a low trailing 12-month GAAP price-to-earnings valuation multiple of just 4.6, according to The Wall Street Journal. PTR has a 12% short float, so there are some skeptics.

On valuation, analysts at BofA are optimistic with a dollar-equivalent price objective near $76. PTR recently spun off a natural gas pipeline unit to focus on more upstream activities. Broadly, earnings are seen increasing to above $10 per share this year and moderating to the $8 to $9 range in the years ahead. That would yield a low intermediate-term P/E.

All the while, investors are paid a solid dividend stream. The stock is very cheap on an EV/EBITDA basis and trades just 0.4 times book versus a historical average of 1.2, per BofA. The kicker on valuation is a massive free cash flow yield, indicative of upside to shareholder accretive activities.

PTR Stock: Earnings, Valuation, Dividend Forecasts

Looking ahead, Wall Street Horizon shows a Q3 2022 earnings date of Thursday, October 27 unconfirmed. There are no other notable events between now and then.

PetroChina’s Corporate Event Calendar

The Technical Take

Bulls must watch the $52 to $56 range on PTR. Shares found support there in years past, but then a bearish breakdown below that key area led to a further 50% collapse in shares back in early 2020 but then formed a bullish double bottom pattern there in late 2020. The stock has failed to climb back above the mid-$50s on a few tries since late last year. The recent energy market pullback found support in the low $40s. The $41 to $42 range must hold otherwise an old unfilled gap could come into play in the low $30.

A bullish breakout above $56 should send PTR back to its 2016 to 2018 range. A measured move target would yield a $70 objective based on the current $14 range, added on top of $56. Overall, the chart is constructive, but we must wait for a bullish breakout or bearish breakdown.

PTR: Shares Consolidating After A Bullish Double Bottom

The Bottom Line

I like PTR on valuation here. I am encouraged by how well energy equities have performed in the face of lower oil. Technically, I’d like to see PTR climb above the mid-$50s with some vigor, but long-term investors can hold it here and collect that big dividend until then. It’s prudent to be mindful of support in the low $40s, however.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.