[ad_1]

Sah Polymers IPO Review: Sah Polymers Limited is coming up with its Initial Public Offering. The IPO will open for subscription on December 30th, 2022, and close on January 4th, 2023. It is looking to raise Rs 66.30 Crores, the whole of which will be a Fresh Issue. In this article, we will look at the Sah Polymers IPO Review 2022 and analyze its strengths and weaknesses. Keep reading to find out!

Sah Polymers IPO Review

About The Company

Sah Polymers Limited is primarily engaged in the manufacturing and selling of Polypropylene (PP), High-Density Polyethylene (HDPE) FIBC Bags, and other woven polymer-based products of different weights, sizes, and colors as per customer’s specifications.

The company offers customized bulk packaging solutions to various industries that include Agro Pesticides Industry, Basic Drug Industry, Cement Industry, Chemical Industry, Fertilizer Industry, Food Products Industry, Textile Industry Ceramic Industry, and Steel Industry.

It has a presence in 6 states and 1 union territory in India. In addition to that, the company internationally supplied its products in Africa, the Middle East, Europe, the USA, Australia, and the Caribbean.

Products of the company

The product portfolio of the company includes:

- FIBC (Flexible intermediate bulk container)

- Container Bag

- Garden bags/wastage bags

- Woven sacks

- PP Fabric

- Ground covers

- Spiral tubing

- Box bags

- PP Woven Fabric Rolls

The competitors of the company

(Source: DRHP of the company)

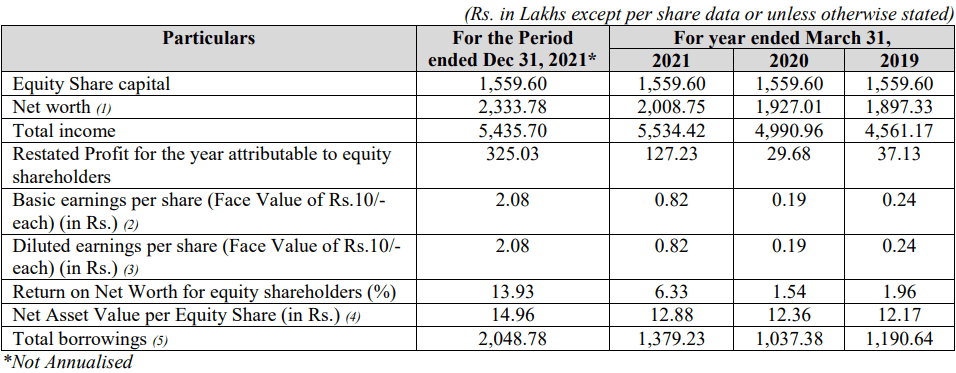

Financial Highlights

(Source: DRHP of the company)

Sah Polymers IPO Review – Industry Overview

The packaging industry is the 5th largest sector of India’s economy. The industry has reported steady growth over the past several years and shows high potential for expansion, particularly in the export market. The country majorly exports flattened cans, printed sheets and components, crown cork, lug caps, plastic film laminates, craft paper, paper boards, and packaging machinery. Going forward, the Indian Packaging Market was valued at USD 50.5 billion in 2019, and it is expected to reach USD 204.81 billion by 2025, registering a CAGR of 26.7% during the period of 2020-2025.

Strengths

- The company has a strong and diversified product portfolio.

- The company not only has a strong domestic but also an international presence.

- The company is led by a strong management team.

Weaknesses

- The company requires a constant supply of raw materials for its operations. Any disruptions can adversely affect the business.

- The company requires significant amounts of working capital. Any failure to meet its requirements can disrupt its operations.

- The promoters and directors along with the company are involved in certain litigations related to criminal, civil and tax proceedings.

- The introduction of alternative packaging materials caused by changes in technology or consumer preferences can severely affect the business.

- The company is subject to certain risks that include Foreign exchange fluctuations and disruption in their plant by employees.

Sah Polymers IPO Review – GMP

The shares of Sah Polymers traded at a premium of 6.15% in the grey market on December 27th, 2022. The shares tarded at Rs 69. This gives it a premium of Rs 4 per share over the cap price of Rs 65.

Key IPO Information

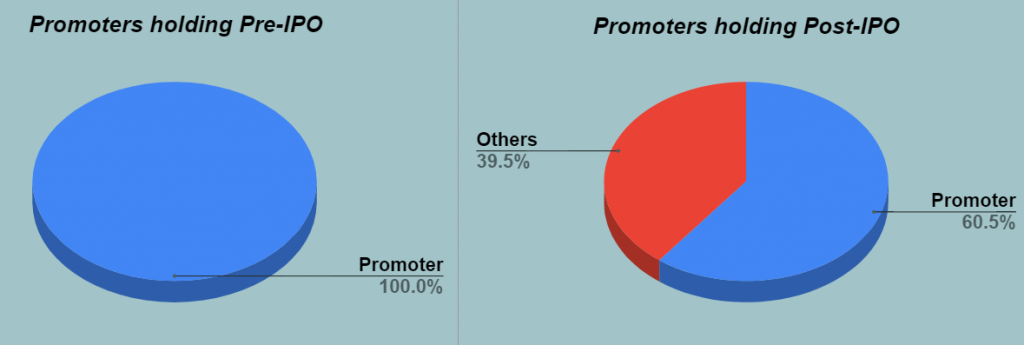

Promoters: SAT Industries Limited

Book Running Lead Managers: Pantomath Capital Advisors Private Limited

Registrar To The Offer: Link Intime India Private Limited

| Particulars | Details |

|---|---|

| IPO Size | ₹66.30 Crore |

| Fresh Issue | ₹66.30 Crore |

| Offer for Sale (OFS) | – |

| Opening date | December 30, 2022 |

| Closing date | January 4, 2023 |

| Face Value | ₹10 per share |

| Price Band | ₹61 to ₹65 per share |

| Lot Size | 230 Shares |

| Minimum Lot Size | 1 (230 Shares) |

| Maximum Lot Size | 13 (2990 Shares) |

| Listing Date | January 12, 2023 |

The Objective of the Issue

The Net Proceeds from the Fresh Issue are proposed to be utilized for:

- Setting up a new manufacturing facility to manufacture Flexible Intermediate Bulk Containers (FIBC).

- Repayment/ Prepayment of certain secured and unsecured borrowings in full or part availed by the Company and its Subsidiaries.

- Funding the working capital requirements.

- General corporate purposes.

In Closing

In this article, we looked at the details of Sah Polymers IPO Review 2022. Analysts remain divided on the IPO and its potential gains. This is a good opportunity for investors to look into the company and analyze its strengths and weaknesses. That’s it for this post.

Are you applying for the IPO? Let us know in the comments below.

You can now get the latest updates in the stock market on Trade Brains News and you can also use our Trade Brains Screener to find the best stocks.

Start Your Financial Learning Journey

Want to learn Stock Market and other Financial Products? Make sure to check out, FinGrad, the learning initiative by Trade Brains. Click here to Register today to Start your 3-Day FREE Trail. And do not miss out on the Introductory Offer!!

[ad_2]

Image and article originally from tradebrains.in. Read the original article here.