[ad_1]

Shidlovski

Sarepta Therapeutics (NASDAQ:SRPT) is a $10 billion market cap biopharmaceutical company. It markets 3 RNA-targeted products EXONDYS 51, VYONDYS 53, and AMONDYS 45, for Duchenne muscular dystrophy (DMD) patients with mutations of the dystrophin gene that is amenable to skipping of respective exon sequences. In Q2, Sarepta’s 6-month net product revenues totaled $400 million (Table 1), and they increased full-year guidance to a range of $825-$840 million. For Q3, analysts expect $234.55 million, an amount that is more likely than not to be surpassed.

Table 1. Quarterly Revenues (in $ thousands)

|

Q2 2022 |

Q1 2022 |

Q4 2021 |

Q3 2021 |

Q2 2021 |

Q1 2021 |

|

|

EXONDYS 51 |

126,377 |

117,133 |

119,117 |

115,598 |

112,461 |

107,185 |

|

AMONDYS 45 |

54,676 |

43,614 |

34,745 |

26,655 |

6,936 |

193 |

|

VYONDYS 53 |

30,184 |

28,078 |

24,863 |

24,658 |

22,442 |

17,548 |

|

Products, net |

211,237 |

188,825 |

178,725 |

166,911 |

141,839 |

124,926 |

|

Collaboration |

22,250 |

22,005 |

22,736 |

22,495 |

22,250 |

22,005 |

|

Total revenues |

233,487 |

210,830 |

201,461 |

189,406 |

164,089 |

146,931 |

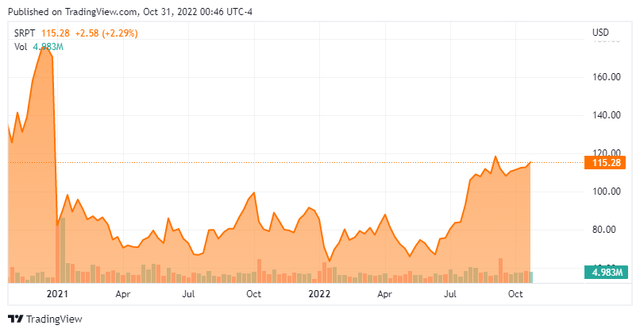

Despite the bear market, Sarepta is up 27.5% year-to-date. The ETF with the most shares with 750,000 SRPT is the Vanguard Small Cap ETF (VB), down 17.3% YTD, is also underperforming both the stock and the S&P since the Q1 2021 CC (Figure 1). While not yet profitable, the company had $1.9 billion in cash and equivalents as of June 30, in addition to $980 million after the September sale of 1.250% Convertible Senior Notes due 2027. The 6-month operating loss was under $300 million, so there is no need for further financing. Also having filed a Biologics License Application (BLA) in a month ago to the FDA for the accelerated approval of SRP-9001, Sarepta will probably have no further updates for their investigational gene therapy for DMD.

Figure 1. Seeking Alpha chart

Approximately 13% of DMD patients are amenable to exon 51 skipping, while 8% are amenable to exon 45 and 53 each. VYONDYS was approved by the U.S. Food and Drug Administration (FDA) on December 12, 2019. However, it faces direct competition from NS Pharma’s Viltepso (approved in the U.S. on August 12, 2020), which explains its more gradual growth. EXONDYS should bring in $125-135 million, while AMONDYS hasn’t shown signs of slowing yet and could net $60-65 million. With VYONDYS and the Roche collaboration earning $32 and $22 million, respectively, Q3 totals could reach up to $255 million (or 34% over 2021). A more conservative estimate is $240 million (+18% YOY).

Since the SRP-9001 trial failure at the beginning of 2021 that slashed its valuation by half (Figure 2), Sarepta has beaten Street revenue estimates for 6 straight quarters, which has led to shares appreciation in the short term (within 3 months) every time.

Figure 2. NASDAQ:SRPT chart by TradingView

The smallest increase was 8% after the 11/3/2021 Q3 call, but this was following the 49% rise after Q2 CC on August 4. Recently, the company recently hit its 52-week high of $120.23, a 27% gain from the last CC. While it’s no guarantee that prices will continue to trend upward, a company smashing a high after upbeat earnings is usually a positive sign. This is especially so for technically-minded investors, who can see a new strong support at the $105 level.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.