[ad_1]

naphtalina/iStock via Getty Images

Published on the Value Lab 11/1/23

Piper Sandler (NYSE:PIPR) is a company that we occasionally cover. It’s not a pure-play advisory company, doing both brokerage and advisory. Their M&A and advisory business are mid-market and doing particularly well relative to advisory peers. On the other side, things could be better in institutional brokerage, which would have been expected to be strong. While PIPR gives us an interesting note on mid-market resilience for our coverage of IBs, the valuation isn’t there for it to be a buy.

Looking at Q3

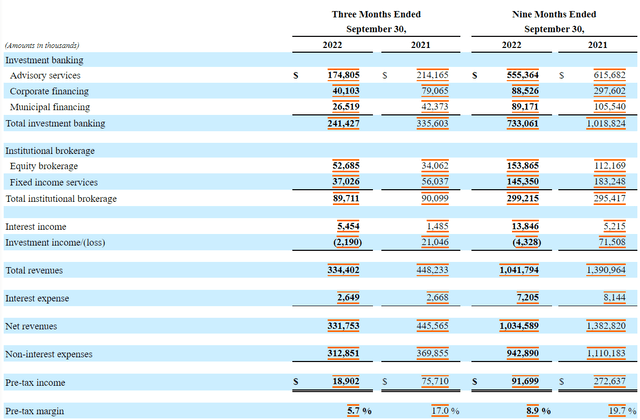

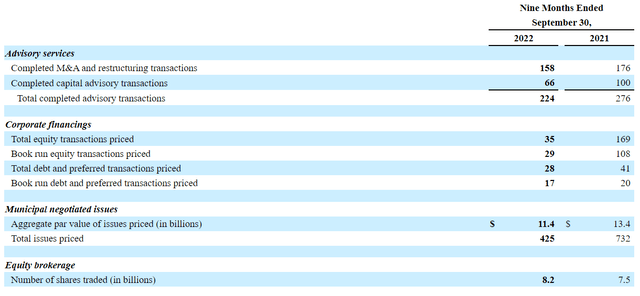

Let’s start with some really great disclosure from the PIPR 10-Q, where they give us supplemental business information that really paints a picture of markets.

Supplemental Business Info (SEC.gov)

The financials and healthcare focus in the mid-market M&A space is seeing decent numbers in terms of closed transactions, and what are mostly corporate finance engagements are not too bad either considering the impact of ECM and DCM declines. Declines could have been expected around 30%, as that’s what the typical shop was losing in M&A and advisory comprehensive of corporate finance in terms of revenues. The quantum of deals here has only declined about 20% overall.

Advisory engagements must include M&A services too, because revenue from advisory only declined about 10% on the same 9 months basis, same as the decline in completed transactions. Meanwhile, corporate financing services, more connected to ECM and DCM activity which has been really struggling, is down more than 60%. The 40% decline in the number of capital advisory transactions reflects that, and also accentuates that the size of ECM and DCM engagement must have fallen in value too as markets tanked and only the most intrepid sponsors and corporates made moves.

Municipal financing also held out on a 9-month basis, although we are seeing pressure in the latest quarter on that segment, losing out share to corporate financing, which has been the typical culprit for pressure on financial results. These government-exposed sectors have always been more resilient.

With the help of resilience in municipal financing and M&A and advisory, the 9-month picture shows a pretty limited 25% decline in revenues for the IB division, ahead of peers, however, the latest quarter is more in line with the broader pressure on the peer group, having declined more than 30% due to a fall-off of the municipal financing business causing some underperformance. It is clear that the M&A business remains strong in the financial and healthcare mid-market.

For institutional brokerage, results would have been expected to be better. Currently, the company’s equity brokerage business is benefiting from the consolidation skew from the Cornerstone Macro platform that they acquired last year. We aren’t sure how much revenue contribution that is, but it could be at a minimum of $15 to $20 million per quarter based on the comprehensive purchase consideration of over $60 million assuming earn-outs. That would put equity brokerage about in line with the results from last year, both on a 9-month and 3-month basis. With an exceptionally volatile year in equity markets, some overperformance would have been expected by us. Fixed income struggled, which was a bit surprising given volatility, and reports from peers indicating that they were able to create growth in the fixed income parts of their capital markets business.

Bottom Line

Mid-market M&A advisory has been doing better than other segments of the advisory market. Moelis (MC) saw 30% decline in the 9 months, while PIPR only saw 10% for that business, and it shows the impact that financing has on marquis, megadeal clients, and how mid-market is more able to weather the current liquidity throttle. However, PIPR broadly doesn’t particularly impress. Moreover, while a return to certainty in the markets will boost all of its businesses, we think implying a 15x 2023 forward PE where we get a midpoint between now and the wild 2021, these single-digit earnings yields are not enough. We know what it’s like to work in markets where you can’t find any value because multiples are so high – the current market is nothing like that. There are still so many opportunities as investors remain dazed on macro, which has been pointing in the right direction for months. PIPR is not uncompelling, it’s just not compelling enough.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.