[ad_1]

Morsa Images

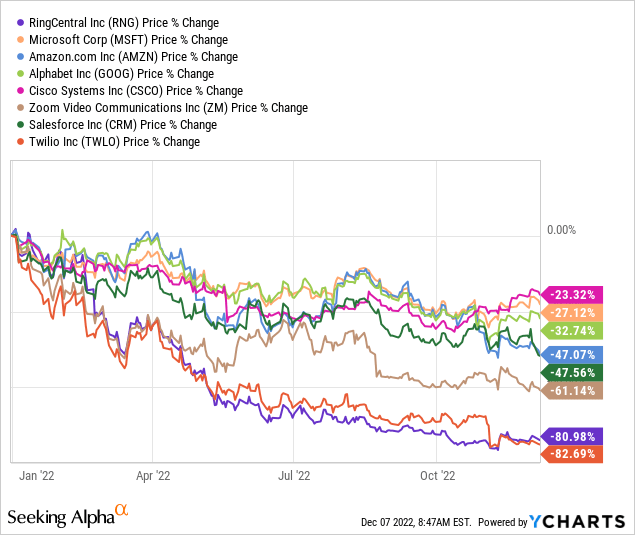

The macroeconomic environment has not been kind to RingCentral Inc. (NYSE:RNG), but we believe the stock provides a solid turnaround investment toward 2023. Our bullish sentiment on the stock is based on two factors: the stock holds a 21% market share within the UCaaS space and is trading relatively lower than its peer group. We believe RingCentral’s shares fell into free fall earlier this year due to the weakening macroeconomic environment causing enterprises to be more cautious about their IT spending on cloud communications. After the stock declined 81% YTD, we believe the weakness of the macroeconomic environment has been factored into the stock. We like RingCentral’s position within the broader cloud communication industry and expect the pandemic-incited hybrid-remote work environment will continue to be a growth driver in RingCentral’s pocket. We recommend investors buy the stock pullback.

Increasing its slice of the UCaaS market

RingCentral operates within the cloud communications industry, and we expect the company to continue gaining market share. RingCentral is a UCaaS provider- in simpler terms, the company is a leading provider of global enterprise cloud communications, video meetings, collaborations, and contact center solutions. RingCentral works in the Unified Communications as a Service market, which is estimated to grow at a CAGR of 10.2% between 2022-2030.

To understand the investment opportunity in RingCentral stock, you must retract and understand the massive potential of cloud communications. We believe the cloud communications platform market is gaining momentum with the increase in remote working facilities. In the post-pandemic environment, remote working facilities have become imperative to the business environment, and this is where Ring Central comes in to optimize and enable hybrid-remote work environments. Despite macroeconomic headwinds, the cloud communications market grew by around 2.3M users in the past six months as of September 2022, according to Cavell Group’s report.

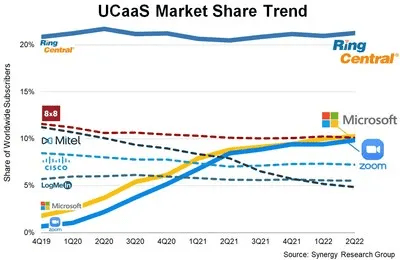

Recently, the company has been named a leader in the 2022 Gartner Magic Quadrant for UCaaS for the eighth year in a row. We expect RingCentral to continue growing its revenue as it increases its market share in the UCaaS space, which is currently estimated to be around 21%. Still, RingCentral faces stiff competition within the UCaaS space, including Microsoft’s (MSFT) Azure, Amazon’s (AMZN) AWS, Cisco (CSCO), and Zoom (ZM), among others. We’re constructive on RingCentral’s position as we expect the company to continue expanding its customer base as it retains long-term relationships with current clients.

The following graph outlines the UCaaS market share trend between 4Q19 and 2Q22.

Synergy Research Group

Subscriber growth means revenue growth

Companies like RingCentral achieve most of their revenue through subscriptions, accounting for around 93% of RingCentral’s total revenues in 2021. We like how RingCentral’s subscriptions are playing out toward 1H23. RingCentral’s subscription revenue increased 25% Y/Y to $483 despite macroeconomic headwinds in 3Q22. We’re constructive on RingCentral’s ability to leverage more subscription revenue as it expands its customer base. We expect subscription revenue to increase in 2023. Based on RingCentral’s earnings call, we believe RingCentral has multiple deals in the pipeline that are taking a bit longer to materialize due to enterprise hesitation about IT spending under current financial stressors.

Risk to our buy-thesis

RingCentral is not immune to the macroeconomic slowdown. Microsoft warned earlier in October of a market slowdown in cloud computing as customers pause their spending in reaction to the slowing economy. The tech space is facing churn as enterprises and businesses cut spending amid soaring inflationary pressures. We believe RingCentral and the cloud peer group will feel the impacts of the softening IT spending toward the end of the year. Still, we believe the stock pullback creates an attractive entry point to buy RingCental before IT spending resumes more meaningfully in 2023.

The following graph outlines RingCentral’s YTD stock performance compared to the competition.

TechStockPros

Valuation

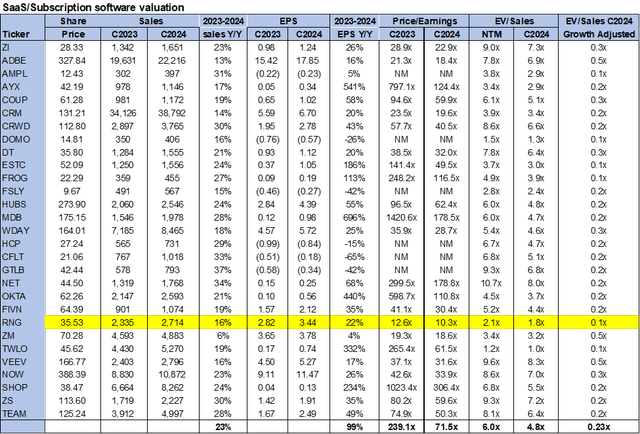

RingCentral is relatively cheap, trading at 10.3x C2024 EPS $3.44 compared to the peer group average of 71.5x. The stock is trading at 1.8x EV/C2024 versus the peer group at 4.8x. We believe RingCentral’s YTD pullback creates an attractive entry point into the stock.

The following table outlines RingCentral’s valuation.

Word on Wall Street

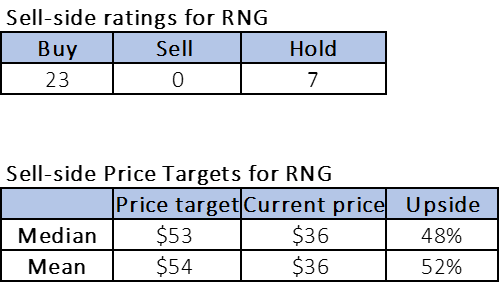

Wall Street shares our bullish sentiment on the stock. Of the 30 analysts covering the stock, 23 are buy-rated, and seven are hold-rated. The stock is currently priced at $36. The median sell-side price target is $53, while the mean price target is $54, with a potential upside of 48-52%.

The following tables outline RingCentral’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

We believe the impact of the pandemic continues to drive the cloud communications market forward, and we expect RingCentral to be a primary benefactor of the demand tailwinds. Still, we expect the macroeconomic environment to continue slowing RingCentral’s customer base expansion toward 1H23. We’re buy-rated on RingCentral as we believe the stock provides an attractive risk-reward scenario for its growth outlook in 2023. We recommend investors buy the stock.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.