[ad_1]

JHVEPhoto

Thesis

Pfizer Inc. (NYSE:PFE) reported a mixed bag of earnings for its Q2 release. It was a robust quarter boosted by a solid performance from its COVID franchise (Comirnaty and Paxlovid), which also saw the company raise the lower end of its FY22 earnings guidance.

However, the market’s reaction has been somewhat languid for PFE since it recovered from its June lows. We also updated investors in our June article that PFE looks to be at a short-term bottom. Therefore, the market had anticipated a robust Q2 card as PFE staged a sharp recovery in June/July before its earnings release. Therefore, we believe the near-term upside in PFE has been reflected accordingly.

Moreover, investors should also be prepared for much slower growth moving ahead for Pfizer, as it laps highly challenging COVID-driven comps in FY22. Therefore, we caution investors that adding at the current levels could lead to market underperformance.

As a result, we reiterate our Hold rating and urge investors to be patient.

Pfizer’s Strong H1’22 Performance. But, What’s Next?

Pfizer delivered another robust quarter, posting record revenue of $27.7B. It also included $16.9B in revenue from Comirnaty and Paxlovid as the company continued to ride on its COVID franchise.

Therefore, it also helped the company surpass the consensus estimates with ease. In addition, Pfizer also lifted the lower end of its FY22 earnings guidance while keeping its revenue outlook unchanged (due to the Forex impact).

The company also remains confident in the resilience of its COVID franchise, given its updated vaccines, bivalent versions, and the “substantial” market opportunity for Paxlovid. CEO Albert Bourla articulated (edited):

In spite of the strong growth we have seen in Paxlovid uptake in the US due to our and the government’s efforts, we estimate that a significant amount of eligible patients outside the US are not yet being treated with the drug and may not know they are at high risk of progressing to severe disease. So, we believe there remains a substantial opportunity to grow Paxlovid utilization. – Barron’s

Bourla’s optimism is understandable. After all, Pfizer highlighted that it had garnered nearly 91% of the US COVID oral therapeutics market share in mid-July. Therefore, the global opportunity could be exciting if Pfizer can execute well.

Furthermore, Comirnaty’s 63% global market share of COVID vaccines demonstrated the world’s confidence in Pfizer’s COVID products. Hence, we believe investors should monitor the momentum in Paxlovid sales outside of the US moving forward.

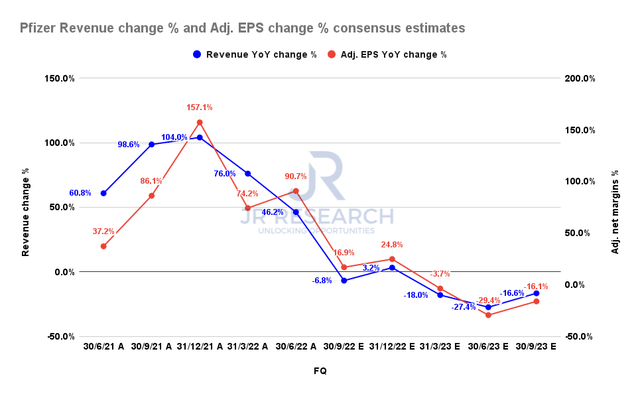

Pfizer revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

However, even the generally bullish Street analysts don’t expect Pfizer to continue its remarkable growth cadence from FY23. Therefore, investors need to be prepared for a dramatic growth deceleration in its revenue and adjusted EBIT from Q3.

Therefore, we believe the tepid reaction from the market, keeping PFE in an extended consolidation range, suggests that it could be looking for more sustainable upside surprises sans its COVID franchise from Bourla & team.

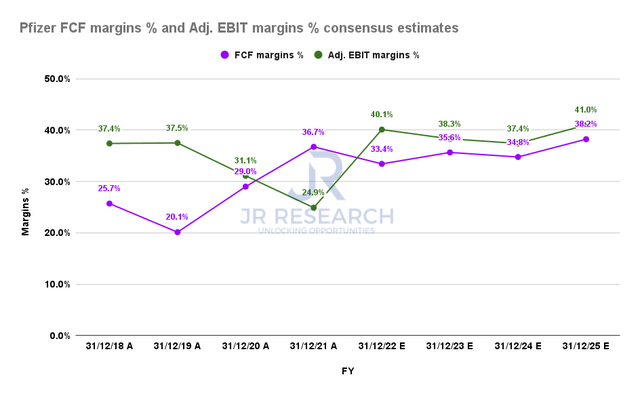

Pfizer FCF margins % and adjusted net margins % consensus estimates (S&P Cap IQ)

Notwithstanding, Pfizer is still expected to sustain its profitability robustly, even though growth is projected to slow remarkably through FY25. Consequently, we believe it is constructive to help undergird PFE’s valuation, despite a potential slowdown in its underlying business.

But, Don’t Expect PFE To Outperform

| Stock | PFE |

| Current market cap | $279.76B |

| Hurdle rate [CAGR] | 7.5% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 9% |

| Assumed TTM FCF margin in CQ4’26 | 36% |

| Implied TTM revenue by CQ4’26 | $96.22B |

PFE reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied a blended market-perform hurdle rate of 7.5% (considering Pfizer’s average dividend yields). However, we also indicated that the market denied further upside in our previous article at its near-term resistance of $55. The market has also been holding that resistance level firmly since the start of 2022.

Interestingly, PFE traded at an FY25 free cash flow (FCF) yield of 8.18% at its near-term resistance, slightly higher than its 5Y mean of 7.97%. Therefore, we believe that the market has de-rated PFE, as it anticipates the impact of the slower top and bottom-line growth moving forward.

Therefore, we believe it’s appropriate to model PFE’s valuation using an FCF yield of 9%.

Accordingly, we derive a TTM revenue target of $96.22B that Pfizer needs to meet by CQ4’26, which is unlikely. Therefore, our valuation analysis suggests that PFE will likely underperform the blended market-perform hurdle rate implied in our model through FY26.

Is PFE Stock A Buy, Sell, Or Hold?

We reiterate our Hold rating on PFE.

We believe the market has de-rated PFE, despite its robust quarterly performance in H1’22. Moreover, the market could be looking past its stellar FY22 results, as the revenue contribution from its COVID franchise could decelerate markedly moving ahead.

Therefore, investors are urged to exercise patience and wait for a deeper pullback in PFE.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.