[ad_1]

Stephen Lam

Salesforce (NYSE:CRM) has been in the public eye for a long time, but only recently has it popped into the windows of value investors, as its stock was chronically overvalued. CRM stock is now trading at close to half of its 52-week high, losing well over $100 billion in equity market cap over the past 12 months. In this article, I highlight why the stock remains unattractive despite the big decline, so let’s get started.

Why Salesforce?

Salesforce’s flagship product, Sales Cloud, has been helping businesses of all sizes to manage their customers better for many years. It offers powerful features that enable users to track customer interactions and insights, create targeted campaigns, and close deals faster.

Along with its CRM offering, Salesforce also provides an array of cloud-based services for enterprise apps such as marketing automation, analytics, customer service, and ecommerce. By leveraging these services, businesses can improve their operations and better serve their customers. Salesforce has also developed a suite of mobile apps that enable users to access their data on the go. This makes it easier for businesses to stay connected with their customers wherever they may be.

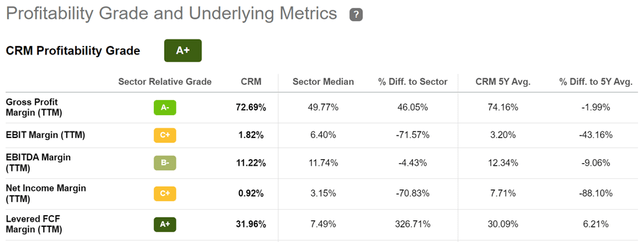

Salesforce holds a strong edge in the CRM space, as its brand recognition and customer base is unparalleled. This is reflected by industry analyst IDC recently ranking Salesforce number one in CRM for the ninth year in a row. This makes Salesforce a virtual “cash minting machine”, as its positioning enables it to charge premium prices for its services, giving way to strong margins. As shown below, Salesforce scores an A+ grade for profitability, with sector leading gross and FCF margins of 73% and 32%, respectively.

Salesforce Profitability (Seeking Alpha)

Recent Results

Salesforce continues to demonstrate growth, with revenue rising by 14% YoY to $7.8 billion during its fiscal third quarter (ended Nov. 30). Like most U.S. multinational companies, a stronger U.S. dollar has resulted in currency headwinds, as revenue growth excluding effects grew by a stronger 19% YoY.

One concern is the decline in current remaining performance obligations, which grew by 15% YoY in constant currency, below the pace of revenue growth. Management admitted to a slowing demand for its products due to “challenging trends in customer behavior”, and is guiding for just 7 to 10% YoY CRPO growth for the fiscal fourth quarter.

Wolfe Research recently downgraded Salesforce to peer perform, and removed its price target. A Seeking Alpha report noted his research comments:

While the macro is impacting nearly every company under coverage, we see Salesforce being particularly impacted as Covid pull-forward, execution missteps & M&A misfires have created meaningful idiosyncratic headwinds,” Zukin wrote in a note to clients.

Zukin added that Salesforce (CRM) is likely going to have to make “very significant incremental cuts” to get its margins needed to be to what investors would expect from a company generating “high single or low-double digit growth.”

Zukin noted that other software companies with significant size, such as Microsoft (MSFT), Oracle (ORCL) and Adobe (ADBE), have operating margins of 40% or more and GAAP earnings, while Workday (WDAY) and ServiceNow (NOW) are still expected to grow revenue at 20% next year. Salesforce (CRM) has neither of those characteristics, Zukin explained.

Buybacks Have Low Appeal

It appears that Salesforce is opening the playbook of a mature company by implementing buybacks. This includes 11 million shares repurchased during the third quarter for $1.7 billion, and a newly implemented $10 billion buyback program.

While buybacks are an efficient return of capital from a tax perspective, I simply don’t see how it would be very accretive to shareholders at the current price of $144.56 with a forward PE of 30. This equates to a low 3% earnings yield on every dollar spent on share repurchases, and implies that management is short of growth opportunities with which to deploy capital.

Founder Dependency

Perhaps more headline grabbing than the slowing CRPO is the recently announced departure of co-CEO Bret Taylor, who is slated to leave by the end of January. This would make founder Benioff again the sole CEO. This is reminiscent of Starbucks (SBUX), which has been the poster child of founder dependency, with Howard Schultz returning to the helm on multiple occasions. While founder Marc Benioff is undoubtedly a visionary, it remains to be seen whether if another person is worthy of carrying forward the baton.

Valuation

Lastly, I view Salesforce as being undervalued at the current price of $145 with a forward PE of 30. That’s because I’m generally wary of companies trading at such a high PE, and the slowdown in the CRPO doesn’t provide much comfort. I would find Salesforce to be more attractive at a 25x PE, which translates to a price of $123. This price would bake in a more tempered level of growth going forward.

Investor Takeaway

Salesforce is a great company with an impressive track record of growth, but there are some areas of concern that investors should be aware of. Specifically, current remaining performance obligations have been slowing down, the buyback program may not be as accretive to shareholders as expected and Benioff’s return to sole CEO places more burden on his decision-making. Given these concerns, I don’t find the stock to be attractive at present, and would look for more attractive entry points down the road.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.