[ad_1]

ipopba

Prospect Capital Corporation (NASDAQ:PSEC), despite its 9.8% dividend yield, has a long history of destroying shareholder value.

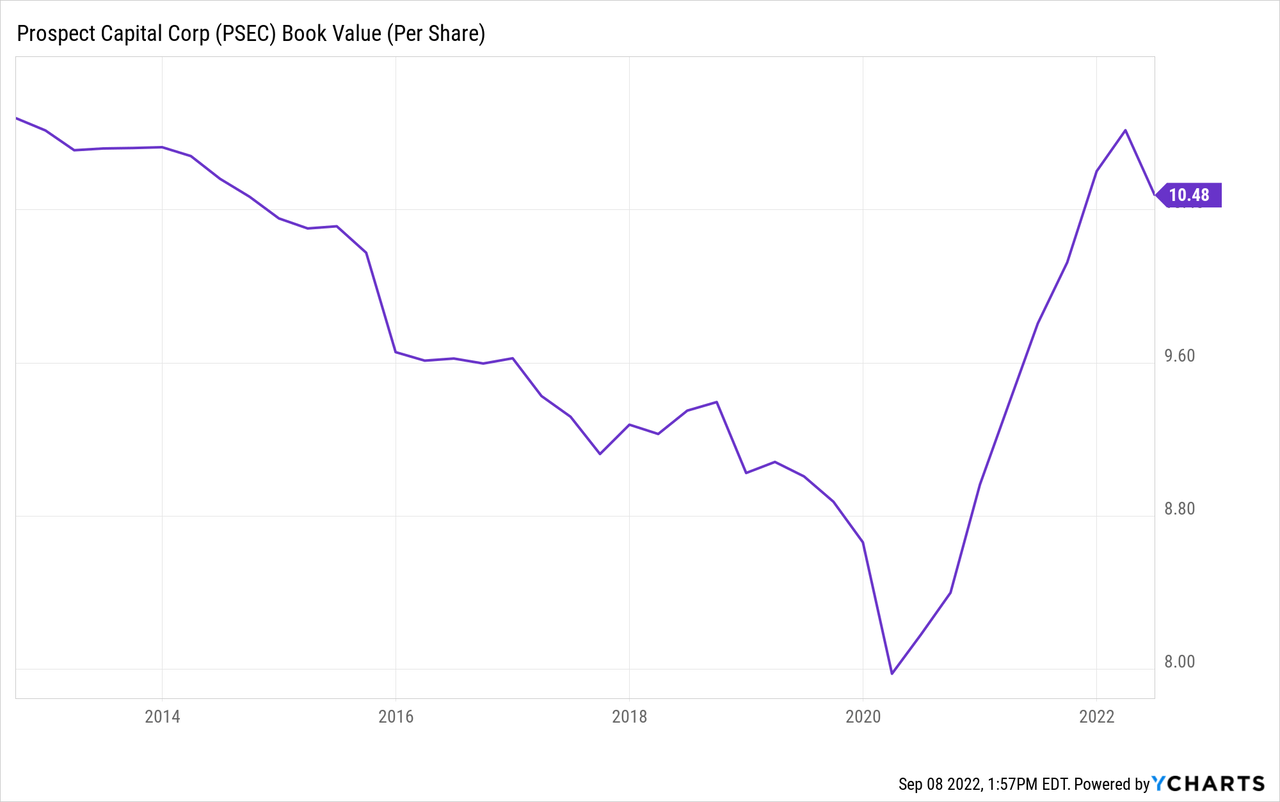

The business development company’s (“BDC”) net asset value has declined over time, and while the portfolio is currently performing well, my confidence in management is relatively low.

Investors with a normal risk tolerance should avoid Prospect Capital, and investors with a very high-risk tolerance should only buy into the BDC if they can get a very large discount on the company’s net asset value.

If Prospect Capital’s net asset value increased by, say, 50%, I would be willing to take a chance on this serial dividend cutter.

Portfolio With Above-Average Risk

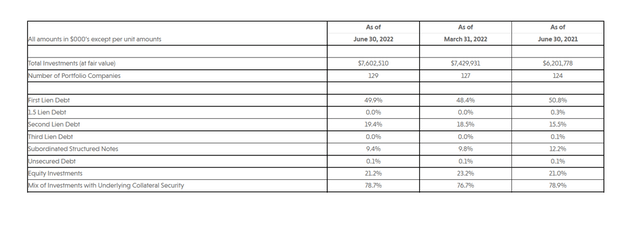

Prospect Capital’s portfolio was worth $7.6 billion as of June 30, 2022, and the business development firm had 129 portfolio companies, two more than the previous quarter.

The portfolio value increased by $172.6 million QoQ, primarily due to new originations. The portfolio as a whole has not changed significantly in the quarter ending June 2022. Approximately 50% of portfolio investments were in First Liens, with the remaining 19.4% in Second Liens. Another 9.4% was put into subordinated debt.

Prospect Capital is a riskier business than the average business development firm, as evidenced by the amount it invested in equity investments (21.2%).

The high allocation of investment funds to Equity, which may or may not produce high returns, implies that Prospect Capital’s net investment income also reflects higher-than-average risks. More conservatively managed business development firms allocate significantly more funds to first lien debt and equity exposure in the low to high single digits.

Equity Investments (Prospect Capital Corporation)

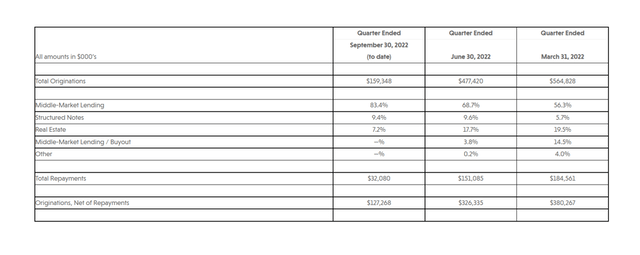

The last quarter saw the majority of new originations (68.7%) in the middle market lending segment, with some investments in structured notes (9.6%) and real estate (17.7%).

New Originations (Prospect Capital Corporation)

Floating Rate Exposure

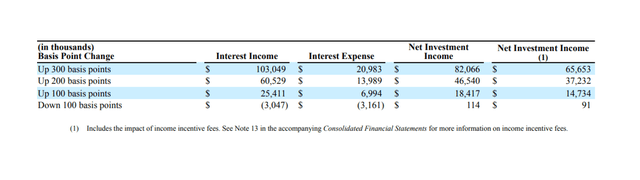

88% of interest-bearing assets are floating rate, which means that loans made to debt borrowers will have a higher interest rate when the central bank raises interest rates by a notch or two.

A 200-basis point increase in interest rates would increase the BDC’s net investment income by approximately $37.2 million, according to Prospect Capital’s sensitivity table from the most recent quarterly 10Q filing (see below). On the other hand, lowering interest rates would have a negative impact on interest income.

Basis Point Change (Prospect Capital Corporation)

Non-Accrual Update

Prospect Capital’s portfolio had a non-accrual ratio of 0.4% in the quarter ending June 30, 2022, indicating that portfolio quality remained consistent.

Prospect Capital also had a non-accrual ratio of 0.4% in the previous quarter. Anything less than 1% in terms of non-accruals (delinquent loans) indicates good portfolio health and well-managed repayment issues.

Dividend Covered

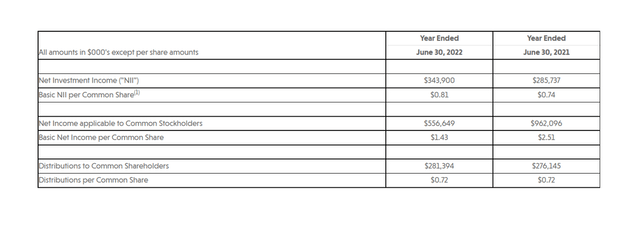

Prospect Capital’s dividend is currently covered by net investment income, implying that dividend risks are currently under control. Prospect Capital’s pay-out ratio was 89% based on basic net investment income in the fiscal year ending June 30, 2022.

Because of higher net investment income and new originations, the pay-out ratio improved from 97% a year ago.

Net Investment Income (Prospect Capital Corporation)

I’ll Buy At $5 (Implied Discount Of 52%)

Prospect Capital’s net asset value was $10.48 per share as of June 30, 2022, down from $10.81 per share at the start of the year.

Prospect Capital has lost a significant portion of its book value over time, calling the BDC’s capital management abilities into question. Because of the extraordinary large decline in book value over time, I would only consider purchasing PSEC (as a short-term holding) at a very large discount to book value.

I would consider purchasing PSEC at around $5 (the stock’s current price is $7.37), at which point the stock would trade at a 52% discount to NAV, assuming a net asset value of $10.48.

In my opinion, a purchase of a subpar business development company like Prospect Capital is justified only when a large (50%+) discount to net asset value is available.

Why Prospect Capital Could See A Higher Valuation

Prospect Capital’s portfolio is generally performing well, so unless portfolio metrics deteriorate significantly, the stock may not trade at a larger discount to net asset value in the near term.

Non-accruals remained stable in the last quarter at a very low level of 0.4% of portfolio (fair) value, and net investment income increased 3% QoQ, suggesting that a deterioration in portfolio metrics is unlikely.

Having said that, I see little reason to believe Prospect Capital’s book value record will improve in the future, given a 10-year track record of declining book value.

My Conclusion

Prospect Capital has a more aggressively structured investment portfolio than the average BDC, with fewer investments in first lien debt and a higher allocation of investment funds to equity.

As a result, Prospect Capital’s net investment income (NII), which is used to calculate pay-out ratios, is riskier than the average business development company’s NII.

Prospect Capital, which has experienced long-term book value deterioration and has been a serial dividend cutter, should, in my opinion, be purchased at a very large (50%+) discount to net asset value, and then only if the investor has a very high-risk tolerance.

Prospect Capital may be unsuitable for investors with a low risk tolerance. In my opinion, the risk of additional book value losses is appropriately priced into Prospect Capital’s valuation only at a 50%+ discount to NAV.

I’d get some PSEC as a speculative buy at $5, but not before.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.